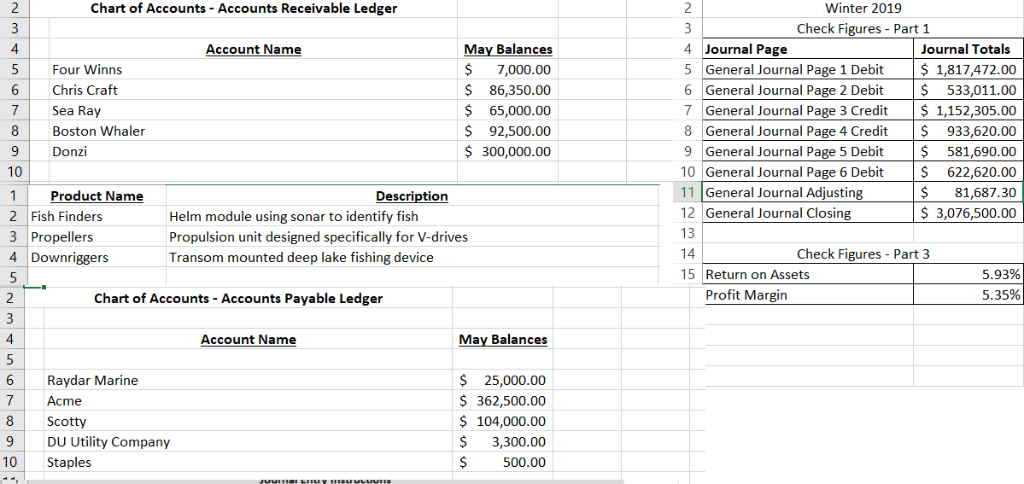

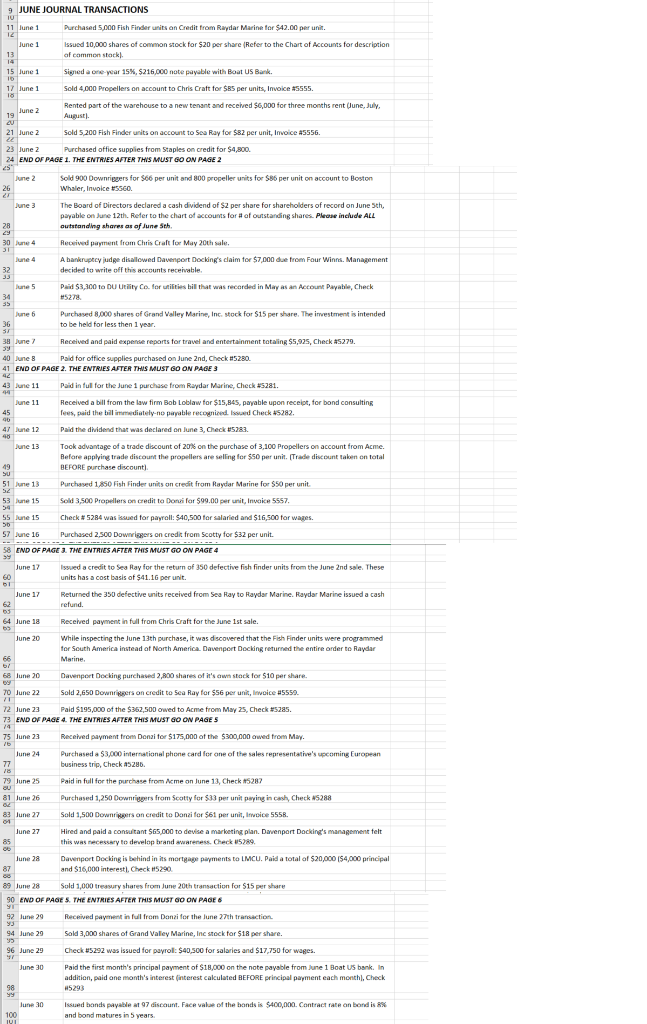

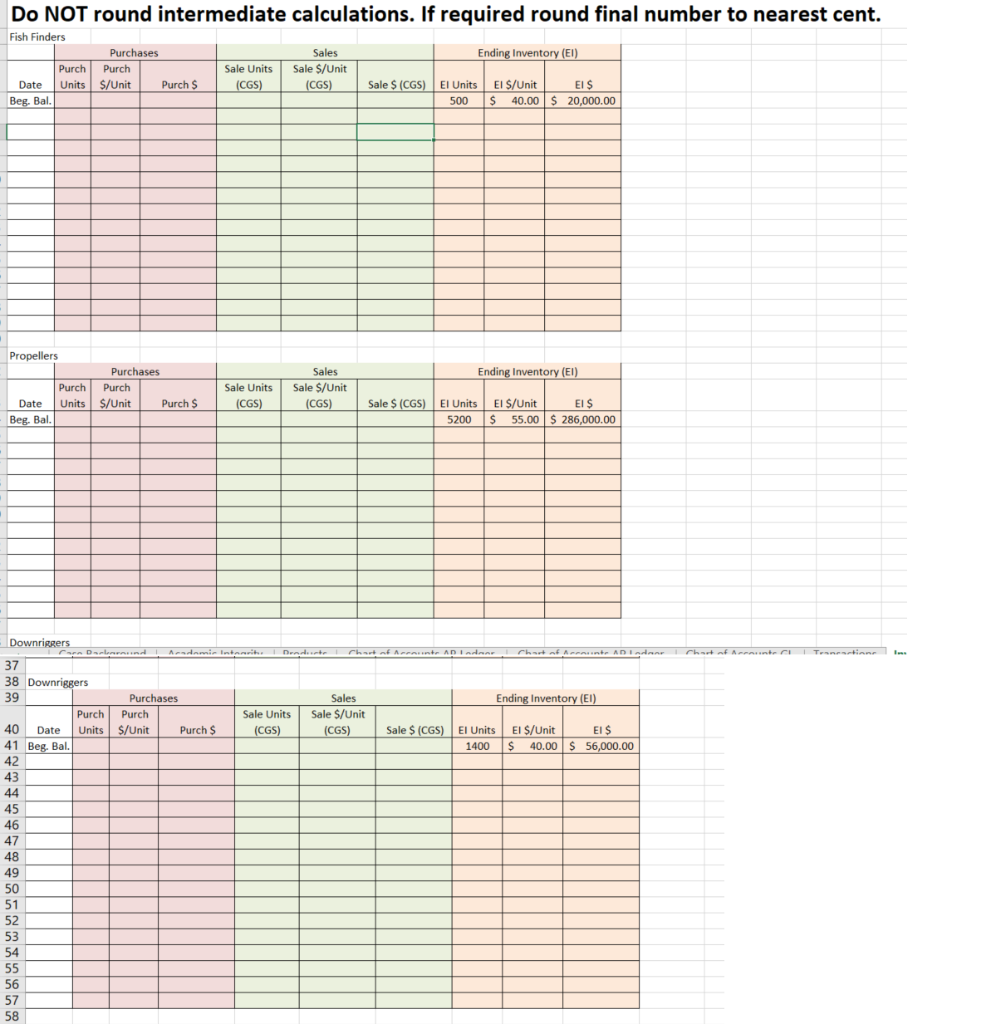

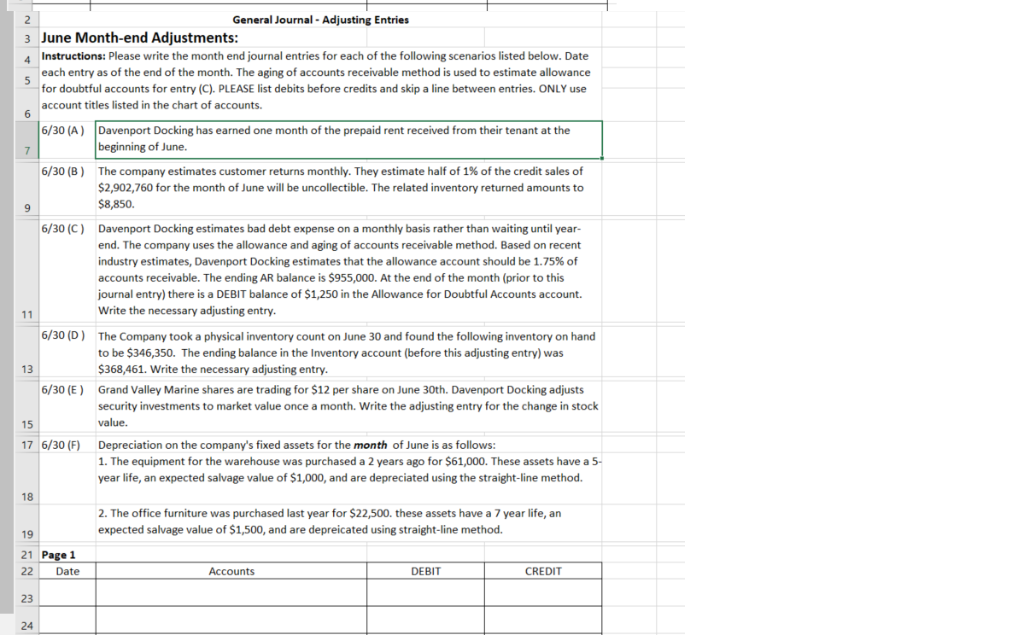

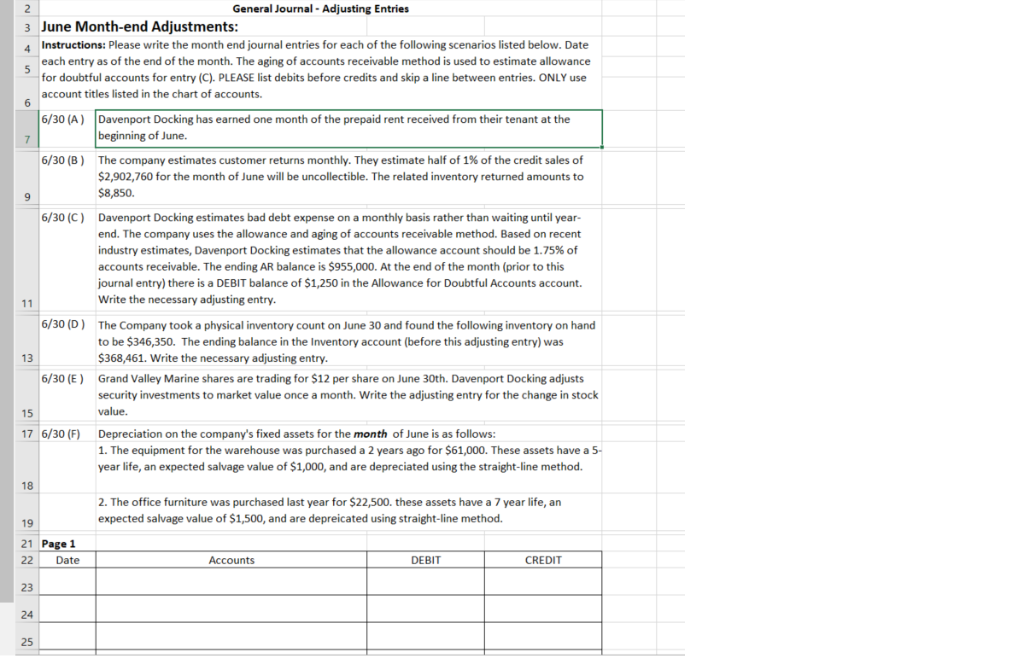

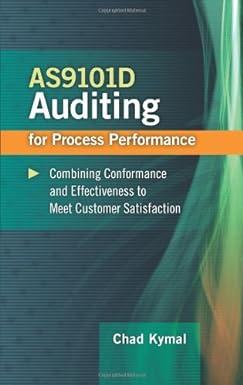

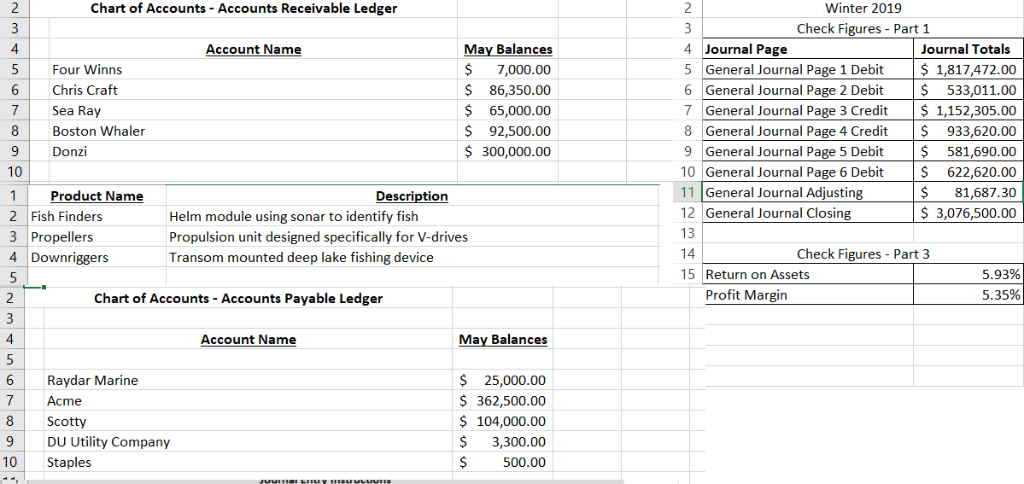

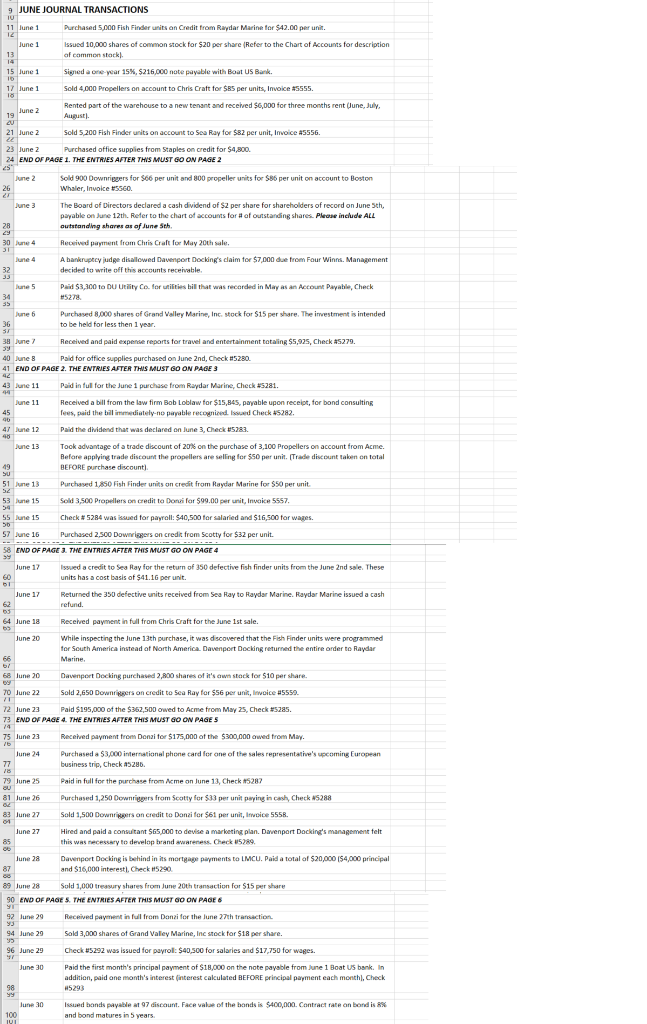

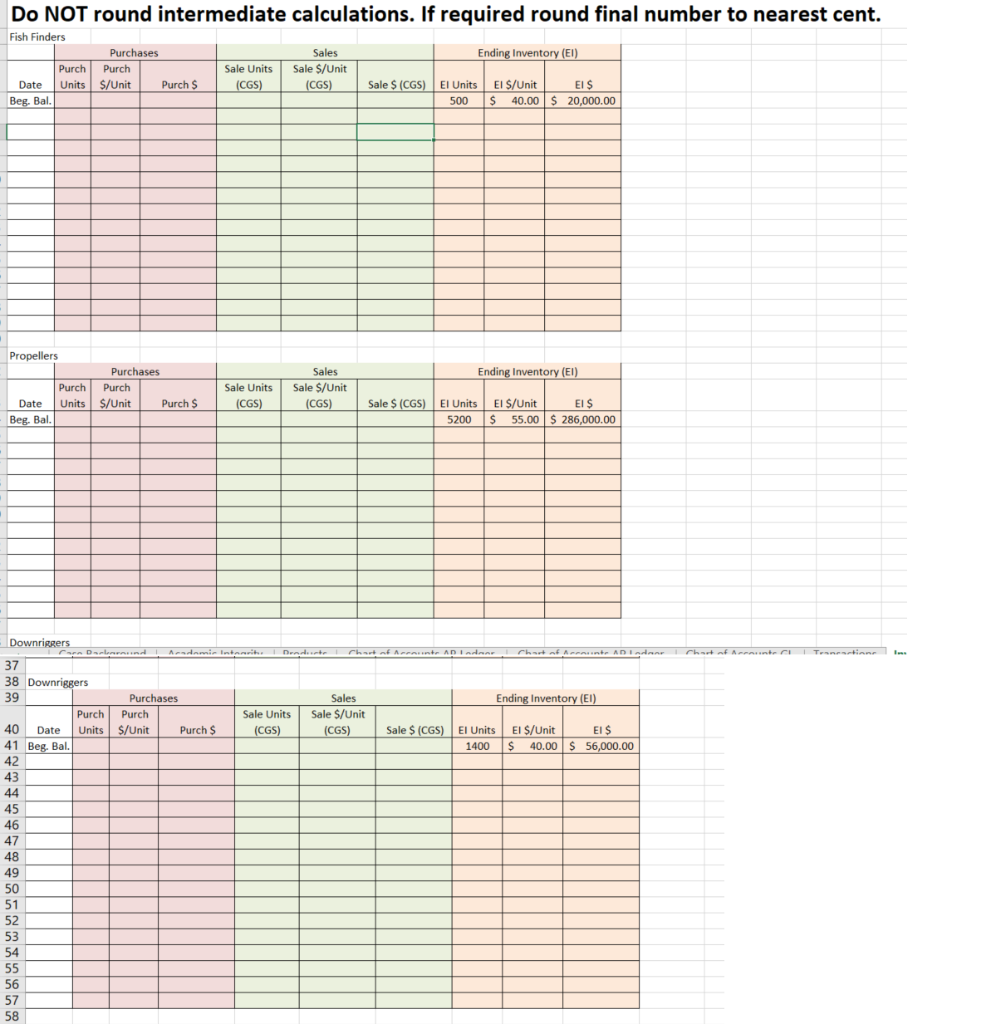

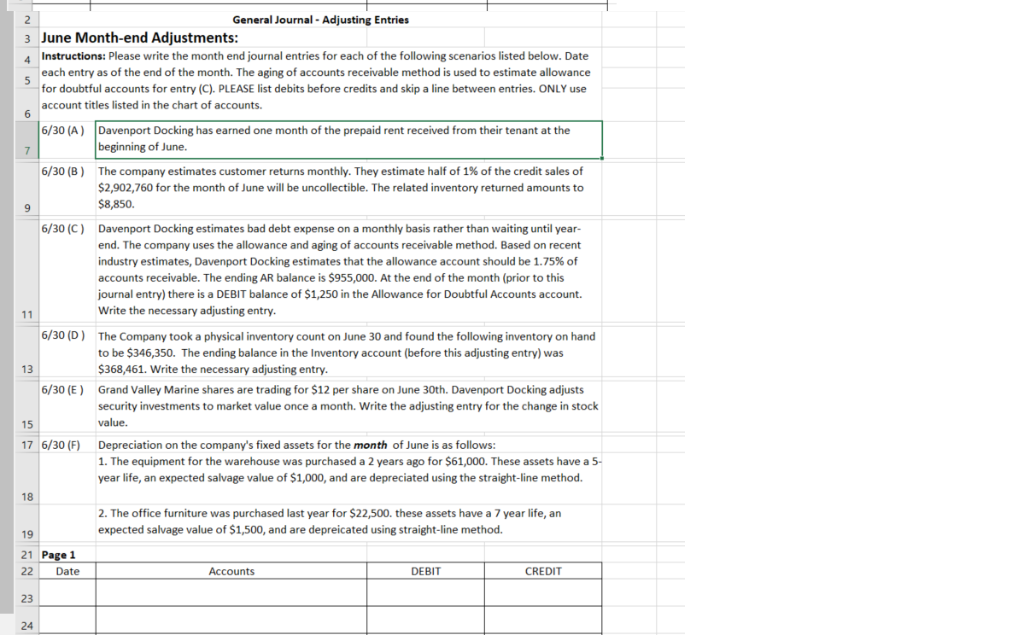

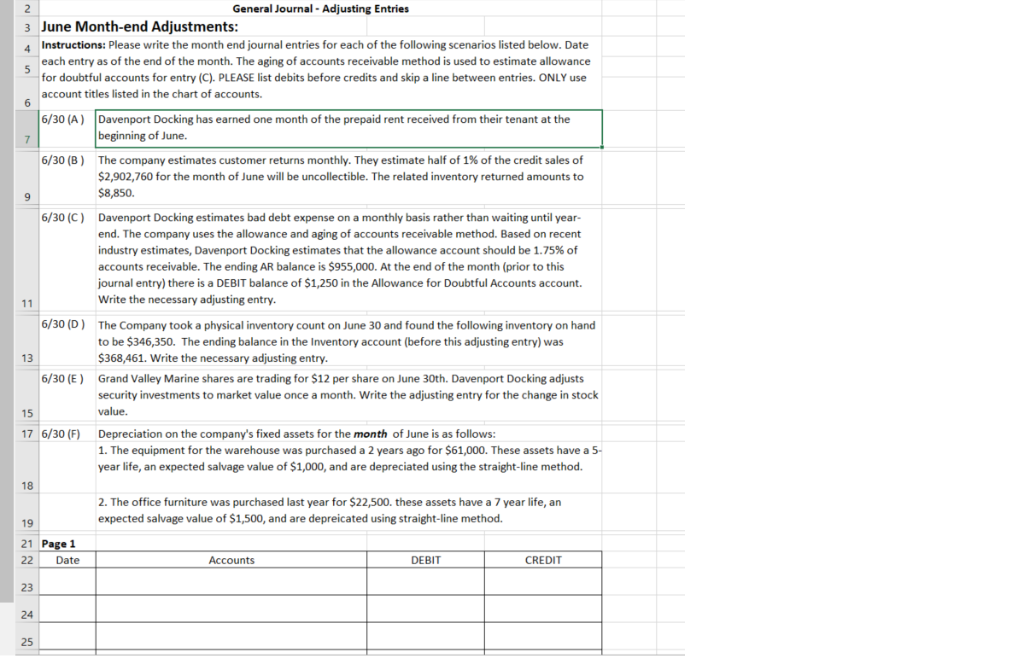

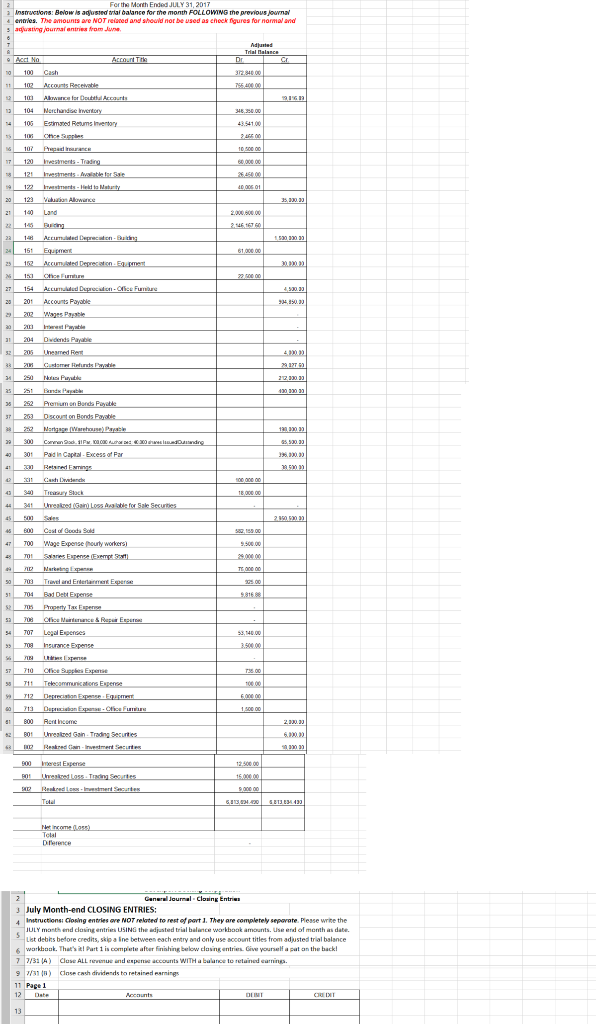

Chart of Accounts Accounts Receivable Ledger 2 2 Winter 2019 Check Figures - Part 1 3 May Balances 4Journal Page Account Name 4 Journal Totals 5 General Journal Page 1 Debit 6 General Journal Page 2 Debit 7 General Journal Page 3 Credit 8 General Journal Page 4 Credit 9 General Journal Page 5 Debit 10 General Journal Page 6 Debit 11 General Journal Adjusting 12 General Journal Closing $ 1,817,472.00 5 Four Winns 7,000.00 $ 86,350.00 6 Chris Craft S 533,011.00 $ 1,152,305.00 7 Sea Ray S 65,000.00 8 Boston Whaler S 933,620.00 92,500.00 $300,000.00 Donzi 581,690.00 10 S 622,620.00 $ 81,687.30 Product Name 2 Fish Finders 3 Propellers 1 Description 3,076,500.00 Helm module using sonar to identify fish 13 Propulsion unit designed specifically for V-drives 14 Check Figures Part 3 4 Downriggers Transom mounted deep lake fishing device 15 Return on Assets 5.93% 5 Profit Margin 5.35% Chart of Accounts - Accounts Payable Ledger 2 May Balances 4 Account Name 5 6 Raydar Marine 25,000.00 $362,500.00 $ 104,000.00 7 Acme Scotty 9 DU Utility Company 3,300.00 10 Staples S 500.00 JuumaLuy auuuun 9 JUNE JOURNAL TRANSACTIONS 11 lune 1 Purchased 5,000 Fish Finder units on Credit from Ravdar Marine for $42.00 per unit June 1 Issued 10,000 shares of common stock for $20 per share (Refer to the Chart of Accounts for description 13 of common stack). 15 June 1 Signed a one year 15% , $216,000 note pavable with Boat US Bank 17 June 1 Sold 4.000 Propellers on account to Chris Craft for $85 per units, Invoice #5555 ewarehouse to a new tenant and received $6.ppo for three months rent June. July. Rented part of June 2 19 August. r$82 per unit, Invoice #5556 21 June 2 Sold 5.200 Fish Finder units on account to Spa Ray $4,800, ND OF PAGF THE ENTrs AFTER THIS MUST 60 ON a4GE S86 per unit account to Boston une aler lnunir. r 306 per unit ond 800 propelller units fe 26 The Board of Directors declared a cash dividend of $2 per share for shareholders of record on June 5th, une: payable on June 12th. Refer to the chart of accounts for # of outstanding shares. Please include ALL outstanding shares as of June Sth Received payment from Chris Craft for May 20th sale 30 June 4 king's claim for $7,000 due trom Four Winns. Management ane- decided to weite off this accounts receivable.. 32 Paid S3,300 to DU Utity Co. for utilties bill that was recorded in May as Account Dayable, Check 34 #5278 Purchased 8000 shares of Grand Valley Marine, Inc. stock for $15 per share e imvestment is intended to be held for less then 1 year 36 Received and paid expense reports tor travel and entertainment totaing $5.925, Check a5279. une Paid for on . CO ONB a80 THIS MUST OF PAGE 2. THE ENTRIES. E 3 Paid in ful for the June 1 purchase from Ravdar Marine, Check 43 June 11 June 11 for bond consulting fees nud thee billinmeEels.ao nek. d Check A5282. 45 Paid the diidend that was declared on June 3, Check #5281. 47 June 12 Tock advantage of a trade discount of 20% on the purchase of 3,100 Propellers on account from Acme. June 13 Before applying trade discount BEFORE purchase discount). propellers are selling for $50 per unit. (Trade discount taken on total 49 51 une 13 Purchased 1,850 Fish Finder units on credit from Raydar Marine for $50 per unit 53 June 15 Sold 3,500 Propellers on credit to Doni far $99.00 per unit, Invaice 5557 Check # 5284 was isuued tor navroll: $40.500 for salaried and $16.500 for wazes 55 June 15 57 June 16 Purchased 2.5co Downriggers on credit from Scotty $32 per unit. EPAGE3, THE ENTRIES AFTER THIS MUST GO ON PAGE 4 58 END June 17 Issued a credit to Sea Ray for the return of 350 defective fish finder units from the June 2nd sale. These units has a cost basis of $41.16 per unit. 60 Returned the 350 defective units received from Sea Ray to Rayvdar Marine, Ravdar Marine issued a cash June 12 refund. 64 June 18 Received pavment in full from Chris Craft for the lune1st sale June 20 Davennort Dockine ceturned the ontice ondes .-nd. South bmerdca iostaad of Moah 6mad Marine Davenport Decking purchased 2,800 shares of it's awn stack for $10 per share. 68 June 20 lovoice a5550 Ray for $56 per e Sold 2.650 Doywnriggers on credit to: 70 June 22 Paid $195,000 of the $362.500 owed to Acme from May 2 72 June 23 Check #$285 73 END OF PAGE 4. THE ENTRIES AFTER THIS MUST Go ON PAGE S 75 June 23 Received payment trom Donai for $175,000 of the $300,0000 awed trom May. June 24 ational phone card for one of the sales representative's upcoming European Purcased p, Check A5286. 79 June 25 Paid in full for the purchase from Acme on June 13, Check #5287 81 June 26 Purchased 1,250 Downrigers from Scatty for $33 per unit paying in cash, Check #5288 83 June 27 Sold 1,500 Downrigoers on credit to Donzi for per unit, Invoice 5558 June 27 Davenport Docking's management felt is was necessery to develop brand awareness, Check #5289. Davenport Docking is behind in its mortgage payments to LMCU, Paid a total of $20,000 ($4,000 principal and $16,000 interest ), Check #5290 June 28 87 a9 June 28 Sold 1,000 treasury shares from June 20th transaction for $15 per share o ON PAGE 6 90 END OF PAGE S. THE ENTRIES AFTER THIS MUST Received payment in full from Danzi for the June 27th transaction 92 June 29 94 June 29 Sold 3,000 shares of Grand Valey Marine, Inc stock for $18 per share 96 June 29 check #5292 was issued for payrol: $40,500 for salaries and $17,750 for wages Paid the t tmonth's principal payment of $18.000 on the nate pavable from June1 Boat US bank, In June 30 id ane month's interest (interest cakulated BEFORE principal payment each month), Check addition #5293 he honds is S4co.000, Contract rate on bood is 8% June 30 and d discaunt Face valae of t Do NOT round intermediate calculations. If required round final number to nearest cent. Fish Finders Purchases Ending Inventory (EI) Sales Purch Sale $/Unit Sale Units Purch Units $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El $/Unit El $ Date El Units Beg. Bal. 500 40.00 20,000.00 Propellers Purchases Sales Ending Inventory (EI) Sale $/Unit Purch Sale Units Purch Date Units $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El Units El $/Unit El$ $ 286,000,00 Beg. Bal. $ 55.00 520 Downriggers Aead Darb .ADLednn ADIodaar Chart nt Accounte C 37 38 Downriggers 39 Ending Inventory (EI) Purchases Sales Sale $/Unit Purch Purch Sale Units 40 $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El $/Unit El $ Date Units El Units 41 Beg, Bal. 42 1400 40.00 S 56,000.00 43 44 45 46 47 48 49 52 53 54 55 56 57 58 General Journal Adjusting Entries 3 June Month-end Adjustments: 4Instructions: Please write the month end journal entries for each f the following scenarios listed below. Date each entry as 5 for doubtful accounts for entry (C). PLEASE list debits before credits and skip a line between entries. ONLY use f the end of the month. The aging of accounts receivable method is used to estimate allowance account titles listed in the chart of accounts 6 6/30 (A) Davenport Docking has earned one month of the prepaid rent received from their tenant at the beginning of June. 7 6/30 (B) The company estimates customer returns monthly. They estimate half of 1% of the credit sales of $2,902,760 for the month of June will be uncollectible. The related inventory returned amounts to $8,850. Davenport Docking estimates bad debt expense on a monthly basis rather than waiting until year- 6/30 (C) end. The company uses the allowance and aging of accounts receivable method. Based on recent industry estimates, Davenport Docking estimates that the allowance account should be 1.75% of accounts receivable. The ending AR balance is $955,000. At the end of the month (prior to this journal entry) there is a DEBIT balance of $1,250 in the Allowance for Doubtful Accounts account. Write the necessary adjusting entry. 11 6/30 (D) The Company took a physical inventory count on June 30 and found the following inventory on hand to be $346,350. The ending balance in the Inventory account (before this adjusting entry) was $368,461. Write the necessary adjusting entry 13 Grand Valley Marine shares are trading for $12 per share on June 30th. Davenport Docking adjusts 6/30 (E) security investments to market value once a month. Write the adjusting entry for the change in stock value. 15 17 6/30 (F) Depreciation on the company's fixed assets for the month of June is as follows: 1. The equipment for the warehouse was purchased a 2 years ago for $61,000. These assets have a 5- year life, an expected salvage value of $1,000, and are depreciated using the straight-line method. 18 2. The office furniture was purchased last year for $22,500. these assets have a 7 year life, an expected salvage value of $1,500, and are depreicated using straight-line method. 19 21 Page 1 22 Date Accounts DEBIT CREDIT 23 24 General Journal - Adjusting Entries 2 3 June Month-end Adjustments: Instructions: Please write the month end journal entries for each of the following scenarios listed below. Date 4 each entry as of the end of the month. The aging of accounts receivable method is used to estimate allowance 5 for doubtful accounts for entry (C). PLEASE list debits before credits and skip a line between entries. ONLY use account titles listed in the chart of accounts 6 6/30 (A) Davenport Docking has earned one month of the prepaid rent received from their tenant at the beginning of June. 7 6/30 (B) The company estimates customer returns monthly. They estimate half of 1% of the credit sales of o for the month of June will L ollectible. The related inventory returned amounts to $8,850. 6/30 (C) Davenport Docking estimates bad debt expense on a monthly basis rather than waiting until year- end. The company uses the allowance and aging of accounts receivable method. Based on recent industry estimates, Davenport Docking estimates that the allowance account should be 1.75% of accounts receivable. The ending AR balance is $955,000. At the end of the month (prior to this journal entry) there is a DEBIT balance of $1,250 in the Allowance for Doubtful Accounts account. Write the necessary adjusting entry 11 6/30 (D) The Company took a physical inventory count on June 30 and found the following inventory on hand to be $346,350. The ending balance in the Inventory account (before this adjusting entry) was 13 $368,461. Write the necessary adjusting entry. 6/30 (E) Grand Valley Marine shares are trading for $12 per share on June 30th. Davenport Docking adjusts security investments to market value once a month. Write the adjusting entry for the change in stock value. 15 17 6/30 (F) Depreciation on the company's fixed assets for the month of June is as follows: 1. The equipment for the warehouse was purchased a 2 years ago for $61,000. These assets have a 5- year life, an expected salvage value of $1,000, and are depreciated using the straight-line method. 18 2. The office furniture was purchased last year for $22,500. these assets have a 7 year life, an expected salvage value of $1,500, and are depreicated using straight-line method. 19 21 Page 1 22 Date Accounts DEBIT CREDIT 23 24 25 Anstrucsions: Below is adlusted trial balance for the month FOLLOWING me previous lournal u reuned and should nor be used as check figures for normal ana redin i Mutted Trial alanc Account Ttk Acct No 100 Cash 102 Accots Recevatle 37246 00 11 7564000 thul Account 3 00 12 104 Nechandise ortone 10 Eimed Retums Inventary 4354100 14 s10 on p 107 Ppat rance 10.50 00 Imehments vaiatle for Se 13 19122 Isments - Hekd to Muturty 20,006 0 20 123 an Alowance 140 Land 2000,800.00 21 4 16 60 1 Acumed DeprectenBring 530 330 33 24 161 Equpment 152 Accumted Deprecation Eurment 153 oeuhr 3003 25 2000 wdon-ofice Funre 220 Accounts Pavable 20 Wages Pashle a 2 west Payable 204 Dvends Payable Csomer Rerds Paale an 250 N P a5251 Bnd Pay 10 130 33 3 252 Premum.en Bands Paatd as 2 Nartge Warehose) Pa 300 Crnd. : 30 Pad in Captal-Excess of Par Retared Exminge 0ca ex0ew uandng 5,530 3 4) 3503 41 Cast Ddenc 10000 4 341nreakred 0Gar) Loss Aralable for Sale Securities 20,530 3 45 s00Ses 600 Cast of Ocods Sold s100 Wage Expense hourty workers 5500.00 Narketng Epes 703 Travel and Ertertarmet Eperse T04 Ba Det Expense s0 sa1s Ppey Tac Espere N & Repa Espers .. 54 707 Legal Espenses 3140 00 T0 Insurance Expense pense Cce Supples Expent T35 00 T ense T12 Deciston Expense EqurmeT 713 Dapeciabon Expense-Cice Funinre 6.00e 00 soe c 800 Ret hcome 23.33 900 eest Expense Uested LassTrading Securtes s Reskred iIstment Securtes 12,500 00 15.00000 Tela Net income as) eece Ca Iqurcal cleing Entriea July Month-end CLOSING ENTRIES to rest of part 1. They are completely separate F write the JULY manth end clasing entries USING the adjusted trial balance warkbook amounts. Use end of month as date anCe 7/31 A) Close ALL revenue and expane accounts WITH a baiance o retained exrmines 31 ) Closes eteede to retained earnines 1 Page 1 DIN CREDT 13 ETTEELEETTEENCFETEE Chart of Accounts Accounts Receivable Ledger 2 2 Winter 2019 Check Figures - Part 1 3 May Balances 4Journal Page Account Name 4 Journal Totals 5 General Journal Page 1 Debit 6 General Journal Page 2 Debit 7 General Journal Page 3 Credit 8 General Journal Page 4 Credit 9 General Journal Page 5 Debit 10 General Journal Page 6 Debit 11 General Journal Adjusting 12 General Journal Closing $ 1,817,472.00 5 Four Winns 7,000.00 $ 86,350.00 6 Chris Craft S 533,011.00 $ 1,152,305.00 7 Sea Ray S 65,000.00 8 Boston Whaler S 933,620.00 92,500.00 $300,000.00 Donzi 581,690.00 10 S 622,620.00 $ 81,687.30 Product Name 2 Fish Finders 3 Propellers 1 Description 3,076,500.00 Helm module using sonar to identify fish 13 Propulsion unit designed specifically for V-drives 14 Check Figures Part 3 4 Downriggers Transom mounted deep lake fishing device 15 Return on Assets 5.93% 5 Profit Margin 5.35% Chart of Accounts - Accounts Payable Ledger 2 May Balances 4 Account Name 5 6 Raydar Marine 25,000.00 $362,500.00 $ 104,000.00 7 Acme Scotty 9 DU Utility Company 3,300.00 10 Staples S 500.00 JuumaLuy auuuun 9 JUNE JOURNAL TRANSACTIONS 11 lune 1 Purchased 5,000 Fish Finder units on Credit from Ravdar Marine for $42.00 per unit June 1 Issued 10,000 shares of common stock for $20 per share (Refer to the Chart of Accounts for description 13 of common stack). 15 June 1 Signed a one year 15% , $216,000 note pavable with Boat US Bank 17 June 1 Sold 4.000 Propellers on account to Chris Craft for $85 per units, Invoice #5555 ewarehouse to a new tenant and received $6.ppo for three months rent June. July. Rented part of June 2 19 August. r$82 per unit, Invoice #5556 21 June 2 Sold 5.200 Fish Finder units on account to Spa Ray $4,800, ND OF PAGF THE ENTrs AFTER THIS MUST 60 ON a4GE S86 per unit account to Boston une aler lnunir. r 306 per unit ond 800 propelller units fe 26 The Board of Directors declared a cash dividend of $2 per share for shareholders of record on June 5th, une: payable on June 12th. Refer to the chart of accounts for # of outstanding shares. Please include ALL outstanding shares as of June Sth Received payment from Chris Craft for May 20th sale 30 June 4 king's claim for $7,000 due trom Four Winns. Management ane- decided to weite off this accounts receivable.. 32 Paid S3,300 to DU Utity Co. for utilties bill that was recorded in May as Account Dayable, Check 34 #5278 Purchased 8000 shares of Grand Valley Marine, Inc. stock for $15 per share e imvestment is intended to be held for less then 1 year 36 Received and paid expense reports tor travel and entertainment totaing $5.925, Check a5279. une Paid for on . CO ONB a80 THIS MUST OF PAGE 2. THE ENTRIES. E 3 Paid in ful for the June 1 purchase from Ravdar Marine, Check 43 June 11 June 11 for bond consulting fees nud thee billinmeEels.ao nek. d Check A5282. 45 Paid the diidend that was declared on June 3, Check #5281. 47 June 12 Tock advantage of a trade discount of 20% on the purchase of 3,100 Propellers on account from Acme. June 13 Before applying trade discount BEFORE purchase discount). propellers are selling for $50 per unit. (Trade discount taken on total 49 51 une 13 Purchased 1,850 Fish Finder units on credit from Raydar Marine for $50 per unit 53 June 15 Sold 3,500 Propellers on credit to Doni far $99.00 per unit, Invaice 5557 Check # 5284 was isuued tor navroll: $40.500 for salaried and $16.500 for wazes 55 June 15 57 June 16 Purchased 2.5co Downriggers on credit from Scotty $32 per unit. EPAGE3, THE ENTRIES AFTER THIS MUST GO ON PAGE 4 58 END June 17 Issued a credit to Sea Ray for the return of 350 defective fish finder units from the June 2nd sale. These units has a cost basis of $41.16 per unit. 60 Returned the 350 defective units received from Sea Ray to Rayvdar Marine, Ravdar Marine issued a cash June 12 refund. 64 June 18 Received pavment in full from Chris Craft for the lune1st sale June 20 Davennort Dockine ceturned the ontice ondes .-nd. South bmerdca iostaad of Moah 6mad Marine Davenport Decking purchased 2,800 shares of it's awn stack for $10 per share. 68 June 20 lovoice a5550 Ray for $56 per e Sold 2.650 Doywnriggers on credit to: 70 June 22 Paid $195,000 of the $362.500 owed to Acme from May 2 72 June 23 Check #$285 73 END OF PAGE 4. THE ENTRIES AFTER THIS MUST Go ON PAGE S 75 June 23 Received payment trom Donai for $175,000 of the $300,0000 awed trom May. June 24 ational phone card for one of the sales representative's upcoming European Purcased p, Check A5286. 79 June 25 Paid in full for the purchase from Acme on June 13, Check #5287 81 June 26 Purchased 1,250 Downrigers from Scatty for $33 per unit paying in cash, Check #5288 83 June 27 Sold 1,500 Downrigoers on credit to Donzi for per unit, Invoice 5558 June 27 Davenport Docking's management felt is was necessery to develop brand awareness, Check #5289. Davenport Docking is behind in its mortgage payments to LMCU, Paid a total of $20,000 ($4,000 principal and $16,000 interest ), Check #5290 June 28 87 a9 June 28 Sold 1,000 treasury shares from June 20th transaction for $15 per share o ON PAGE 6 90 END OF PAGE S. THE ENTRIES AFTER THIS MUST Received payment in full from Danzi for the June 27th transaction 92 June 29 94 June 29 Sold 3,000 shares of Grand Valey Marine, Inc stock for $18 per share 96 June 29 check #5292 was issued for payrol: $40,500 for salaries and $17,750 for wages Paid the t tmonth's principal payment of $18.000 on the nate pavable from June1 Boat US bank, In June 30 id ane month's interest (interest cakulated BEFORE principal payment each month), Check addition #5293 he honds is S4co.000, Contract rate on bood is 8% June 30 and d discaunt Face valae of t Do NOT round intermediate calculations. If required round final number to nearest cent. Fish Finders Purchases Ending Inventory (EI) Sales Purch Sale $/Unit Sale Units Purch Units $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El $/Unit El $ Date El Units Beg. Bal. 500 40.00 20,000.00 Propellers Purchases Sales Ending Inventory (EI) Sale $/Unit Purch Sale Units Purch Date Units $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El Units El $/Unit El$ $ 286,000,00 Beg. Bal. $ 55.00 520 Downriggers Aead Darb .ADLednn ADIodaar Chart nt Accounte C 37 38 Downriggers 39 Ending Inventory (EI) Purchases Sales Sale $/Unit Purch Purch Sale Units 40 $/Unit Purch $ (CGS) (CGS) Sale $ (CGS) El $/Unit El $ Date Units El Units 41 Beg, Bal. 42 1400 40.00 S 56,000.00 43 44 45 46 47 48 49 52 53 54 55 56 57 58 General Journal Adjusting Entries 3 June Month-end Adjustments: 4Instructions: Please write the month end journal entries for each f the following scenarios listed below. Date each entry as 5 for doubtful accounts for entry (C). PLEASE list debits before credits and skip a line between entries. ONLY use f the end of the month. The aging of accounts receivable method is used to estimate allowance account titles listed in the chart of accounts 6 6/30 (A) Davenport Docking has earned one month of the prepaid rent received from their tenant at the beginning of June. 7 6/30 (B) The company estimates customer returns monthly. They estimate half of 1% of the credit sales of $2,902,760 for the month of June will be uncollectible. The related inventory returned amounts to $8,850. Davenport Docking estimates bad debt expense on a monthly basis rather than waiting until year- 6/30 (C) end. The company uses the allowance and aging of accounts receivable method. Based on recent industry estimates, Davenport Docking estimates that the allowance account should be 1.75% of accounts receivable. The ending AR balance is $955,000. At the end of the month (prior to this journal entry) there is a DEBIT balance of $1,250 in the Allowance for Doubtful Accounts account. Write the necessary adjusting entry. 11 6/30 (D) The Company took a physical inventory count on June 30 and found the following inventory on hand to be $346,350. The ending balance in the Inventory account (before this adjusting entry) was $368,461. Write the necessary adjusting entry 13 Grand Valley Marine shares are trading for $12 per share on June 30th. Davenport Docking adjusts 6/30 (E) security investments to market value once a month. Write the adjusting entry for the change in stock value. 15 17 6/30 (F) Depreciation on the company's fixed assets for the month of June is as follows: 1. The equipment for the warehouse was purchased a 2 years ago for $61,000. These assets have a 5- year life, an expected salvage value of $1,000, and are depreciated using the straight-line method. 18 2. The office furniture was purchased last year for $22,500. these assets have a 7 year life, an expected salvage value of $1,500, and are depreicated using straight-line method. 19 21 Page 1 22 Date Accounts DEBIT CREDIT 23 24 General Journal - Adjusting Entries 2 3 June Month-end Adjustments: Instructions: Please write the month end journal entries for each of the following scenarios listed below. Date 4 each entry as of the end of the month. The aging of accounts receivable method is used to estimate allowance 5 for doubtful accounts for entry (C). PLEASE list debits before credits and skip a line between entries. ONLY use account titles listed in the chart of accounts 6 6/30 (A) Davenport Docking has earned one month of the prepaid rent received from their tenant at the beginning of June. 7 6/30 (B) The company estimates customer returns monthly. They estimate half of 1% of the credit sales of o for the month of June will L ollectible. The related inventory returned amounts to $8,850. 6/30 (C) Davenport Docking estimates bad debt expense on a monthly basis rather than waiting until year- end. The company uses the allowance and aging of accounts receivable method. Based on recent industry estimates, Davenport Docking estimates that the allowance account should be 1.75% of accounts receivable. The ending AR balance is $955,000. At the end of the month (prior to this journal entry) there is a DEBIT balance of $1,250 in the Allowance for Doubtful Accounts account. Write the necessary adjusting entry 11 6/30 (D) The Company took a physical inventory count on June 30 and found the following inventory on hand to be $346,350. The ending balance in the Inventory account (before this adjusting entry) was 13 $368,461. Write the necessary adjusting entry. 6/30 (E) Grand Valley Marine shares are trading for $12 per share on June 30th. Davenport Docking adjusts security investments to market value once a month. Write the adjusting entry for the change in stock value. 15 17 6/30 (F) Depreciation on the company's fixed assets for the month of June is as follows: 1. The equipment for the warehouse was purchased a 2 years ago for $61,000. These assets have a 5- year life, an expected salvage value of $1,000, and are depreciated using the straight-line method. 18 2. The office furniture was purchased last year for $22,500. these assets have a 7 year life, an expected salvage value of $1,500, and are depreicated using straight-line method. 19 21 Page 1 22 Date Accounts DEBIT CREDIT 23 24 25 Anstrucsions: Below is adlusted trial balance for the month FOLLOWING me previous lournal u reuned and should nor be used as check figures for normal ana redin i Mutted Trial alanc Account Ttk Acct No 100 Cash 102 Accots Recevatle 37246 00 11 7564000 thul Account 3 00 12 104 Nechandise ortone 10 Eimed Retums Inventary 4354100 14 s10 on p 107 Ppat rance 10.50 00 Imehments vaiatle for Se 13 19122 Isments - Hekd to Muturty 20,006 0 20 123 an Alowance 140 Land 2000,800.00 21 4 16 60 1 Acumed DeprectenBring 530 330 33 24 161 Equpment 152 Accumted Deprecation Eurment 153 oeuhr 3003 25 2000 wdon-ofice Funre 220 Accounts Pavable 20 Wages Pashle a 2 west Payable 204 Dvends Payable Csomer Rerds Paale an 250 N P a5251 Bnd Pay 10 130 33 3 252 Premum.en Bands Paatd as 2 Nartge Warehose) Pa 300 Crnd. : 30 Pad in Captal-Excess of Par Retared Exminge 0ca ex0ew uandng 5,530 3 4) 3503 41 Cast Ddenc 10000 4 341nreakred 0Gar) Loss Aralable for Sale Securities 20,530 3 45 s00Ses 600 Cast of Ocods Sold s100 Wage Expense hourty workers 5500.00 Narketng Epes 703 Travel and Ertertarmet Eperse T04 Ba Det Expense s0 sa1s Ppey Tac Espere N & Repa Espers .. 54 707 Legal Espenses 3140 00 T0 Insurance Expense pense Cce Supples Expent T35 00 T ense T12 Deciston Expense EqurmeT 713 Dapeciabon Expense-Cice Funinre 6.00e 00 soe c 800 Ret hcome 23.33 900 eest Expense Uested LassTrading Securtes s Reskred iIstment Securtes 12,500 00 15.00000 Tela Net income as) eece Ca Iqurcal cleing Entriea July Month-end CLOSING ENTRIES to rest of part 1. They are completely separate F write the JULY manth end clasing entries USING the adjusted trial balance warkbook amounts. Use end of month as date anCe 7/31 A) Close ALL revenue and expane accounts WITH a baiance o retained exrmines 31 ) Closes eteede to retained earnines 1 Page 1 DIN CREDT 13 ETTEELEETTEENCFETEE