Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapters 3 and 4: Financial Statements and Long-term Financial Planning and Growth 13. An increase in accounts payable represents an increase in net cash provided

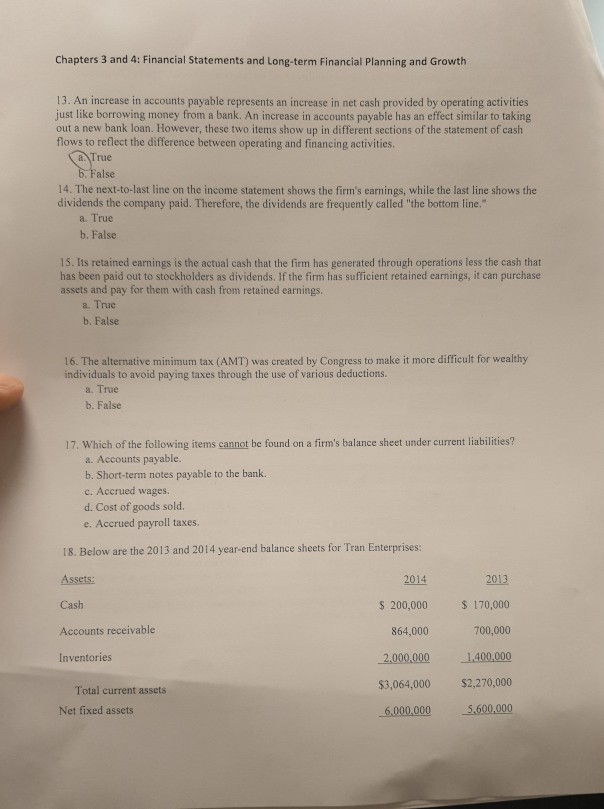

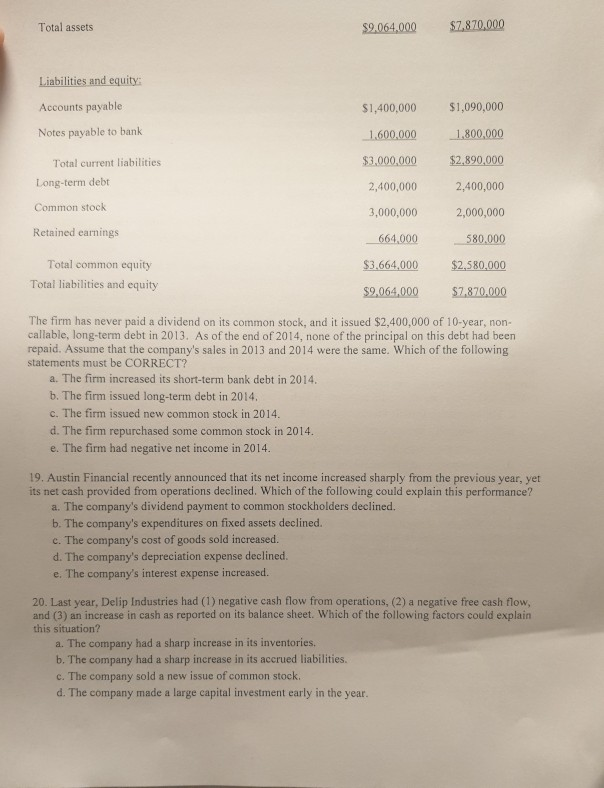

Chapters 3 and 4: Financial Statements and Long-term Financial Planning and Growth 13. An increase in accounts payable represents an increase in net cash provided by operating activities just like borrowing money from a bank. An increase in accounts payable has an effect similar to taking out a new bank loan. However, these two items show up in different sections of the statement of cash flows to reflect the difference between operating and financing activities. a True b. False 14. The next-to-last line on the income statement shows the firm's earnings, while the last line shows the dividends the company paid. Therefore, the dividends are frequently called "the bottom line. a. True b. False 15. Its retained earnings is the actual cash that the firm has generated through operations less the cash that has been paid out to stockholders as dividends. If the firm has sufficient retained earnings, it can purchase assets and pay for them with cash from retained earnings. a. True b. False 16. The alternative minimum tax (AMT) was created by Congress to make it more difficult for wealthy individuals to avoid paying taxes through the use of various deductions. a. True b. False 17, Which of the following items cannot be found on a firm's balance sheet under current liabilities? a. Accounts payable. b. Short-term notes payable to the bank. c. Accrued wages. d. Cost of goods sold. e. Accrued payroll taxes. 18. Below are the 2013 and 2014 year-end balance sheets for Tran Enterprises: Assets: 2014 2013 $ 200,000 $ 170,000 Cash Accounts receivable 700,000 864,000 Inventories 2,000,000 1,400,000 $2,270,000 $3,064,000 Total current assets 5,600,000 Net fixed assets 6,000,000 $7,870,000 Total assets $9,064,000 Liabilities and equity: $1,090,000 Accounts payable $1,400,000 Notes payable to bank 1,800,000 1,600,000 $3,000,000 $2,890,000 Total current liabilities Long-term debt 2,400,000 2,400,000 Common stock 3,000,000 2,000,000 Retained earnings 664,000 580,000 Total common equity $3,664,000 $2,580,000 Total liabilities and equity $9,064,000 $7,870,000 The firm has never paid a dividend on its common stock, and it issued $2,400,000 of 10-year, callable, long-term debt in 2013. As of the end of 2014, none of the principal on this debt had been repaid. Assume that the company's sales in 2013 and 2014 were the same. Which of the following statements must be CORRECT? a. The firm increased its short-term bank debt in 2014. non- b. The firm issued long-term debt in 2014. c. The firm issued new common stock in 2014. d. The firm repurchased some common stock in 2014. e. The firm had negative net income in 2014. 19. Austin Financial recently announced that its net income increased sharply from the previous year, yet its net cash provided from operations declined. Which of the following could explain this performance? a. The company's dividend payment to common stockholders declined. b. The company's expenditures on fixed assets declined. c. The company's cost of goods sold increased. d. The company's depreciation expense declined. e. The company's interest expense increased. 20. Last year, Delip Industries had (1) negative cash flow from operations, (2) a negative free cash flow, and (3) an increase in cash as reported on its balance sheet. Which of the following factors could explain this situation? a. The company had a sharp increase in its inventories. b. The company had a sharp increase in its accrued liabilities. c. The company sold a new issue of common stock. d. The company made a large capital investment early in the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started