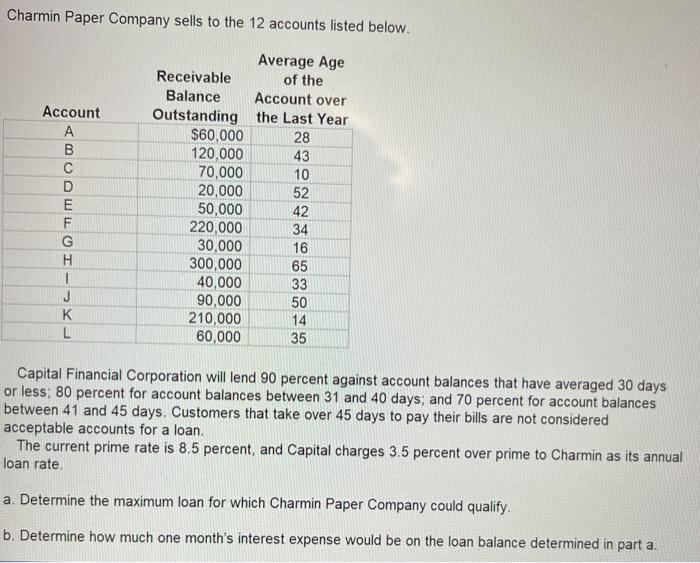

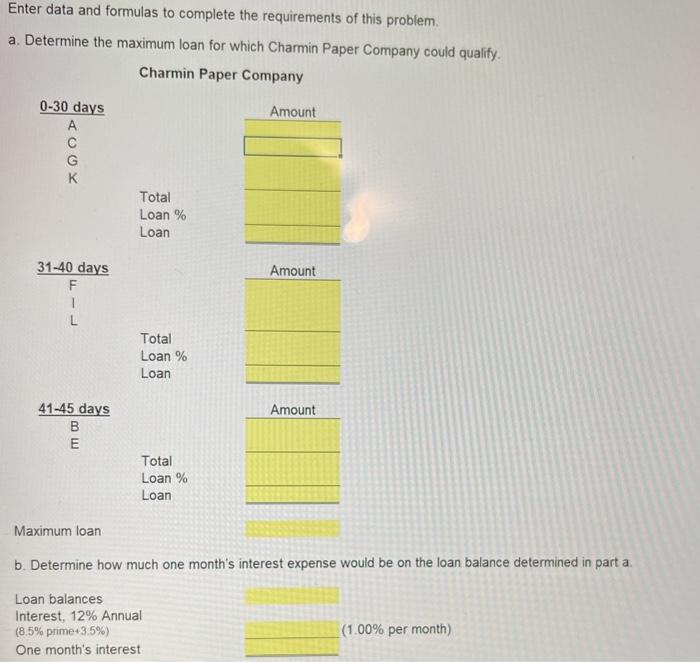

Charmin Paper Company sells to the 12 accounts listed below. Account B D E F G H 1 J K L Average Age Receivable of the Balance Account over Outstanding the Last Year $60,000 28 120,000 43 70,000 10 20,000 52 50,000 42 220,000 34 30,000 16 300,000 65 40,000 33 90,000 50 210,000 14 60,000 35 Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less: 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 8.5 percent, and Capital charges 3.5 percent over prime to Charmin as its annual loan rate a. Determine the maximum loan for which Charmin Paper Company could qualify. b. Determine how much one month's interest expense would be on the loan balance determined in part a. Enter data and formulas to complete the requirements of this problem a. Determine the maximum loan for which Charmin Paper Company could qualify Charmin Paper Company 0-30 days A Amount COOY Total Loan % Loan Amount 31-40 days F 1 L Total Loan % Loan Amount 41-45 days B E Total Loan % Loan Maximum loan b. Determine how much one month's interest expense would be on the loan balance determined in part a. Loan balances Interest, 12% Annual (8.5% prime435%) One month's interest (1.00% per month) Charmin Paper Company sells to the 12 accounts listed below. Account B D E F G H 1 J K L Average Age Receivable of the Balance Account over Outstanding the Last Year $60,000 28 120,000 43 70,000 10 20,000 52 50,000 42 220,000 34 30,000 16 300,000 65 40,000 33 90,000 50 210,000 14 60,000 35 Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less: 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 8.5 percent, and Capital charges 3.5 percent over prime to Charmin as its annual loan rate a. Determine the maximum loan for which Charmin Paper Company could qualify. b. Determine how much one month's interest expense would be on the loan balance determined in part a. Enter data and formulas to complete the requirements of this problem a. Determine the maximum loan for which Charmin Paper Company could qualify Charmin Paper Company 0-30 days A Amount COOY Total Loan % Loan Amount 31-40 days F 1 L Total Loan % Loan Amount 41-45 days B E Total Loan % Loan Maximum loan b. Determine how much one month's interest expense would be on the loan balance determined in part a. Loan balances Interest, 12% Annual (8.5% prime435%) One month's interest (1.00% per month)