Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Char and Russ Dasrup have one daughter, Siera, who is 1 6 years old. In November of last year, the Dasrups took in Siera's 1

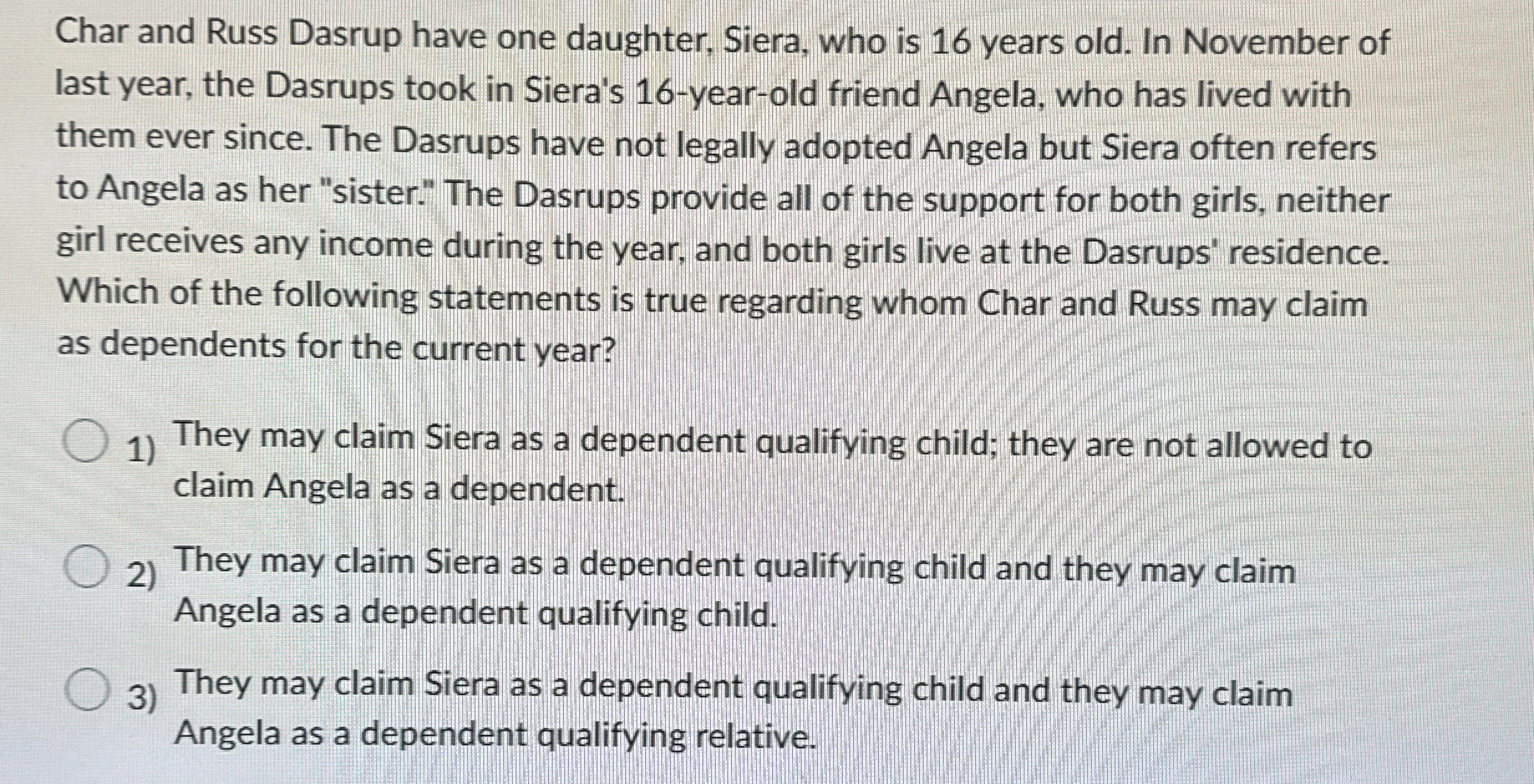

Char and Russ Dasrup have one daughter, Siera, who is years old. In November of last year, the Dasrups took in Siera's yearold friend Angela, who has lived with them ever since. The Dasrups have not legally adopted Angela but Siera often refers to Angela as her "sister." The Dasrups provide all of the support for both girls, neither girl receives any income during the year, and both girls live at the Dasrups' residence. Which of the following statements is true regarding whom Char and Russ may claim as dependents for the current year?

They may claim Siera as a dependent qualifying child; they are not allowed to claim Angela as a dependent.

They may claim Siera as a dependent qualifying child and they may claim Angela as a dependent qualifying child.

They may claim Siera as a dependent qualifying child and they may claim Angela as a dependent qualifying relative.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started