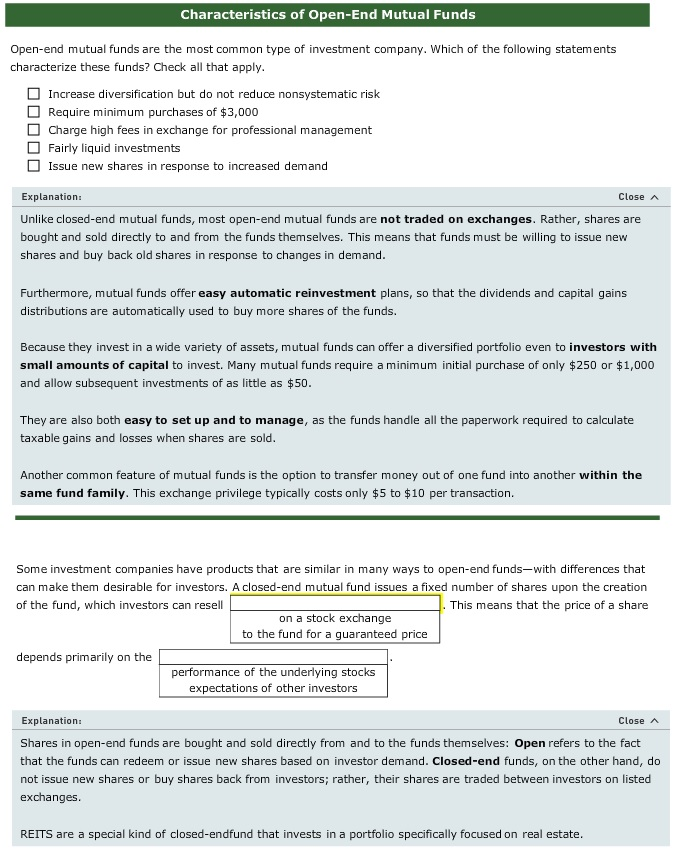

Characteristics of Open-End Mutual Funds Open-end mutual funds are the most common type of investment company. Which of the following statements characterize these funds? Check all that apply Increase diversification but do not reduce nonsystematic risk Require minimum purchases of $3,000 Charge high fees in exchange for professional management Fairly liquid investments Issue new shares in response to increased demand Close A Explanation Unlike closed-end mutual funds, most open-end mutual funds are not traded on exchanges. Rather, shares are bought and sold directly to and from the funds themselves. This means that funds must be willing to issue new shares and buy back old shares in response to changes in demand Furthermore, mutual funds offer easy automatic reinvestment plans, so that the dividends and capital gains distributions are automatically used to buy more shares of the funds. Because they invest in a wide variety of assets, mutual funds can offer a diversified portfolio even to investors with small amounts of capital to invest. Many mutual funds require a minimum initial purchase of only $250 or $1,000 and allow subsequent investments of as little as $50 They are also both easy to set up and to manage, as the funds handle all the paperwork required to calculate taxable gains and losses when shares are sold Another common feature of mutual funds is the option to transfer money out of one fund into another within the same fund family. This exchange privilege typically costs only $5 to $10 per transaction. Some investment companies have products that are similar in many ways to open-end funds-with differences that can make them desirable for investors. A closed-end mutual fund issues a fixed number of shares upon the creation of the fund, which investors can resell This means that the price of a share on a stock exchange to the fund for a guaranteed price depends primarily on the performance of the underlying stocks expectations of other investors Explanation Shares in open-end funds are bought and sold directly from and to the funds themselves: Open refers to the fact that the funds can redeem or issue new shares based on investor demand. Closed-end funds, on the other hand, do not issue new shares or buy shares back from investors; rather, their shares are traded between investors on listed exchanges Close A REITS are a special kind of closed-endfund that invests in a portfolio specifically focused on real estate