Question

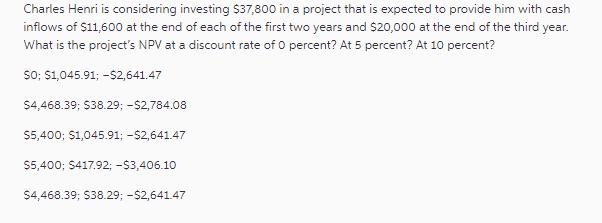

Charles Henri is considering investing $37,800 in a project that is expected to provide him with cash inflows of $11,600 at the end of

Charles Henri is considering investing $37,800 in a project that is expected to provide him with cash inflows of $11,600 at the end of each of the first two years and $20,000 at the end of the third year. What is the project's NPV at a discount rate of 0 percent? At 5 percent? At 10 percent? SO; $1,045.91; -$2,641.47 $4,468.39; $38.29; -$2,784.08 $5,400; $1,045.91; -$2,641.47 $5,400; $417.92; -$3,406.10 $4,468.39; $38.29; -$2,641.47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the Net Present Value NPV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Ethics Ethical Decision Making & Cases

Authors: O. C. Ferrell, John Fraedrich, Linda Ferrell

8th Edition

1439042233, 978-1439042236

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App