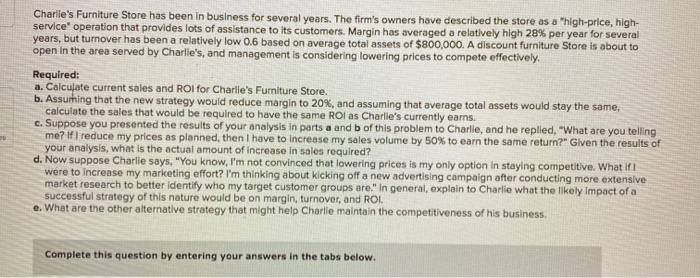

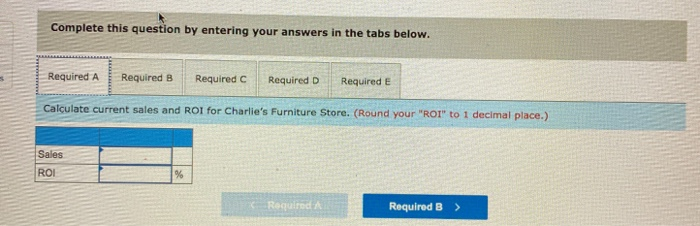

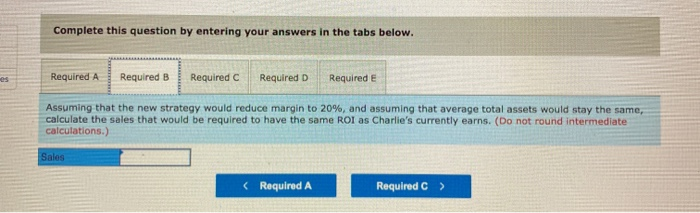

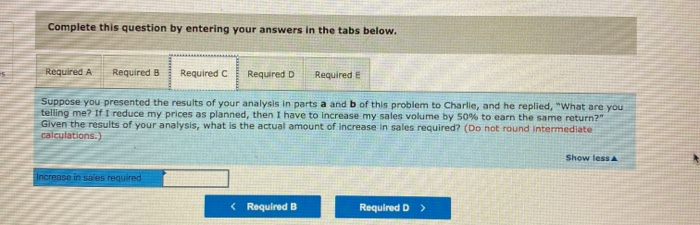

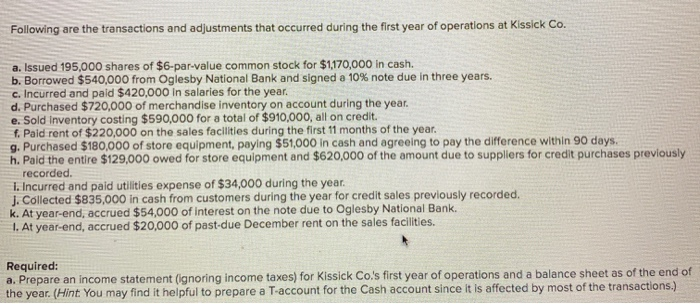

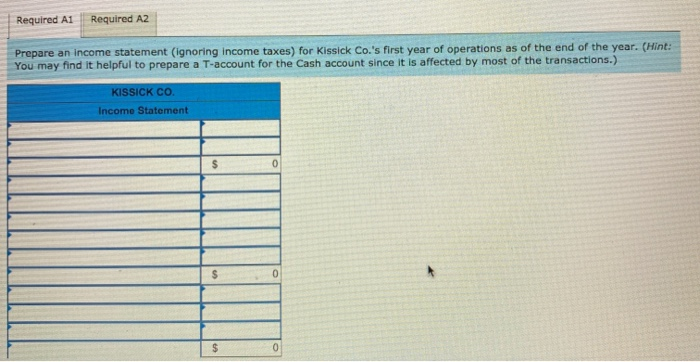

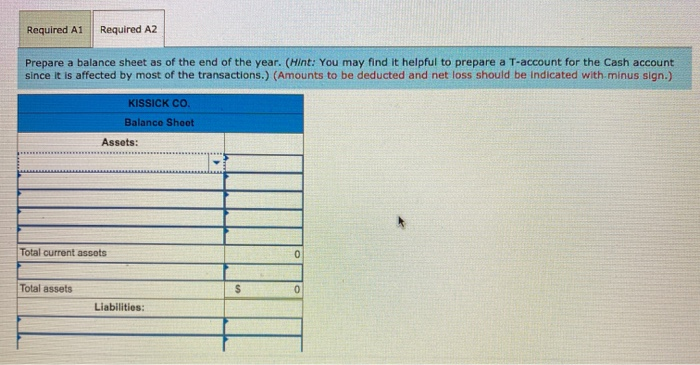

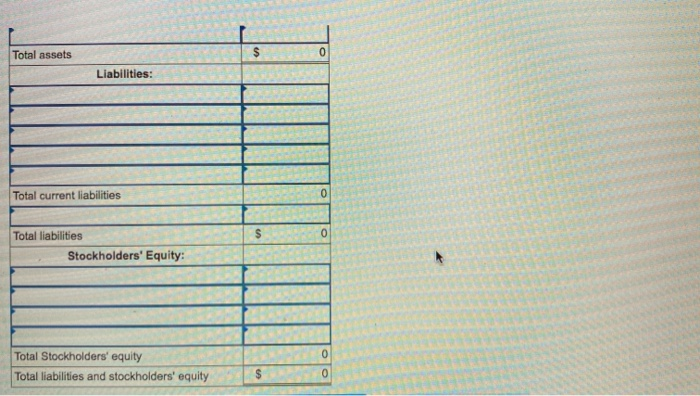

Charlie's Furniture Store has been in business for several years. The firm's owners have described the store as a "high-price, high- service operation that provides lots of assistance to its customers. Margin has averaged a relatively high 28% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management is considering lowering prices to compete effectively, Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuring that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROI as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charlie, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to increase my sales volume by 50% to earn the same return?" Given the results of your analysis, what is the actual amount of increase in sales required? d. Now suppose Charlie says, "You know, I'm not convinced that lowering prices is my only option in staying competitive. What it were to increase my marketing effort? I'm thinking about kicking off a new advertising campaign after conducting more extensive market research to better identify who my target customer groups are." In general, explain to Charlie what the likely impact of a successful strategy of this nature would be on margin, turnover, and ROI. e. What are the other alternative strategy that might help Charlie maintain the competitiveness of his business. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required a Required B Required C Required D Required E Calculate current sales and ROI for Charlie's Furniture Store. (Round your "ROT" to 1 decimal place.) Sales ROI % Required Required B > Complete this question by entering your answers in the tabs below. Required a Required B Required Required D Required E Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROI as Charlie's currently earns. (Do not round intermediate calculations.) Sales Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Suppose you presented the results of your analysis in parts a and b of this problem to Charlie, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to increase my sales volume by 50% to earn the same return?" Given the results of your analysis, what is the actual amount of increase in sales required? (Do not round Intermediate calculations.) Show less Increase in sales required Following are the transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 195,000 shares of $6-par-value common stock for $1,170,000 in cash. b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in three years. c. Incurred and paid $420,000 in salaries for the year. d. Purchased $720,000 of merchandise inventory on account during the year. e. Sold inventory costing $590,000 for a total of $910,000, all on credit. f. Paid rent of $220,000 on the sales facilities during the first 11 months of the year. g. Purchased $180,000 of store equipment, paying $51,000 in cash and agreeing to pay the difference within 90 days. h. Pald the entire $129,000 owed for store equipment and $620,000 of the amount due to suppliers for credit purchases previously recorded. 1. Incurred and paid utilities expense of $34,000 during the year. J. Collected $835,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank. 1. At year-end, accrued $20,000 of past-due December rent on the sales facilities. Required: a. Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations and a balance sheet as of the end of the year. (Hint You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Required A1 Required A2 Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) KISSICK CO. Income Statement 0 0 $ 0 Required A1 Required A2 Prepare a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) (Amounts to be deducted and net loss should be indicated with minus sign.) KISSICK CO Balance Sheet Assets: Total current assets 0 Total assets $ 0 Liabilities: Total assets $ Liabilities: Total current liabilities 0 $ 0 Total liabilities Stockholders' Equity 0 Total Stockholders' equity Total liabilities and stockholders' equity 0 Charlie's Furniture Store has been in business for several years. The firm's owners have described the store as a "high-price, high- service operation that provides lots of assistance to its customers. Margin has averaged a relatively high 28% per year for several years, but turnover has been a relatively low 0.6 based on average total assets of $800,000. A discount furniture Store is about to open in the area served by Charlie's, and management is considering lowering prices to compete effectively, Required: a. Calculate current sales and ROI for Charlie's Furniture Store. b. Assuring that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROI as Charlie's currently earns. c. Suppose you presented the results of your analysis in parts a and b of this problem to Charlie, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to increase my sales volume by 50% to earn the same return?" Given the results of your analysis, what is the actual amount of increase in sales required? d. Now suppose Charlie says, "You know, I'm not convinced that lowering prices is my only option in staying competitive. What it were to increase my marketing effort? I'm thinking about kicking off a new advertising campaign after conducting more extensive market research to better identify who my target customer groups are." In general, explain to Charlie what the likely impact of a successful strategy of this nature would be on margin, turnover, and ROI. e. What are the other alternative strategy that might help Charlie maintain the competitiveness of his business. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required a Required B Required C Required D Required E Calculate current sales and ROI for Charlie's Furniture Store. (Round your "ROT" to 1 decimal place.) Sales ROI % Required Required B > Complete this question by entering your answers in the tabs below. Required a Required B Required Required D Required E Assuming that the new strategy would reduce margin to 20%, and assuming that average total assets would stay the same, calculate the sales that would be required to have the same ROI as Charlie's currently earns. (Do not round intermediate calculations.) Sales Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Suppose you presented the results of your analysis in parts a and b of this problem to Charlie, and he replied, "What are you telling me? If I reduce my prices as planned, then I have to increase my sales volume by 50% to earn the same return?" Given the results of your analysis, what is the actual amount of increase in sales required? (Do not round Intermediate calculations.) Show less Increase in sales required Following are the transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 195,000 shares of $6-par-value common stock for $1,170,000 in cash. b. Borrowed $540,000 from Oglesby National Bank and signed a 10% note due in three years. c. Incurred and paid $420,000 in salaries for the year. d. Purchased $720,000 of merchandise inventory on account during the year. e. Sold inventory costing $590,000 for a total of $910,000, all on credit. f. Paid rent of $220,000 on the sales facilities during the first 11 months of the year. g. Purchased $180,000 of store equipment, paying $51,000 in cash and agreeing to pay the difference within 90 days. h. Pald the entire $129,000 owed for store equipment and $620,000 of the amount due to suppliers for credit purchases previously recorded. 1. Incurred and paid utilities expense of $34,000 during the year. J. Collected $835,000 in cash from customers during the year for credit sales previously recorded. k. At year-end, accrued $54,000 of interest on the note due to Oglesby National Bank. 1. At year-end, accrued $20,000 of past-due December rent on the sales facilities. Required: a. Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations and a balance sheet as of the end of the year. (Hint You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Required A1 Required A2 Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) KISSICK CO. Income Statement 0 0 $ 0 Required A1 Required A2 Prepare a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) (Amounts to be deducted and net loss should be indicated with minus sign.) KISSICK CO Balance Sheet Assets: Total current assets 0 Total assets $ 0 Liabilities: Total assets $ Liabilities: Total current liabilities 0 $ 0 Total liabilities Stockholders' Equity 0 Total Stockholders' equity Total liabilities and stockholders' equity 0