Answered step by step

Verified Expert Solution

Question

1 Approved Answer

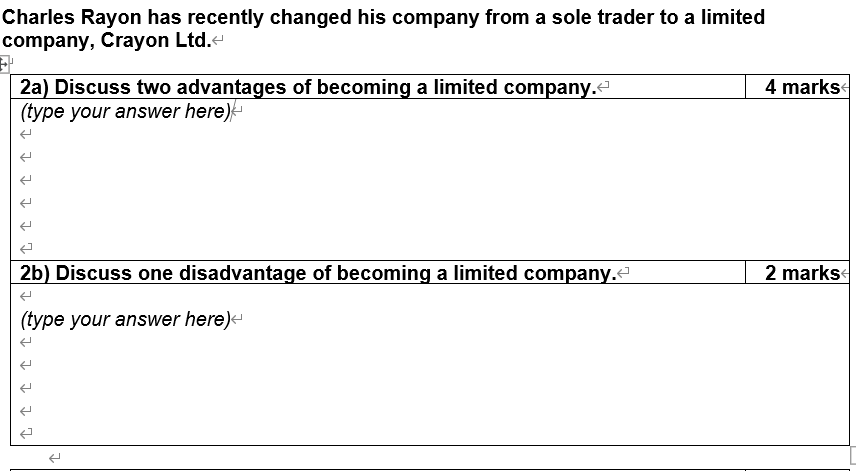

Charles Rayon has recently changed his company from a sole trader to a limited company, Crayon Ltd. 4 marks 2a) Discuss two advantages of becoming

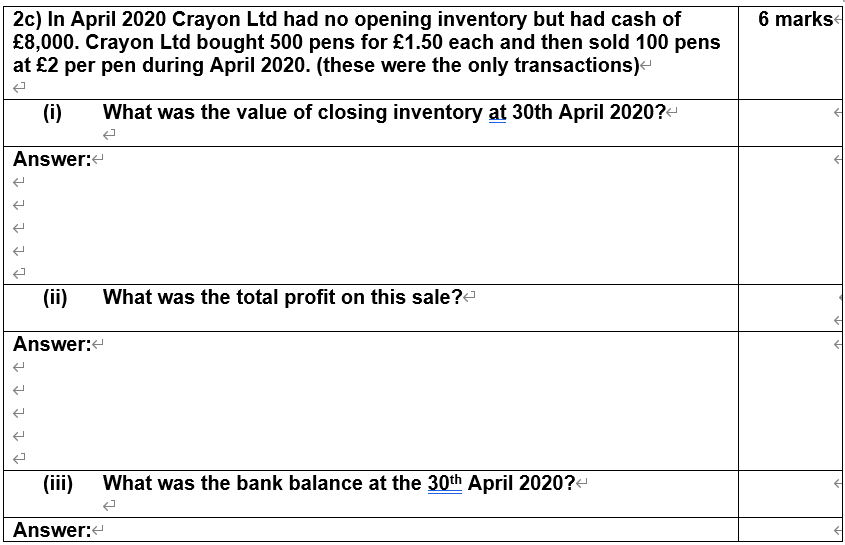

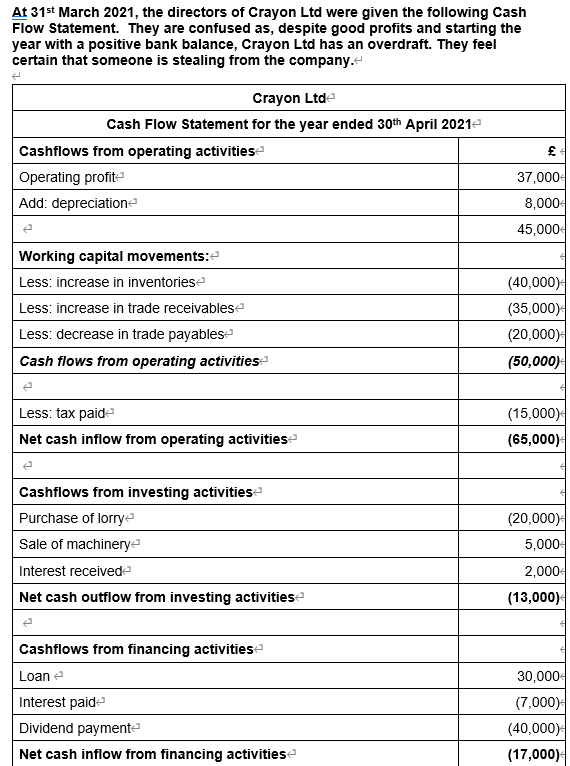

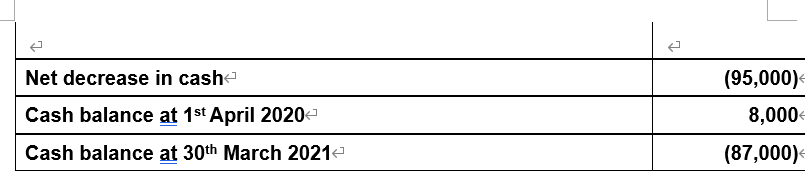

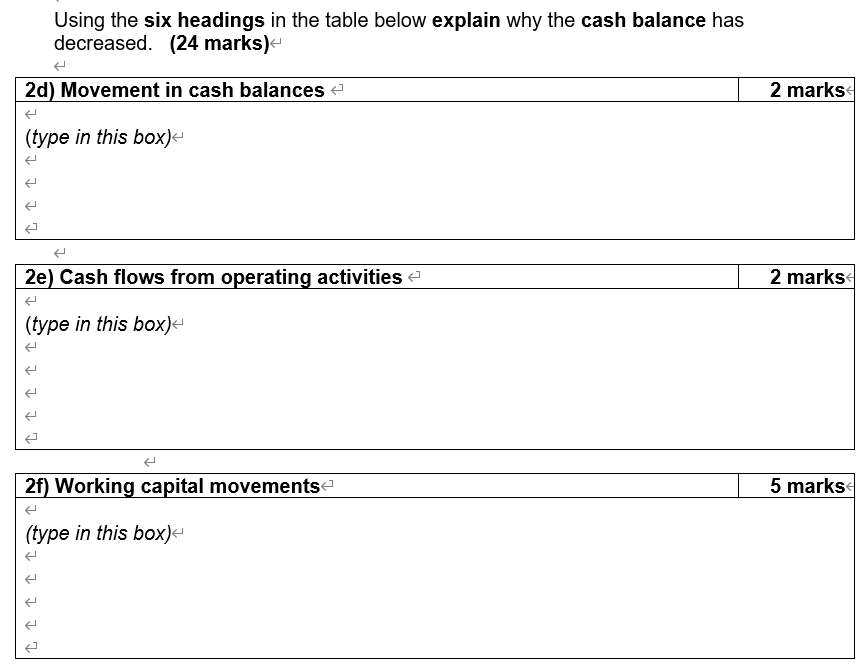

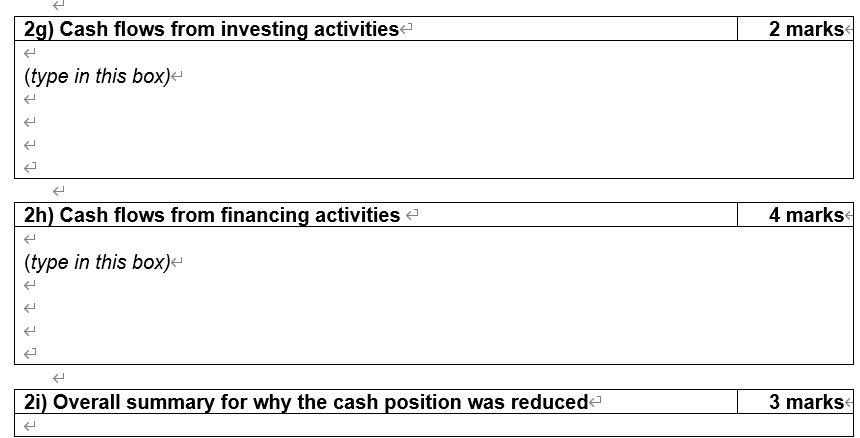

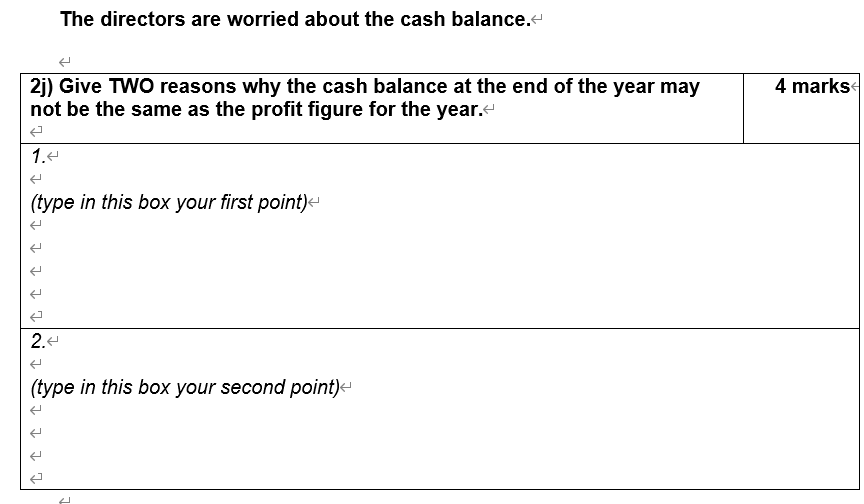

Charles Rayon has recently changed his company from a sole trader to a limited company, Crayon Ltd. 4 marks 2a) Discuss two advantages of becoming a limited company.- (type your answer here) 2b) Discuss one disadvantage of becoming a limited company. 2 marks (type your answer here) + 6 marks 2c) In April 2020 Crayon Ltd had no opening inventory but had cash of 8,000. Crayon Ltd bought 500 pens for 1.50 each and then sold 100 pens at 2 per pen during April 2020. (these were the only transactions) (0) What was the value of closing inventory at 30th April 2020?- Answer: ** * (ii) What was the total profit on this sale?- Answer: 1 1 2 (iii) What was the bank balance at the 30th April 2020?- Answer: At 31st March 2021, the directors of Crayon Ltd were given the following Cash Flow Statement. They are confused as, despite good profits and starting the year with a positive bank balance, Crayon Ltd has an overdraft. They feel certain that someone is stealing from the company. Crayon Ltde Cash Flow Statement for the year ended 30th April 20212 Cashflows from operating activities Operating profite Add: depreciatione 37,000 8,000 45,000 Working capital movements: Less: increase in inventoriese Less: increase in trade receivablese Less: decrease in trade payables Cash flows from operating activities (40,000) (35,000) (20,000) (50,000) Less: tax paide Net cash inflow from operating activities (15,000) (65,000) Cashflows from investing activities Purchase of lorry Sale of machinerye Interest receivede Net cash outflow from investing activitiese (20,000) 5,000 2,000 (13,000) Cashflows from financing activities Loan e Interest paide Dividend paymente Net cash inflow from financing activities 30,000 (7,000) (40,000) (17,000) Net decrease in cash Cash balance at 1st April 2020- Cash balance at 30th March 20214 (95,000) 8,000 (87,000) Using the six headings in the table below explain why the cash balance has decreased. (24 marks) - 2d) Movement in cash balances 2 marks (type in this box) 2e) Cash flows from operating activities 2 marks (type in this box) 2f) Working capital movements 5 marks (type in this box) ? ? ? 29) Cash flows from investing activities 2 marks (type in this box) 2h) Cash flows from financing activities 4 marks (type in this box) 2i) Overall summary for why the cash position was reduced 3 marks The directors are worried about the cash balance. 4 marks 2j) Give TWO reasons why the cash balance at the end of the year may not be the same as the profit figure for the year. 1. (type in this box your first point) IN I ? (type in this box your second point) LLL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started