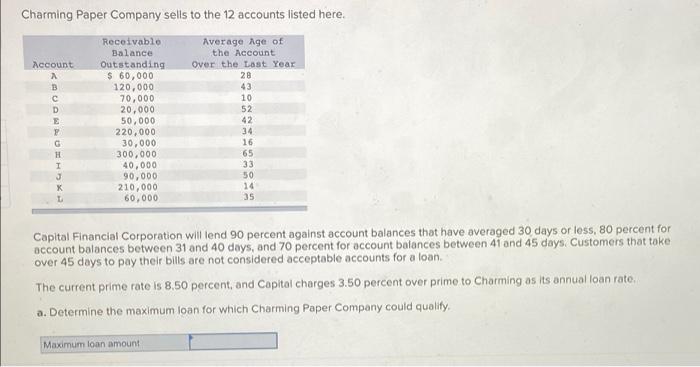

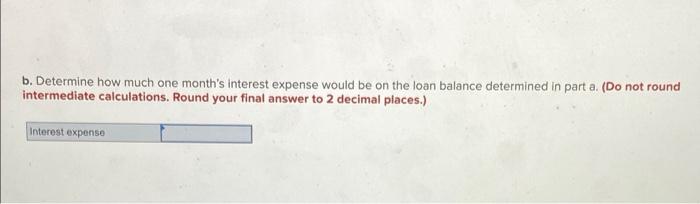

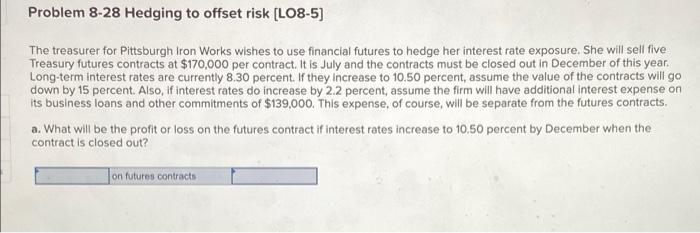

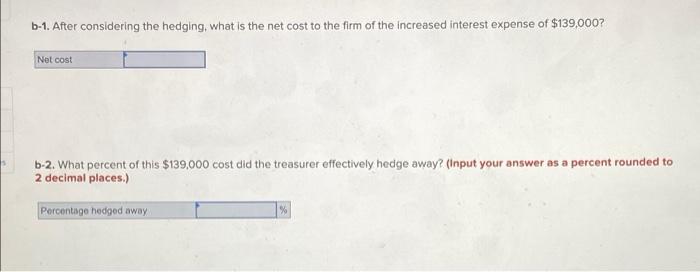

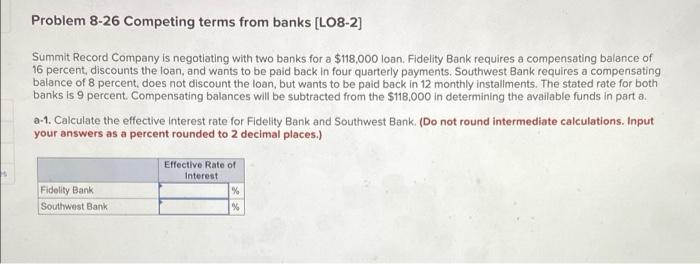

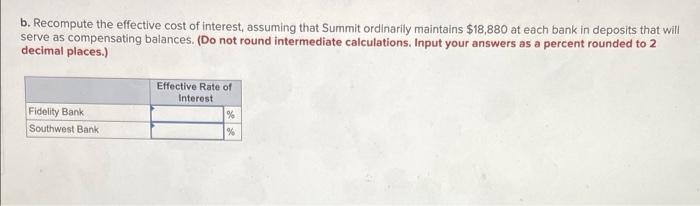

Charming Paper Company sells to the 12 accounts listed here. Average Age of the Account Account Receivable Balance Outstanding $ 60,000 120,000 Over the Last Year 28 43 70,000 10 20,000 52 50,000 42 220,000 34 30,000 16 300,000 65 40,000 33 J 90,000 50 210,000 14 60,000 35 Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less, 80 percent for account balances between 31 and 40 days, and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 8.50 percent, and Capital charges 3.50 percent over prime to Charming as its annual loan rate... a. Determine the maximum loan for which Charming Paper Company could qualify. Maximum loan amount RACDWAUHH? B E G I b. Determine how much one month's interest expense would be on the loan balance determined in part a. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Interest expense Problem 8-28 Hedging to offset risk [LO8-5] The treasurer for Pittsburgh Iron Works wishes to use financial futures to hedge her interest rate exposure. She will sell five Treasury futures contracts at $170,000 per contract. It is July and the contracts must be closed out in December of this year. Long-term interest rates are currently 8.30 percent. If they increase to 10.50 percent, assume the value of the contracts will go down by 15 percent. Also, if interest rates do increase by 2.2 percent, assume the firm will have additional interest expense on its business loans and other commitments of $139,000. This expense, of course, will be separate from the futures contracts. a. What will be the profit or loss on the futures contract if interest rates increase to 10.50 percent by December when the contract is closed out? on futures contracts b-1. After considering the hedging, what is the net cost to the firm of the increased interest expense of $139,000? Net cost b-2. What percent of this $139,000 cost did the treasurer effectively hedge away? (Input your answer as a percent rounded to 2 decimal places.) % Percentage hedged away Problem 8-26 Competing terms from banks [LO8-2] Summit Record Company is negotiating with two banks for a $118,000 loan. Fidelity Bank requires a compensating balance of 16 percent, discounts the loan, and wants to be paid back in four quarterly payments. Southwest Bank requires a compensating balance of 8 percent, does not discount the loan, but wants to be paid back in 12 monthly installments. The stated rate for both banks is 9 percent. Compensating balances will be subtracted from the $118,000 in determining the available funds in part a. a-1. Calculate the effective interest rate for Fidelity Bank and Southwest Bank. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest % Fidelity Bank Southwest Bank % b. Recompute the effective cost of interest, assuming that Summit ordinarily maintains $18,880 at each bank in deposits that will serve as compensating balances. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Effective Rate of Interest Fidelity Bank % Southwest Bank %