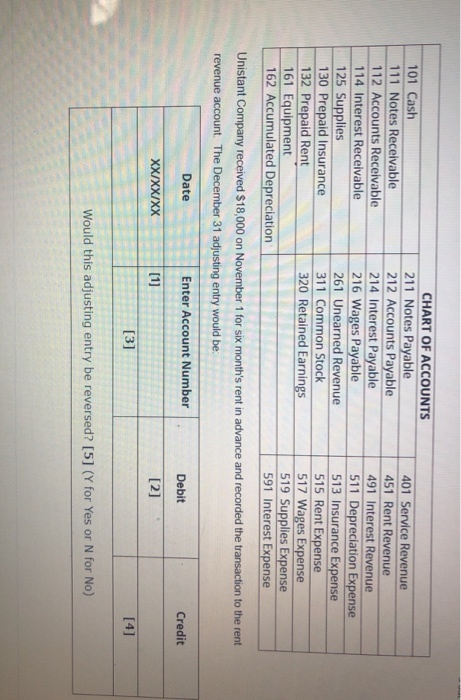

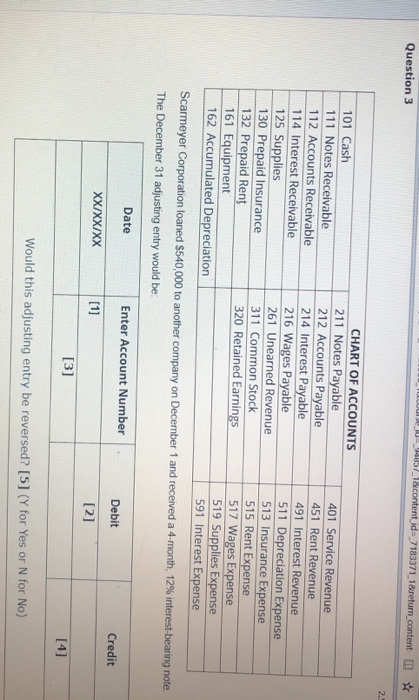

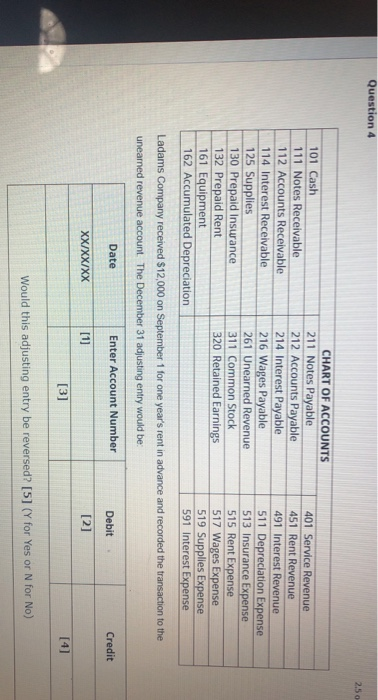

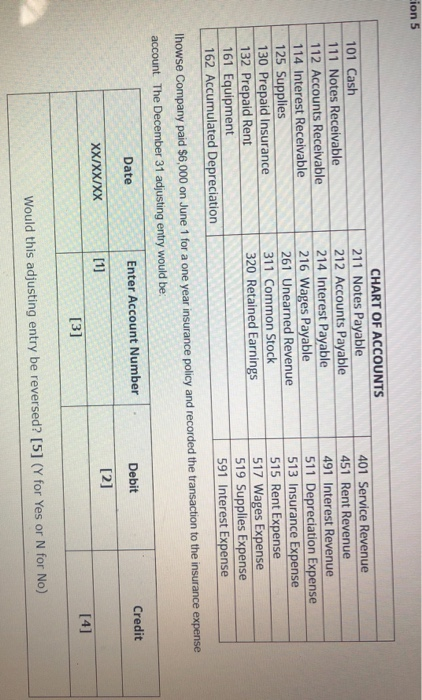

CHART OF ACCOUNTS 101 Cash 211 Notes Payable 401 Service Revenue 111 Notes Receivable 212 Accounts Payable 451 Rent Revenue 112 Accounts Receivable 214 Interest Payable 491 Interest Revenue 114 Interest Receivable 216 Wages Payable 511 Depreciation Expense 125 Supplies 261 Unearned Revenue 513 Insurance Expense 130 Prepaid Insurance 311 Common Stock 515 Rent Expense 132 Prepaid Rent 320 Retained Earnings 517 Wages Expense 161 Equipment 519 Supplies Expense 162 Accumulated Depreciation 591 Interest Expense Unistant Company received $18,000 on November 1 for six month's rent in advance and recorded the transaction to the rent revenue account. The December 31 adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX [1] [2] [3] [4] Would this adjusting entry be reversed? [5] (Y for Yes or N for No) Question 3 94857_1&content_id=7183371_1&return_content 2 CHART OF ACCOUNTS 101 Cash 211 Notes Payable 401 Service Revenue 111 Notes Receivable 212 Accounts Payable 451 Rent Revenue 112 Accounts Receivable 214 Interest Payable 491 Interest Revenue 114 Interest Receivable 216 Wages Payable 511 Depreciation Expense 125 Supplies 261 Unearned Revenue 513 Insurance Expense 130 Prepaid Insurance 311 Common Stock 515 Rent Expense 132 Prepaid Rent 320 Retained Earnings 517 Wages Expense 161 Equipment 519 Supplies Expense 162 Accumulated Depreciation 591 Interest Expense Scarmeyer Corporation loaned $540,000 to another company on December 1 and received a 4-month, 12% interest-bearing note. The December 31 adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX [1] [2] [3] [4] Would this adjusting entry be reversed? [5] (Y for Yes or N for No) Question 4 2.50 101 Cash 111 Notes Receivable 112 Accounts Receivable 114 Interest Receivable 125 Supplies 130 Prepaid Insurance 132 Prepaid Rent 161 Equipment 162 Accumulated Depreciation CHART OF ACCOUNTS 211 Notes Payable 212 Accounts Payable 214 Interest Payable 216 Wages Payable 261 Unearned Revenue 311 Common Stock 320 Retained Earnings 401 Service Revenue 451 Rent Revenue 491 Interest Revenue 511 Depreciation Expense 513 Insurance Expense 515 Rent Expense 517 Wages Expense 519 Supplies Expense 591 Interest Expense Ladams Company received $12,000 on September 1 for one year's rent in advance and recorded the transaction to the unearned revenue account. The December 31 adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX [1] [2] [3] [4] Would this adjusting entry be reversed? [5] (Y for Yes or N for No) cion 5 101 Cash 111 Notes Receivable 112 Accounts Receivable 114 Interest Receivable 125 Supplies 130 Prepaid Insurance 132 Prepaid Rent 161 Equipment 162 Accumulated Depreciation CHART OF ACCOUNTS 211 Notes Payable 212 Accounts Payable 214 Interest Payable 216 Wages Payable 261 Unearned Revenue 311 Common Stock 320 Retained Earnings 401 Service Revenue 451 Rent Revenue 491 Interest Revenue 511 Depreciation Expense 513 Insurance Expense 515 Rent Expense 517 Wages Expense 519 Supplies Expense 591 Interest Expense Ihowse Company paid $6,000 on June 1 for a one year insurance policy and recorded the transaction to the insurance expense account. The December 31 adjusting entry would be Date Enter Account Number Credit Debit [2] [1] XX/XX/XX [4] [3] Would this adjusting entry be reversed? [5] (Y for Yes or N for No)