Answered step by step

Verified Expert Solution

Question

1 Approved Answer

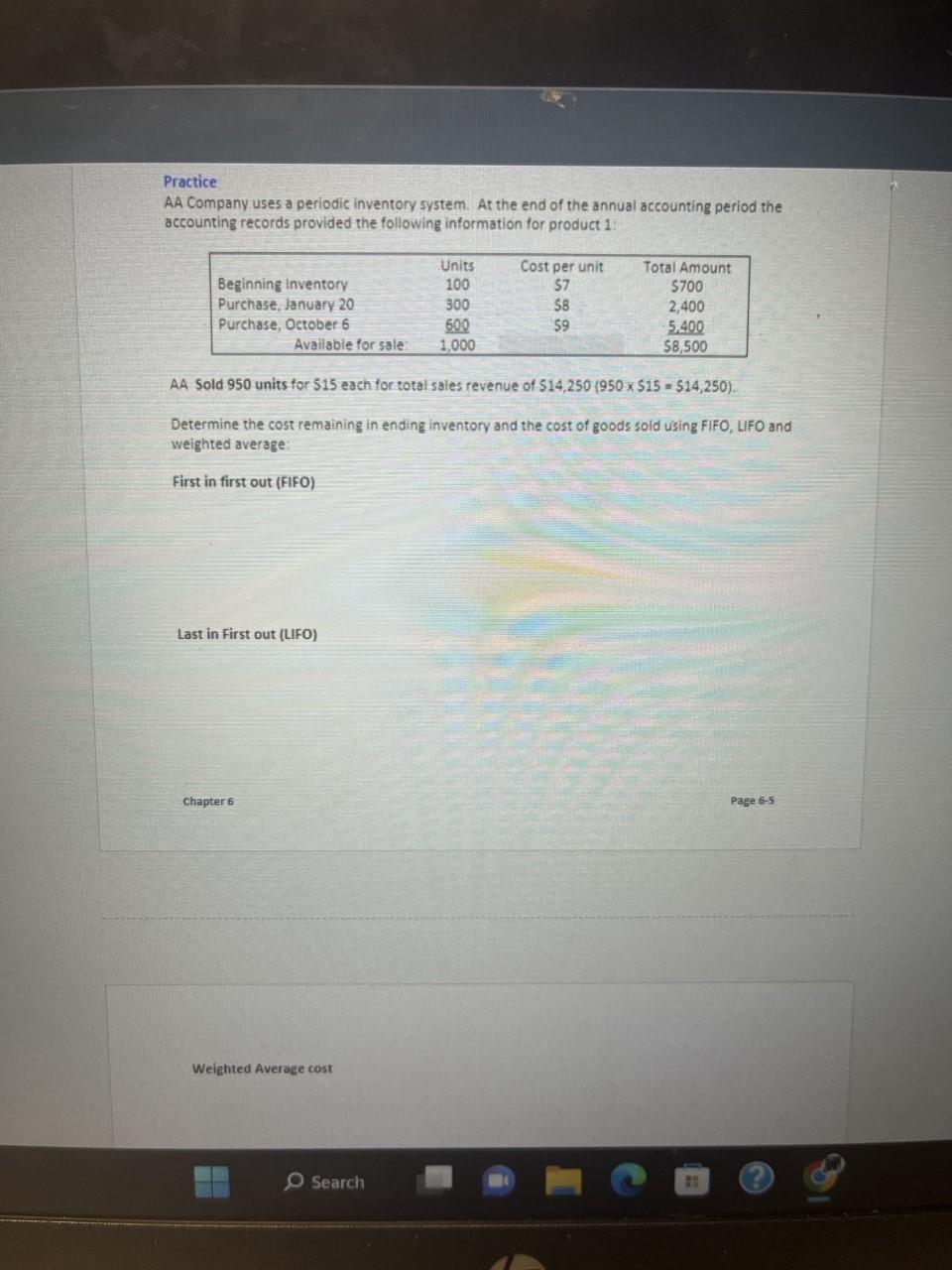

chart in second pic Practice AA Company uses a periodic inventory system. At the end of the annual accounting period the accounting records provided the

chart in second pic

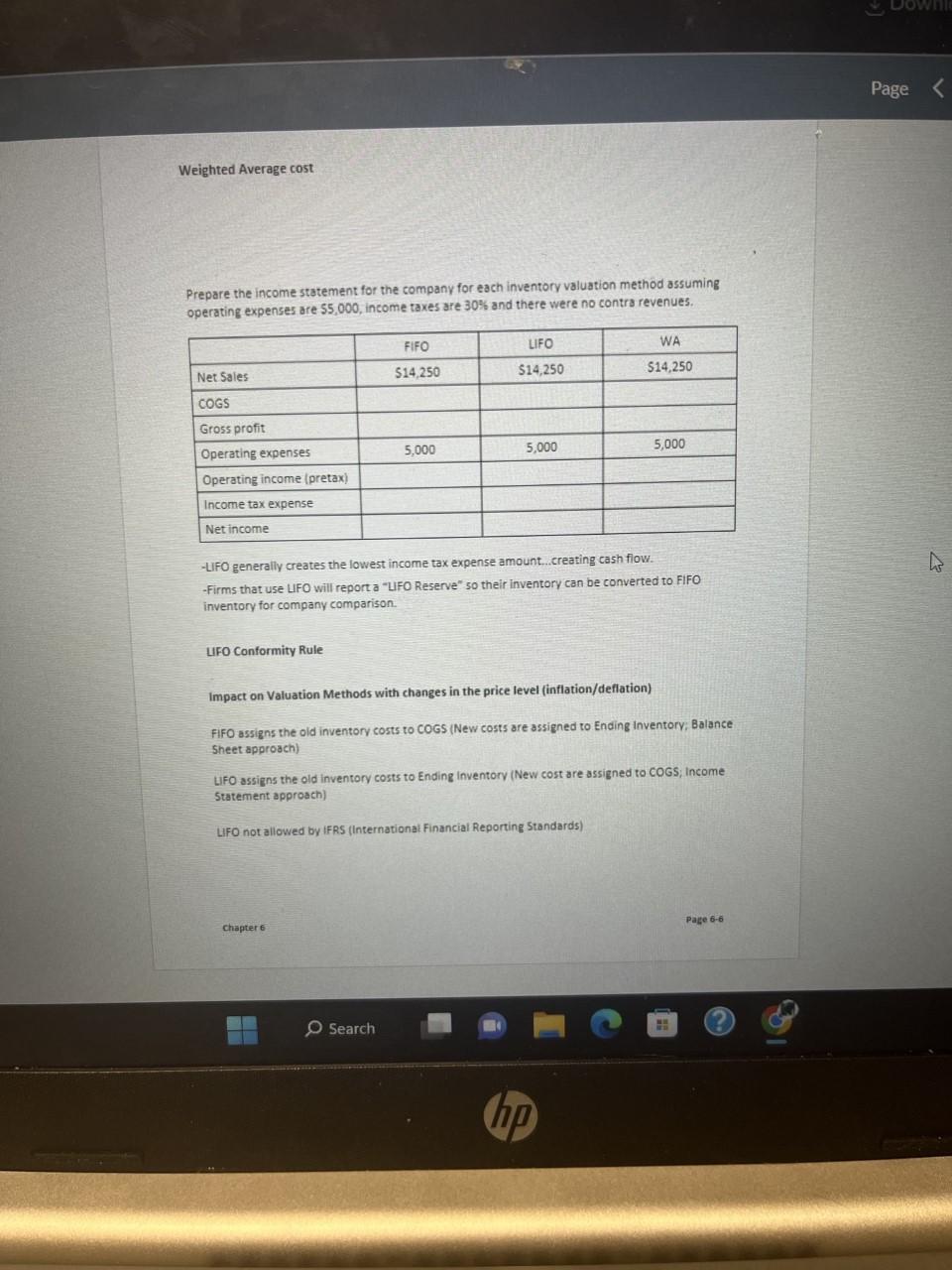

Practice AA Company uses a periodic inventory system. At the end of the annual accounting period the accounting records provided the following information for product 1 : AA Sold 950 units for $15 each for total saies revenue of $14,250(950$15=$14,250). Determine the cost remaining in ending inventory and the cost of goods sold using FIFO, LFO and weighted average: First in first out (FFF) Last in First out (LIFO) chapter 6 Page 6-5 Prepare the income statement for the company for each inventory valuation method assuming operating expenses are 55,000 , income taxes are 30% and there were no contra revenues. -LFOO generally creates the lowest income tax expense amount..creating cash flow. - Firms that use LIFO will report a "UFO Reserve" so their inventory can be converted to FIFO inventory for company comparison. UFO Conformity Rule Impact on Valuation Methods with changes in the price level (inflation/deflation) FIFO assigns the old inventory costs to COGS (New costs are assigned to Ending inventory; Balance Sheet approach) LFO assigns the old inventory costs to Ending inventory (New cost are assigned to COGS; Income Statement approach) LFO not allowed by IFRS (International Financial Reporting Standards)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started