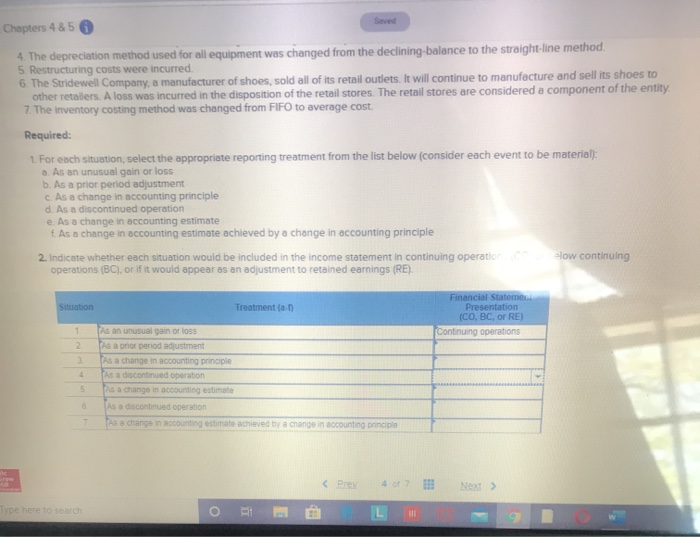

Chapters 4&5 4. The depreciation method used for all equipment was changed from the declining balance to the straight-line method 5. Restructuring costs were incurred 6. The Stridewell Company, a manufacturer of shoes, sold all of its retail outlets. It will continue to manufacture and sell its shoes to other retailers. A loss was incurred in the disposition of the retail stores. The retail stores are considered a component of the entity 7. The inventory costing method was changed from FIFO to average cost. Required: 1. For each situation, select the appropriate reporting treatment from the list below (consider each event to be material: a. As an unusual gain or loss b. As a prior period adjustment c. As a change in accounting principle d. As a discontinued operation e. As a change in accounting estimate As a change in accounting estimate achieved by a change in accounting principle e low continuing 2. Indicate whether each situation would be included in the income statement in continuing operation operations (BC), or if it would appear as an adjustment to retained earnings (RE) Situation Treatment (a.n Financial Stateme Presentation (CO, BC, or RE Continuing operations As an unusual gain or loss As a prior period adjustment As a change in accounting principle As a discontinued operation As a change in accounting estimate As a discontinued operation As a change in accounting estimate achieved by a change in accounting principle Type here to search Chapters 4&5 4. The depreciation method used for all equipment was changed from the declining balance to the straight-line method 5. Restructuring costs were incurred 6. The Stridewell Company, a manufacturer of shoes, sold all of its retail outlets. It will continue to manufacture and sell its shoes to other retailers. A loss was incurred in the disposition of the retail stores. The retail stores are considered a component of the entity 7. The inventory costing method was changed from FIFO to average cost. Required: 1. For each situation, select the appropriate reporting treatment from the list below (consider each event to be material: a. As an unusual gain or loss b. As a prior period adjustment c. As a change in accounting principle d. As a discontinued operation e. As a change in accounting estimate As a change in accounting estimate achieved by a change in accounting principle e low continuing 2. Indicate whether each situation would be included in the income statement in continuing operation operations (BC), or if it would appear as an adjustment to retained earnings (RE) Situation Treatment (a.n Financial Stateme Presentation (CO, BC, or RE Continuing operations As an unusual gain or loss As a prior period adjustment As a change in accounting principle As a discontinued operation As a change in accounting estimate As a discontinued operation As a change in accounting estimate achieved by a change in accounting principle Type here to search