Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charlie Ltd. intends to invest in a new machine. A feasibility study for this investment was carried out three months ago costing 6,000 and this

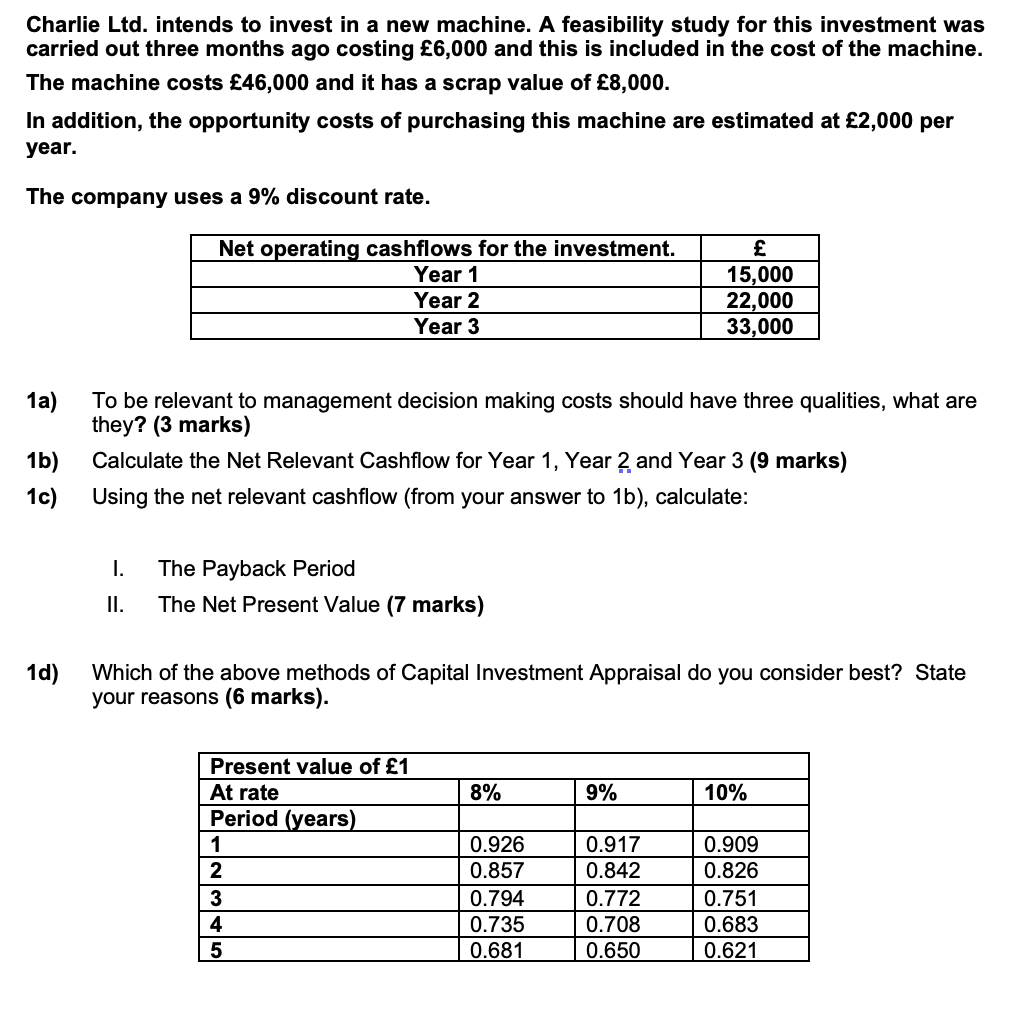

Charlie Ltd. intends to invest in a new machine. A feasibility study for this investment was carried out three months ago costing 6,000 and this is included in the cost of the machine. The machine costs 46,000 and it has a scrap value of 8,000. In addition, the opportunity costs of purchasing this machine are estimated at 2,000 per year. The company uses a 9% discount rate. 1a) To be relevant to management decision making costs should have three qualities, what are they? (3 marks) 1b) Calculate the Net Relevant Cashflow for Year 1, Year 2 and Year 3 (9 marks) 1c) Using the net relevant cashflow (from your answer to 1b ), calculate: I. The Payback Period II. The Net Present Value (7 marks) 1d) Which of the above methods of Capital Investment Appraisal do you consider best? State your reasons (6 marks)

Charlie Ltd. intends to invest in a new machine. A feasibility study for this investment was carried out three months ago costing 6,000 and this is included in the cost of the machine. The machine costs 46,000 and it has a scrap value of 8,000. In addition, the opportunity costs of purchasing this machine are estimated at 2,000 per year. The company uses a 9% discount rate. 1a) To be relevant to management decision making costs should have three qualities, what are they? (3 marks) 1b) Calculate the Net Relevant Cashflow for Year 1, Year 2 and Year 3 (9 marks) 1c) Using the net relevant cashflow (from your answer to 1b ), calculate: I. The Payback Period II. The Net Present Value (7 marks) 1d) Which of the above methods of Capital Investment Appraisal do you consider best? State your reasons (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started