Question

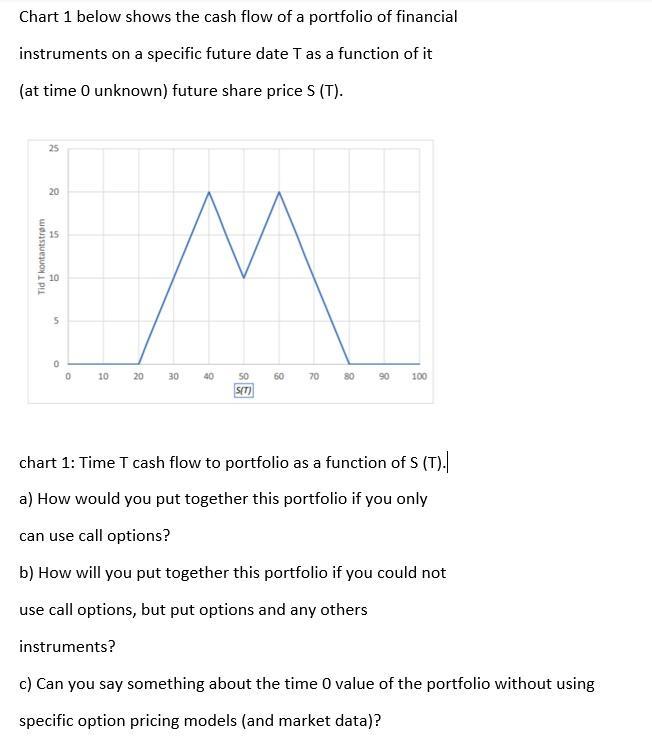

Chart 1 below shows the cash flow of a portfolio of financial instruments on a specific future date T as a function of it

Chart 1 below shows the cash flow of a portfolio of financial instruments on a specific future date T as a function of it (at time 0 unknown) future share price S (T). Tid T kontantstrm 25 20 15 10 5 0 0 M 40 50 60 S(T) 10 20 30 70 80 90 100 chart 1: Time T cash flow to portfolio as a function of S (T). a) How would you put together this portfolio if you only can use call options? b) How will you put together this portfolio if you could not use call options, but put options and any others instruments? c) Can you say something about the time 0 value of the portfolio without using specific option pricing models (and market data)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To put together this portfolio using only call options the investor would need to purchase call op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Business And Economics

Authors: James T. McClave, P. George Benson, Terry T Sincich

12th Edition

032182623X, 978-0134189888, 134189884, 978-0321826237

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App