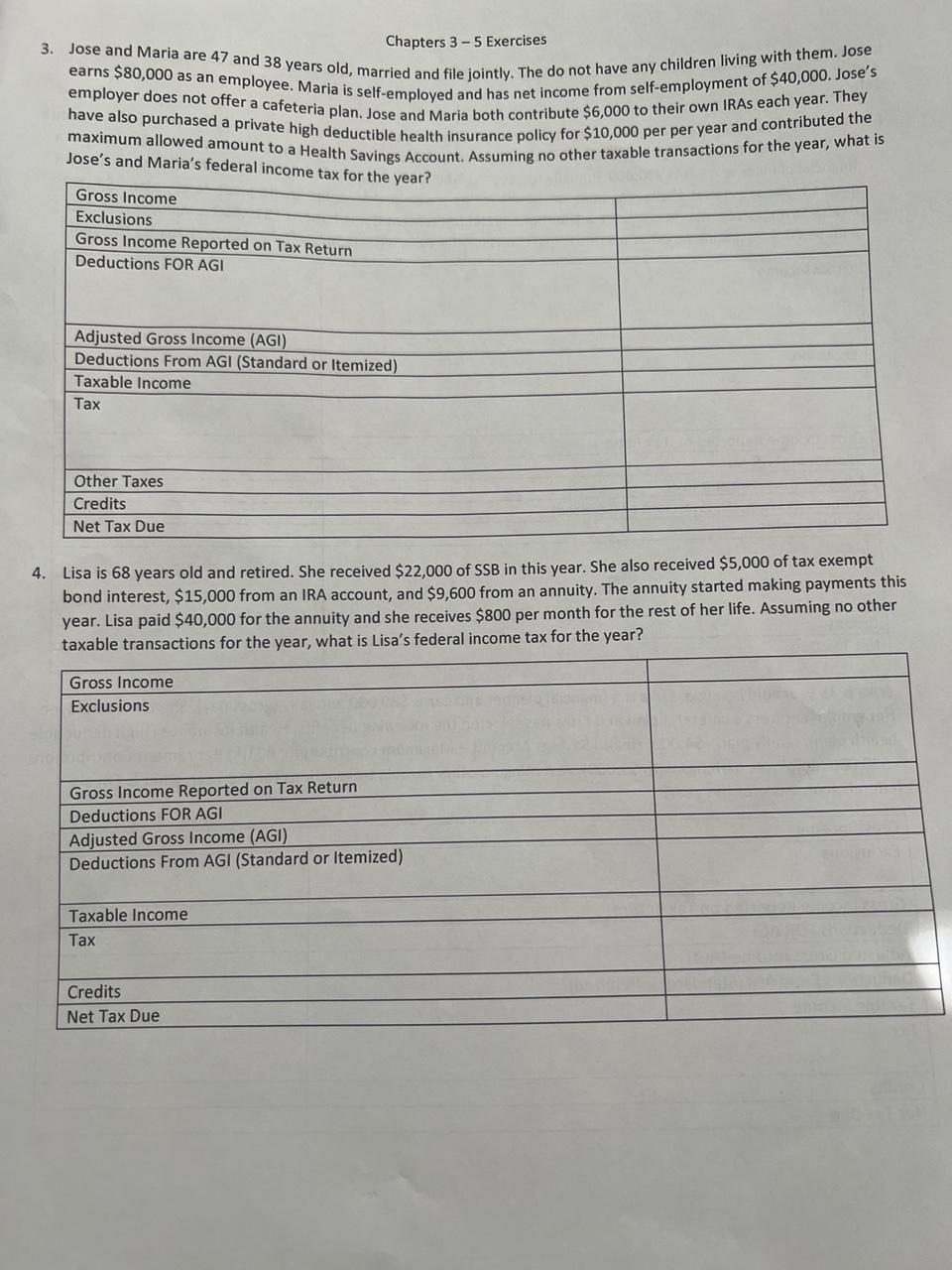

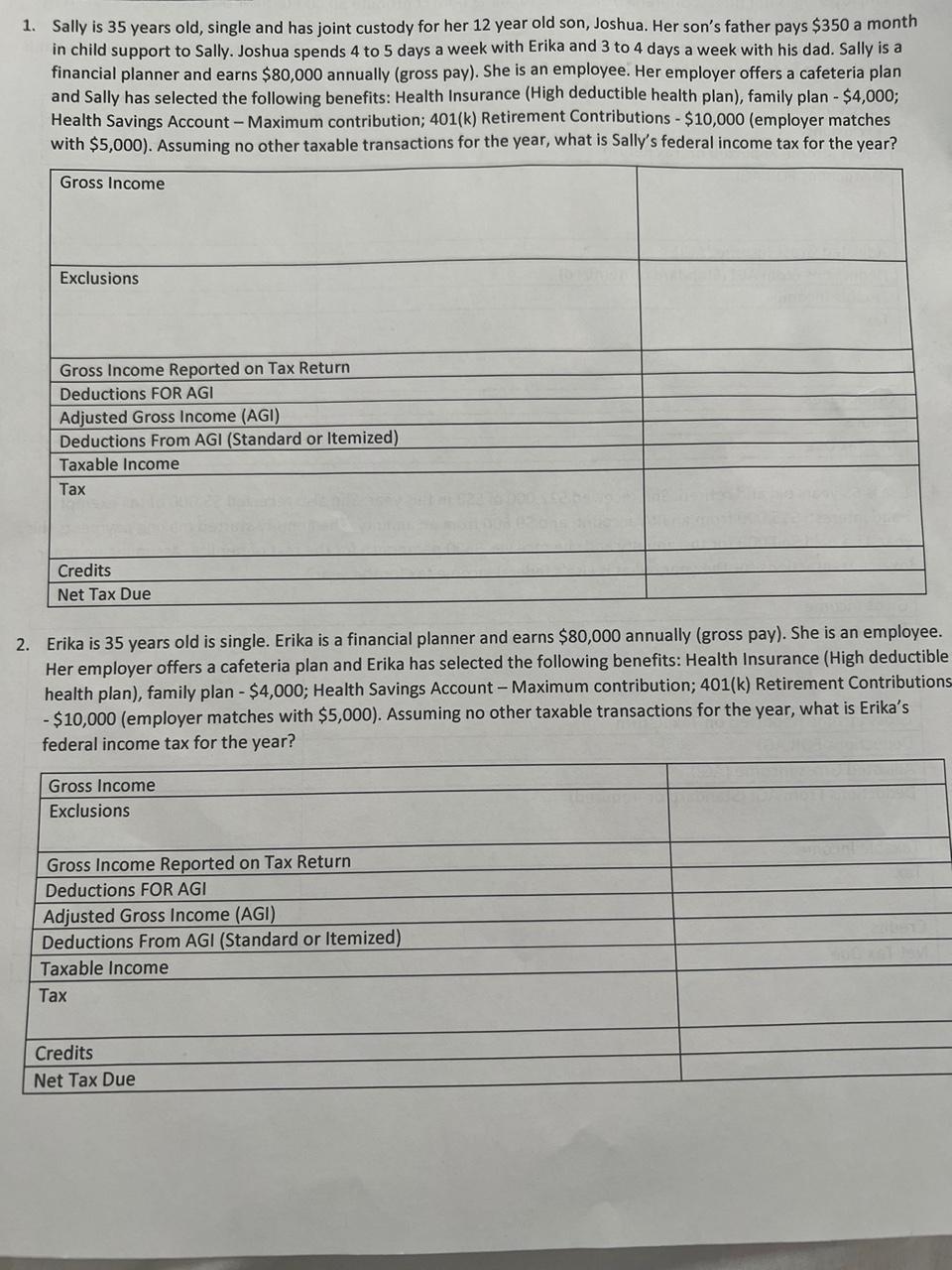

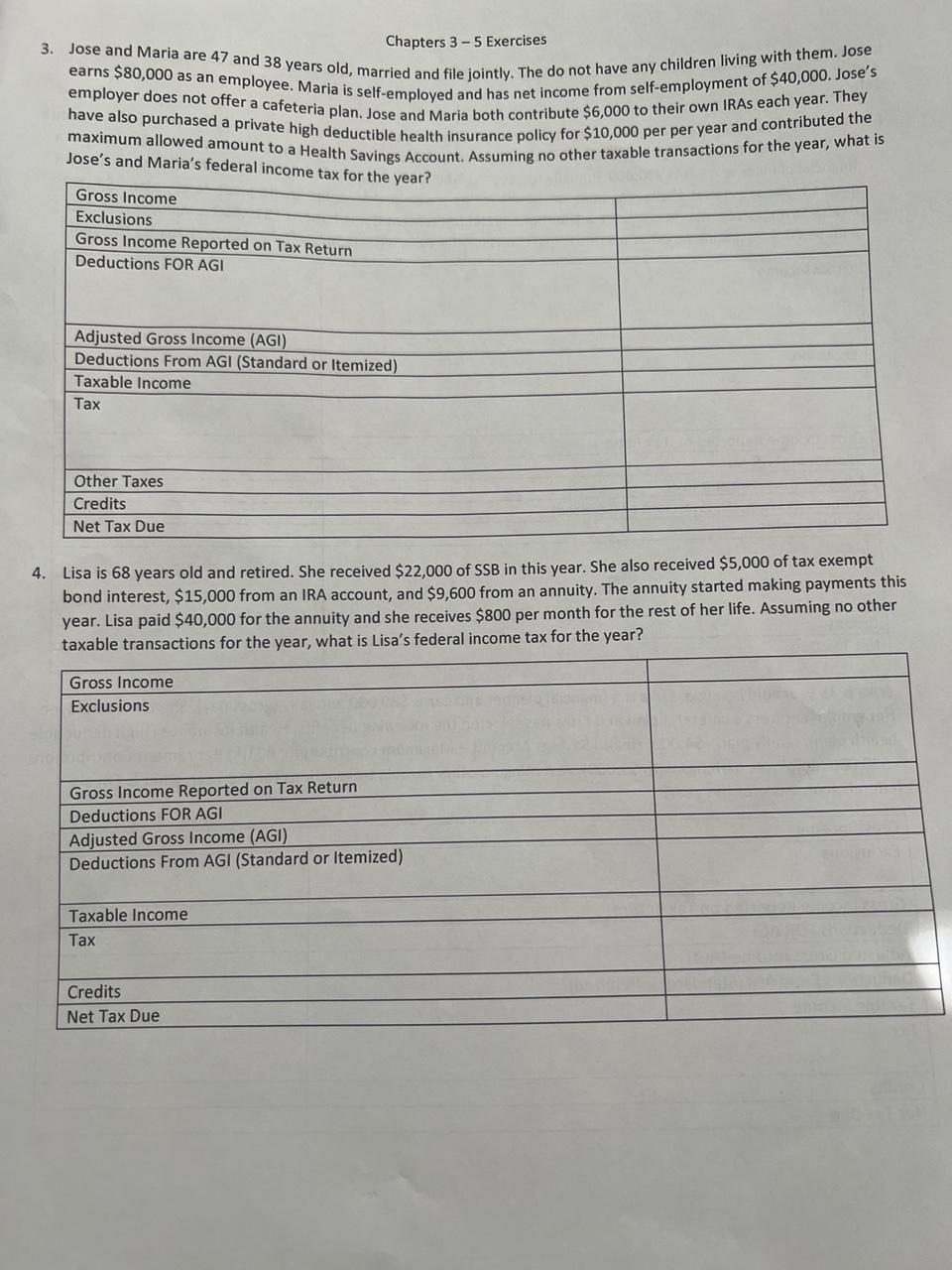

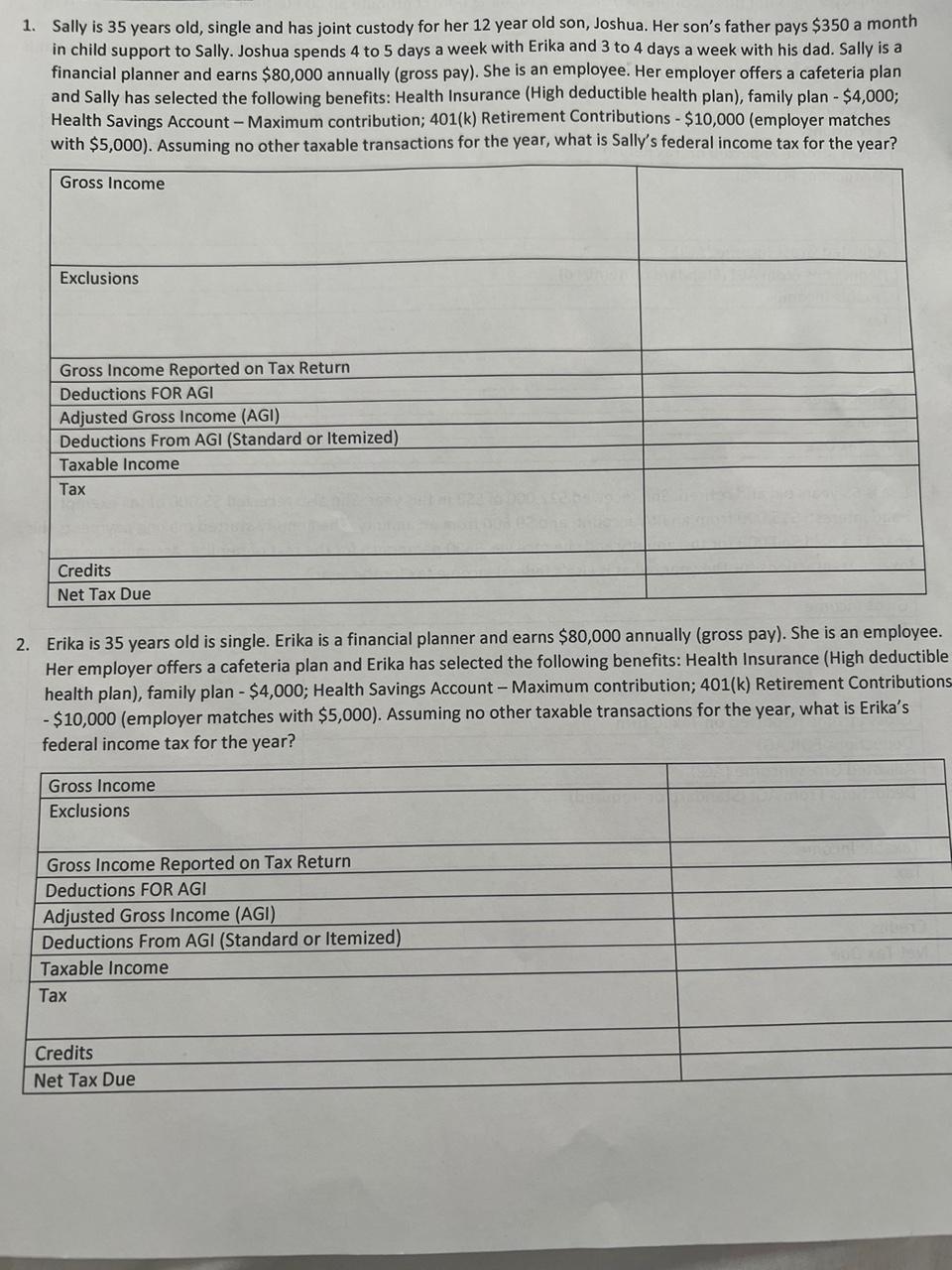

Chapters 3 - 5 Exercises 3. Jose and Maria are 47 and 38 years old, married and file jointly. The do not have any children living with them. Jose earns $80,000 as an employee. Maria is self-employed and has net income from self-employment of $40,000. Jose's employer does not offer a cafeteria plan. Jose and Maria both contribute $6,000 to their own IRAs each year. They have also purchased a private high deductible health insurance policy for $10,000 per per year and contributed the maximum allowed amount to a Health Savings Account. Assuming no other taxable transactions for the year, what is Jose's and Maria's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Other Taxes Credits Net Tax Due 4. Lisa is 68 years old and retired. She received $22,000 of SSB in this year. She also received $5,000 of tax exempt bond interest, $15,000 from an IRA account, and $9,600 from an annuity. The annuity started making payments this year. Lisa paid $40,000 for the annuity and she receives $800 per month for the rest of her life. Assuming no other taxable transactions for the year, what is Lisa's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Credits Net Tax Due 1. Sally is 35 years old, single and has joint custody for her 12 year old son, Joshua. Her son's father pays $350 a month in child support to Sally. Joshua spends 4 to 5 days a week with Erika and 3 to 4 days a week with his dad. Sally is a financial planner and earns $80,000 annually (gross pay). She is an employee. Her employer offers a cafeteria plan and Sally has selected the following benefits: Health Insurance (High deductible health plan), family plan - $4,000; Health Savings Account - Maximum contribution; 401(k) Retirement Contributions - $10,000 (employer matches with $5,000). Assuming no other taxable transactions for the year, what is Sally's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or Itemized) Taxable income Tax Credits Net Tax Due 2. Erika is 35 years old is single. Erika is a financial planner and earns $80,000 annually (gross pay). She is an employee. Her employer offers a cafeteria plan and Erika has selected the following benefits: Health Insurance (High deductible health plan), family plan - $4,000; Health Savings Account - Maximum contribution; 401(k) Retirement Contributions - $10,000 (employer matches with $5,000). Assuming no other taxable transactions for the year, what is Erika's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Credits Net Tax Due Chapters 3 - 5 Exercises 3. Jose and Maria are 47 and 38 years old, married and file jointly. The do not have any children living with them. Jose earns $80,000 as an employee. Maria is self-employed and has net income from self-employment of $40,000. Jose's employer does not offer a cafeteria plan. Jose and Maria both contribute $6,000 to their own IRAs each year. They have also purchased a private high deductible health insurance policy for $10,000 per per year and contributed the maximum allowed amount to a Health Savings Account. Assuming no other taxable transactions for the year, what is Jose's and Maria's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Other Taxes Credits Net Tax Due 4. Lisa is 68 years old and retired. She received $22,000 of SSB in this year. She also received $5,000 of tax exempt bond interest, $15,000 from an IRA account, and $9,600 from an annuity. The annuity started making payments this year. Lisa paid $40,000 for the annuity and she receives $800 per month for the rest of her life. Assuming no other taxable transactions for the year, what is Lisa's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Credits Net Tax Due 1. Sally is 35 years old, single and has joint custody for her 12 year old son, Joshua. Her son's father pays $350 a month in child support to Sally. Joshua spends 4 to 5 days a week with Erika and 3 to 4 days a week with his dad. Sally is a financial planner and earns $80,000 annually (gross pay). She is an employee. Her employer offers a cafeteria plan and Sally has selected the following benefits: Health Insurance (High deductible health plan), family plan - $4,000; Health Savings Account - Maximum contribution; 401(k) Retirement Contributions - $10,000 (employer matches with $5,000). Assuming no other taxable transactions for the year, what is Sally's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or Itemized) Taxable income Tax Credits Net Tax Due 2. Erika is 35 years old is single. Erika is a financial planner and earns $80,000 annually (gross pay). She is an employee. Her employer offers a cafeteria plan and Erika has selected the following benefits: Health Insurance (High deductible health plan), family plan - $4,000; Health Savings Account - Maximum contribution; 401(k) Retirement Contributions - $10,000 (employer matches with $5,000). Assuming no other taxable transactions for the year, what is Erika's federal income tax for the year? Gross Income Exclusions Gross Income Reported on Tax Return Deductions FOR AGI Adjusted Gross Income (AGI) Deductions From AGI (Standard or itemized) Taxable income Tax Credits Net Tax Due