Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charles Windsor is a visiting scholar from England. He arrived in the U S. on August 28. 2015 in a J-1 immigration status and was

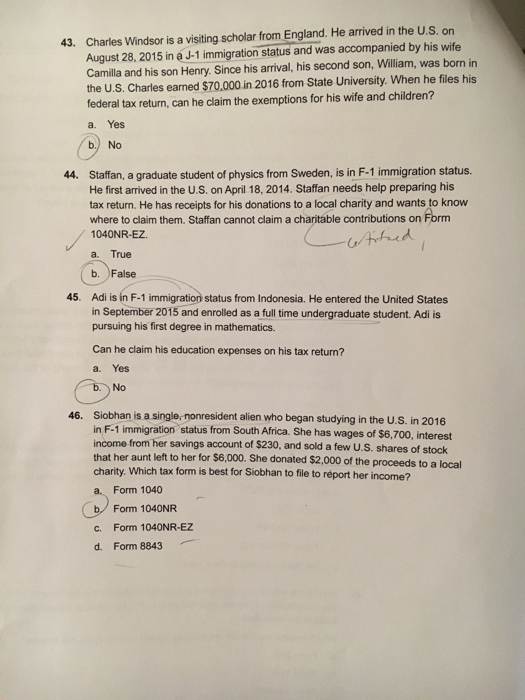

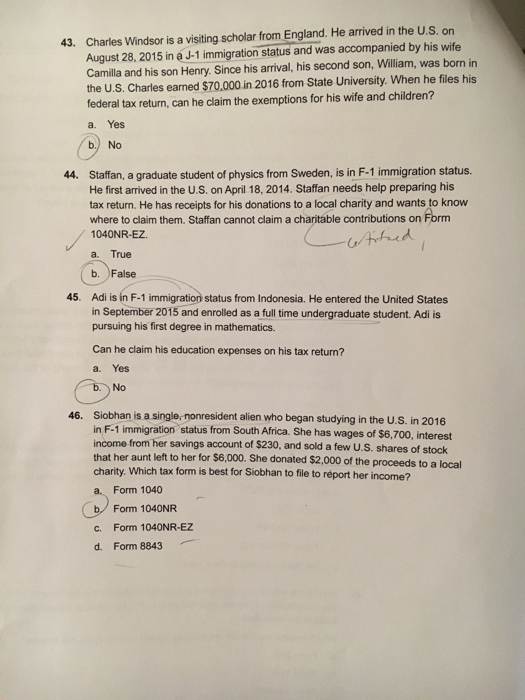

Charles Windsor is a visiting scholar from England. He arrived in the U S. on August 28. 2015 in a J-1 immigration status and was accompanied by his wife Camilla and his son Henry. Since his arrival, his second son. William, was born in the U S. Charles earned $70,000 in 2016 from State University. When he files his federal tax return, can he claim the exemptions for his wife and children? Yes No Staffan. a graduate student of physics from Sweden, is in F-1 immigration status. He first arrived in the U S. on April 18. 2014 Staffan needs help preparing his tax return He has receipts for his donations to a local charity and wants to know where to claim them. Staffan cannot claim a charitable contributions on Form 1040NR-EZ. True False Adi is in F-1 immigration status from Indonesia. He entered the United States in September 2015 and enrolled as a full time undergraduate student. Adi is pursuing his first degree in mathematics. Can he claim his education expenses on his tax return? Yes No Siobhan is a single, nonresident alien who began studying in the U S. in 2016 in F-1 immigration status from South Africa. She has wages of $6, 700. interest income from her savings account of $230. and sold a few U S shares of stock that her aunt left to her for $6,000. She donated $2,000 of the proceeds to a local charity. Which tax form is best for Siobhan to file to report her income? Form 1040 Form 1040NR Form 1040NR-EZ

Charles Windsor is a visiting scholar from England. He arrived in the U S. on August 28. 2015 in a J-1 immigration status and was accompanied by his wife Camilla and his son Henry. Since his arrival, his second son. William, was born in the U S. Charles earned $70,000 in 2016 from State University. When he files his federal tax return, can he claim the exemptions for his wife and children? Yes No Staffan. a graduate student of physics from Sweden, is in F-1 immigration status. He first arrived in the U S. on April 18. 2014 Staffan needs help preparing his tax return He has receipts for his donations to a local charity and wants to know where to claim them. Staffan cannot claim a charitable contributions on Form 1040NR-EZ. True False Adi is in F-1 immigration status from Indonesia. He entered the United States in September 2015 and enrolled as a full time undergraduate student. Adi is pursuing his first degree in mathematics. Can he claim his education expenses on his tax return? Yes No Siobhan is a single, nonresident alien who began studying in the U S. in 2016 in F-1 immigration status from South Africa. She has wages of $6, 700. interest income from her savings account of $230. and sold a few U S shares of stock that her aunt left to her for $6,000. She donated $2,000 of the proceeds to a local charity. Which tax form is best for Siobhan to file to report her income? Form 1040 Form 1040NR Form 1040NR-EZ

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started