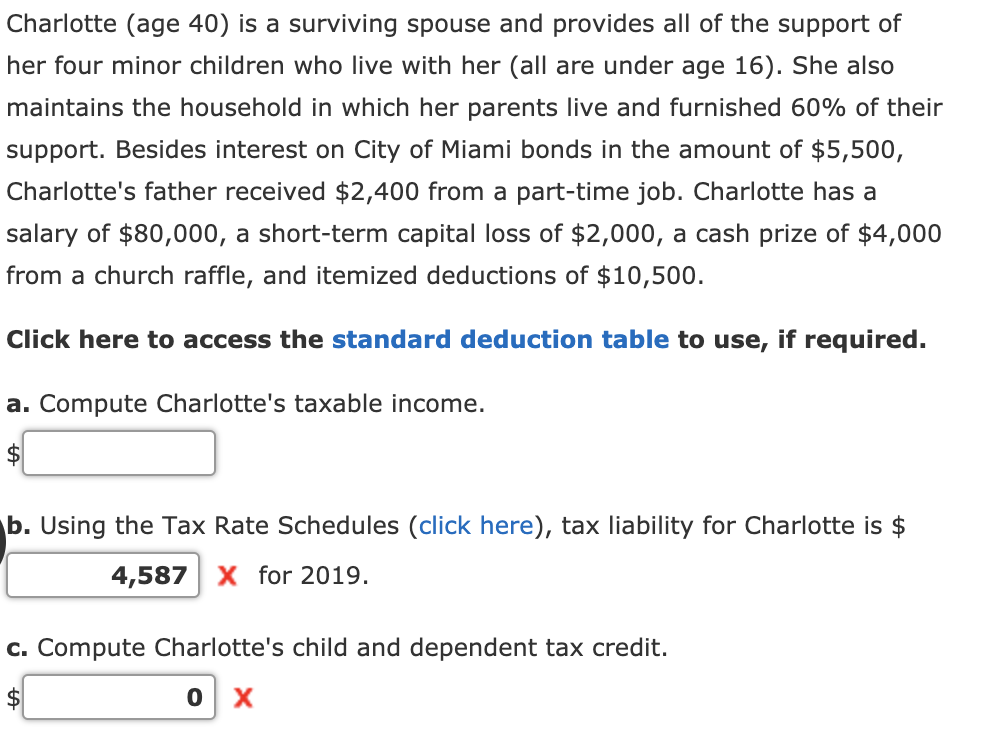

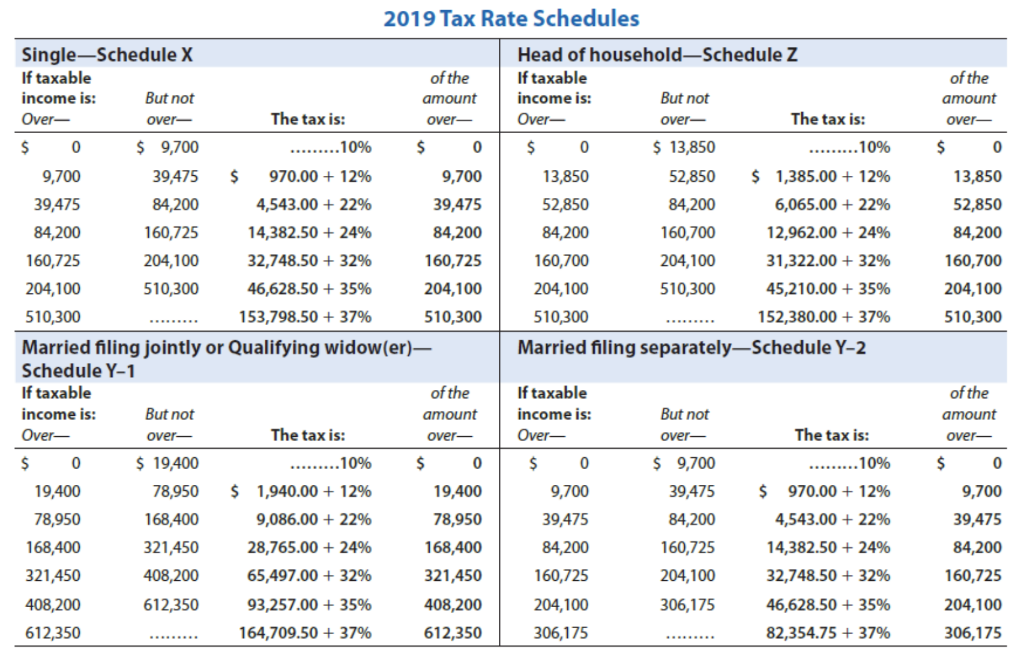

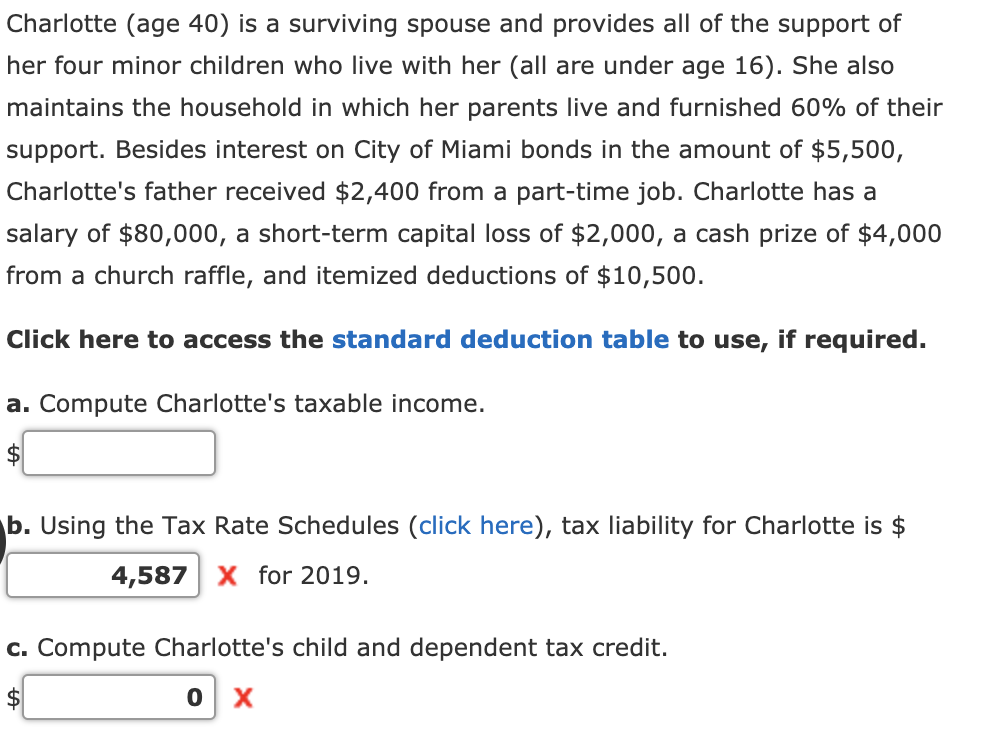

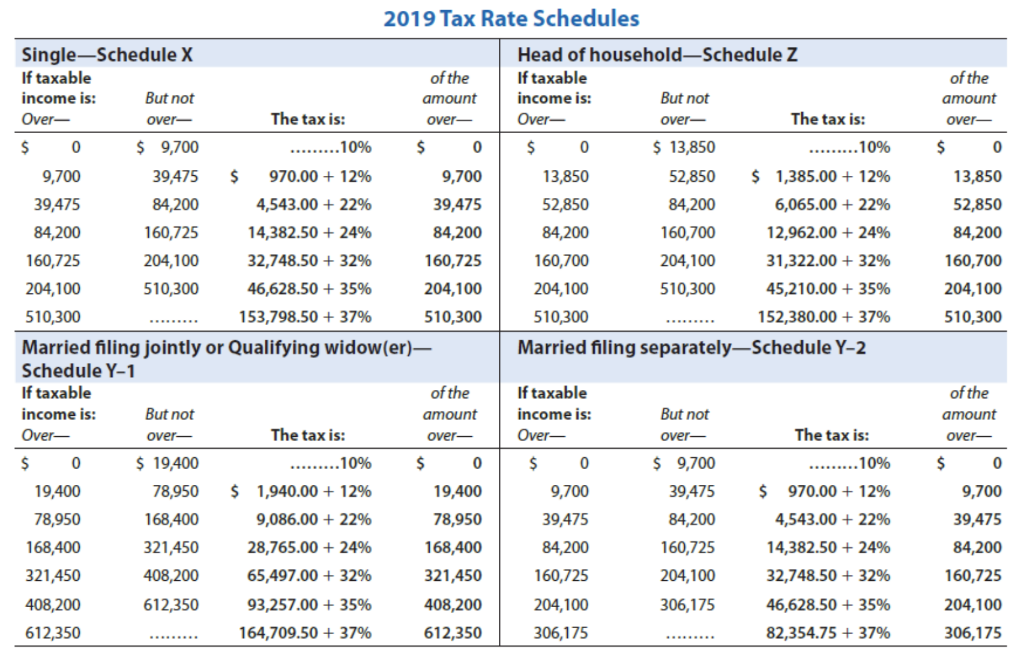

Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her (all are under age 16). She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. Click here to access the standard deduction table to use, if required. a. Compute Charlotte's taxable income. b. Using the Tax Rate Schedules (click here), tax liability for Charlotte is $ 4,587 x for 2019. C. Compute Charlotte's child and dependent tax credit. over- of the amount over- $ 0 13,850 52,850 84,200 160,700 204,100 510,300 2019 Tax Rate Schedules Single-Schedule X Head of householdSchedule Z If taxable of the If taxable income is: But not amount income is: But not Over- The tax is: over- Over- over- The tax is: $ 0 $ 9,700 .........10% $ 0 $ 0 $ 13,850 ......... 10% 9,700 39,475 $ 970.00 + 12% 9,700 13,850 52,850 $ 1,385.00 + 12% 39,475 84,200 4,543.00 + 22% 39,475 52,850 84,200 6,065.00 + 22% 84,200 160,725 14,382.50 + 24% 84,200 84,200 160,700 12,962.00 + 24% 160,725 204,100 32,748.50 + 32% 160,725 160,700 204,100 31,322.00 + 32% 204,100 510,300 46,628.50 + 35% 204,100 204,100 510,300 45,210.00 + 35% 510,300 ......... 153,798.50 + 37% 510,300 510,300 152,380.00 + 37% Married filing jointly or Qualifying widow(er) Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over- over- The tax is: $ 0 $ 19,400 ......... 10% $ 0 $ 0 $ 9,700 ......... 10% 19,400 78,950 $ 1,940.00 + 12% 19,400 9,700 39,475 $ 970.00 + 12% 78,950 168,400 9,086.00 + 22% 78,950 39,475 84,200 4,543.00 + 22% 168,400 321,450 28,765.00 + 24% 168,400 84,200 160,725 14,382.50 + 24% 321,450 408,200 65,497.00 + 32% 321,450 160,725 204,100 32,748.50 + 32% 408,200 612,350 93,257.00 + 35% 408,200 204,100 306,175 46,628.50 + 35% 612,350 ......... 164,709.50 + 37% 612,350 306,175 ......... 82,354.75 + 37% of the amount over- $ 0 9,700 39,475 84,200 160,725 204,100 306,175