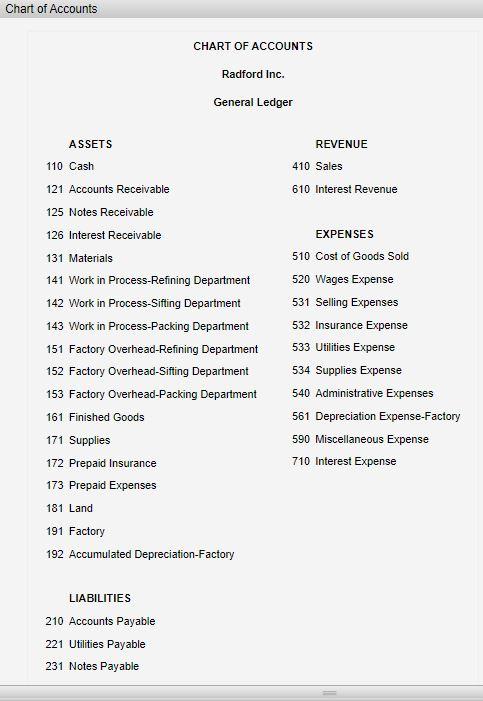

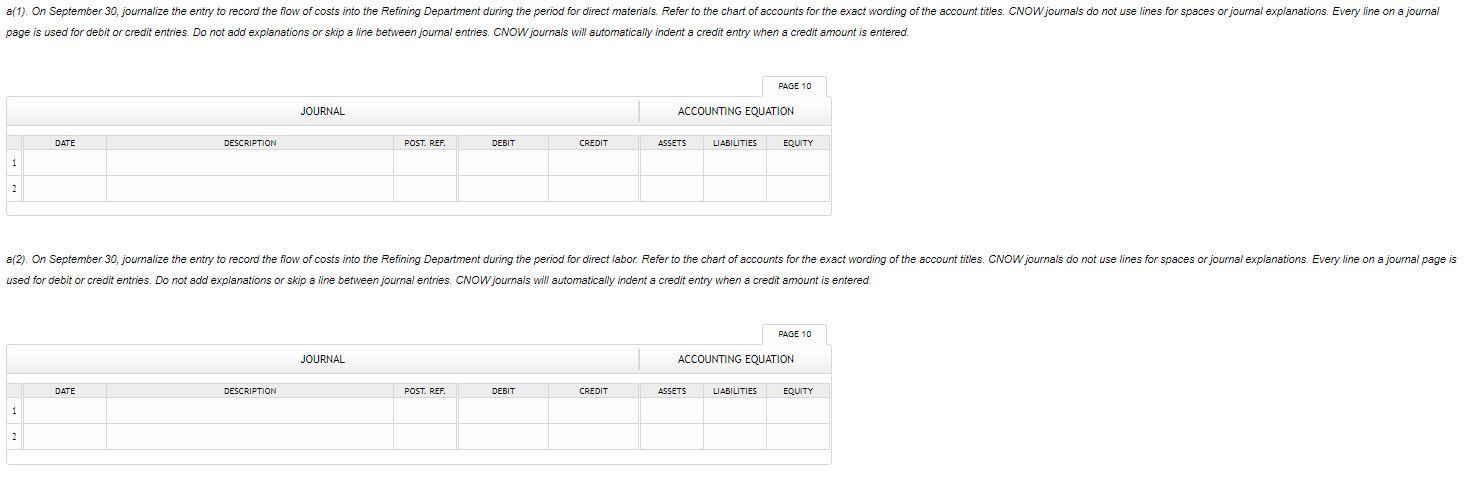

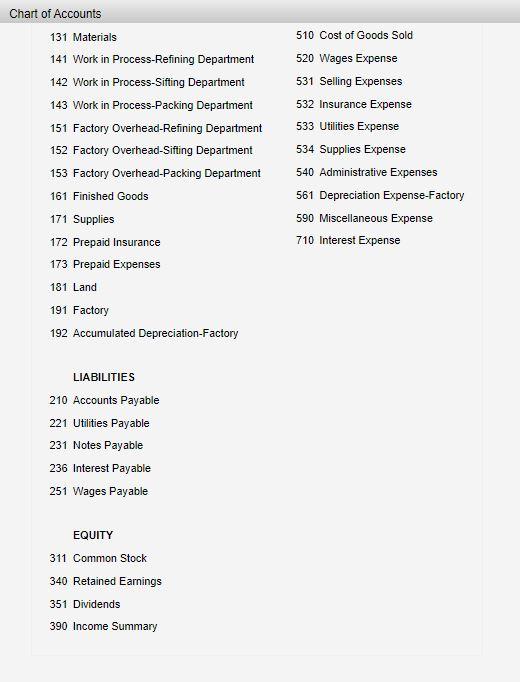

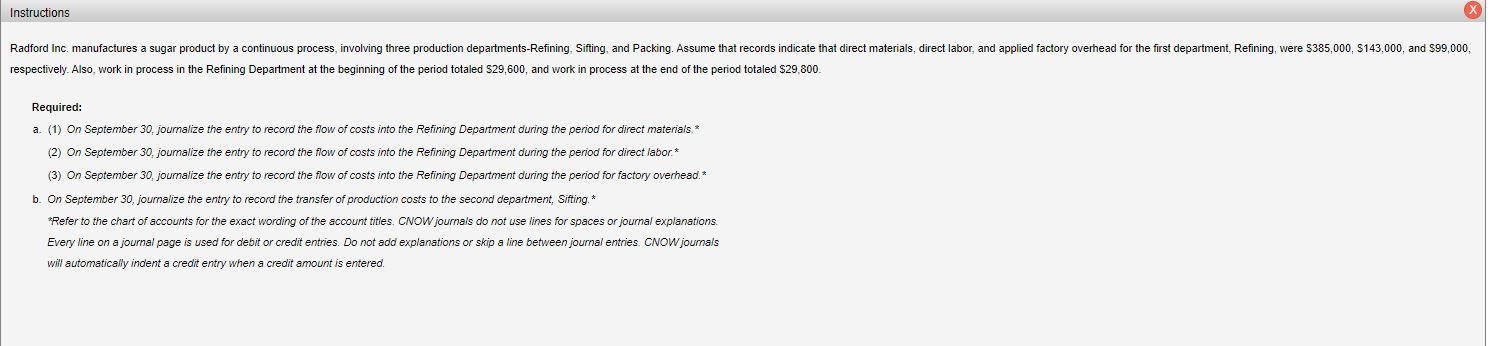

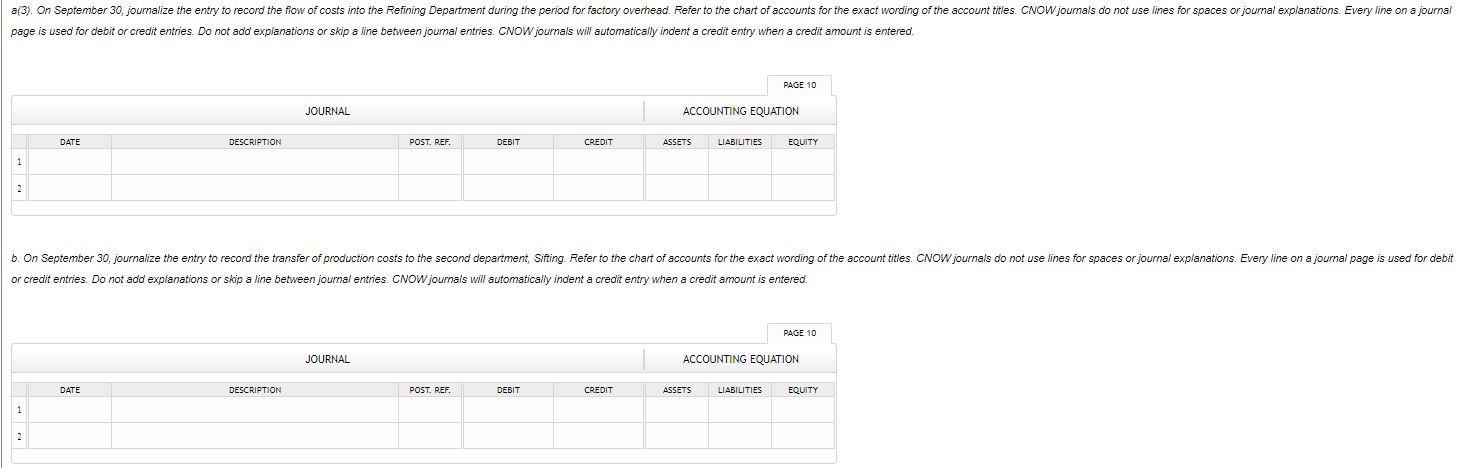

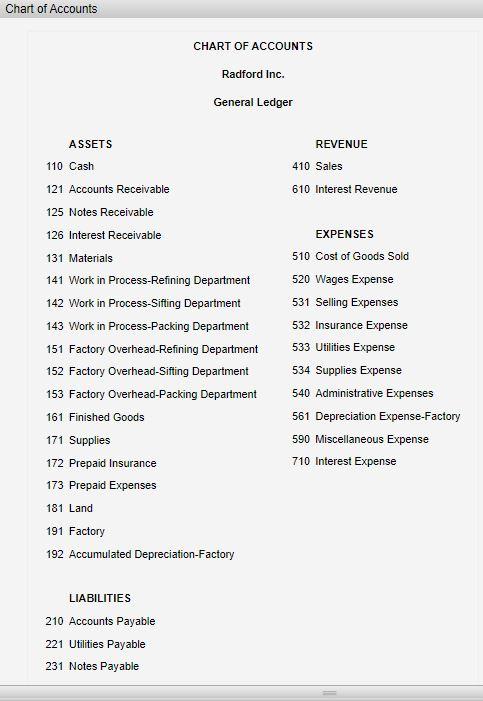

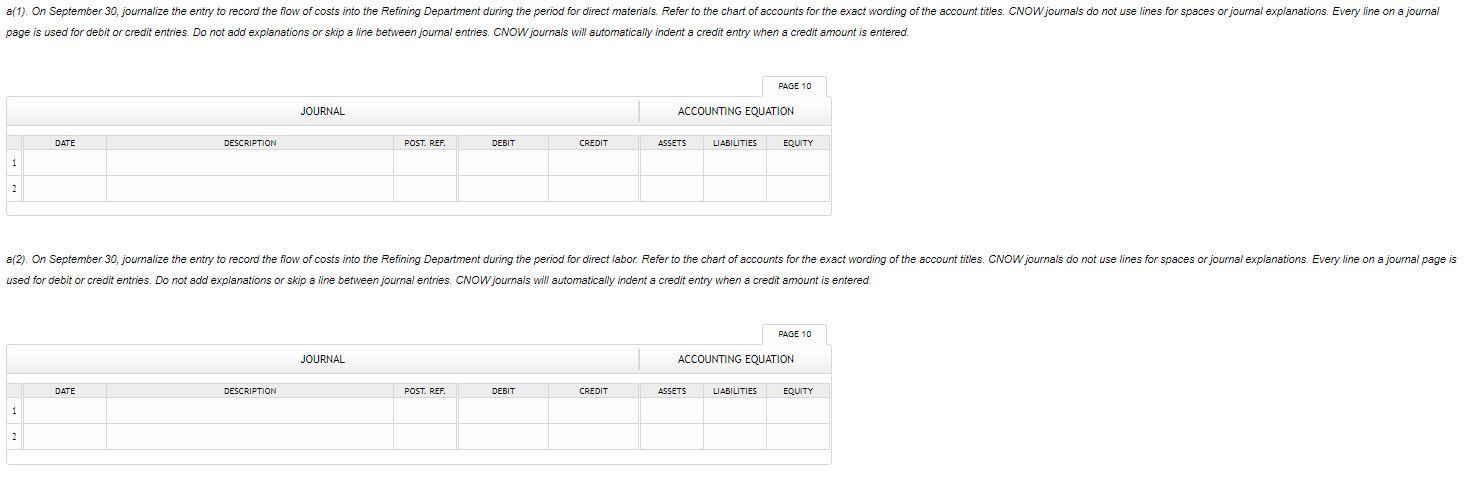

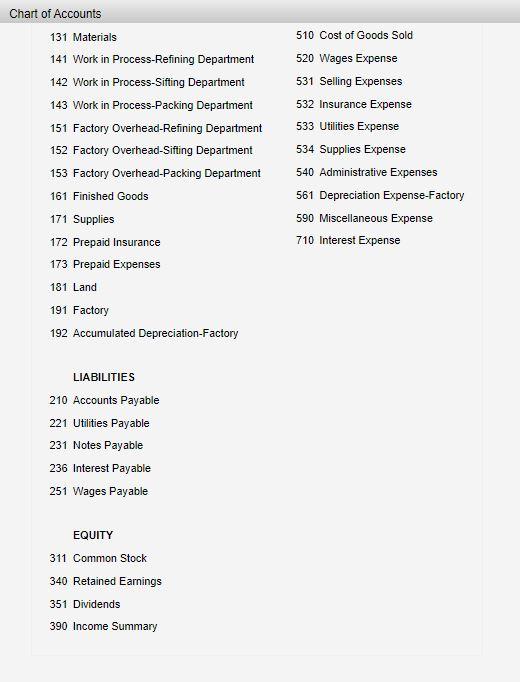

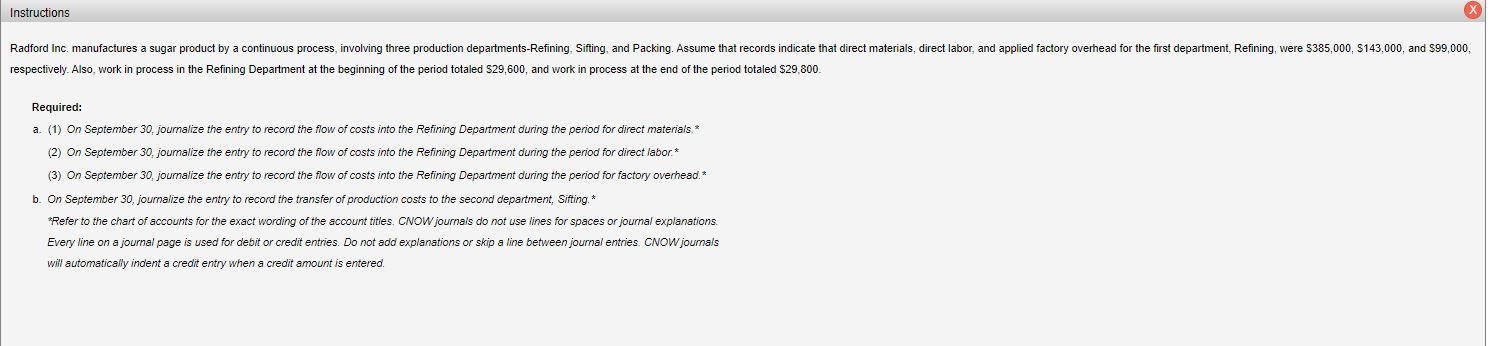

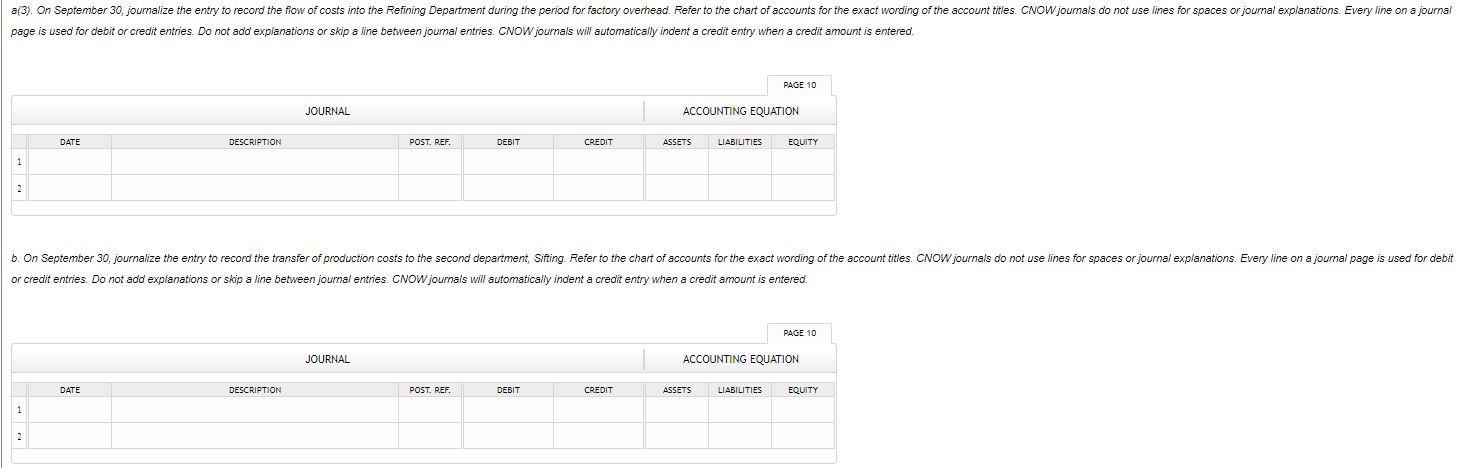

Chart of Accounts CHART OF ACCOUNTS Radford Inc. General Ledger REVENUE 410 Sales 610 Interest Revenue ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 141 Work in Process-Refining Department 142 Work in Process-Sifting Department 143 Work in Process-Packing Department 151 Factory Overhead-Refining Department 152 Factory Overhead-Sifting Department 153 Factory Overhead-Packing Department 161 Finished Goods 171 Supplies 172 Prepaid Insurance 173 Prepaid Expenses 181 Land 191 Factory 192 Accumulated Depreciation-Factory EXPENSES 510 Cost of Goods Sold 520 Wages Expense 531 Selling Expenses 532 Insurance Expense 533 Utilities Expense 534 Supplies Expense 540 Administrative Expenses 561 Depreciation Expense-Factory 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable a(1). On September 30, journalize the entry to record the flow of costs into the Refining Department during the period for direct materials. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 a(2). On September 30, journalize the entry to record the flow of costs into the Refining Department during the period for direct labor. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 510 Cost of Goods Sold Chart of Accounts 131 Materials 141 Work in Process-Refining Department 142 Work in Process-Sifting Department 143 Work in Process-Packing Department 151 Factory Overhead-Refining Department 152 Factory Overhead-Sifting Department 153 Factory Overhead-Packing Department 161 Finished Goods 171 Supplies 172 Prepaid Insurance 173 Prepaid Expenses 181 Land 191 Factory 192 Accumulated Depreciation-Factory 520 Wages Expense 531 Selling Expenses 532 Insurance Expense 533 Utilities Expense 534 Supplies Expense 540 Administrative Expenses 561 Depreciation Expense-Factory 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 251 Wages Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary Instructions Radford Inc, manufactures a sugar product by a continuous process, involving three production departments-Refining. Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $385,000, 5143,000, and 599,000, respectively. Also, work process in the Refining Department at the beginning of the period totaled S29,600, and work in process at the end of the period totaled $29,800 Required: a. (1) On September 30, journalize the entry to record the flow of costs into the Refining Department during the period for direct materials (2) On September 30, journalize the entry to record the flow of costs into the Refining Department during the period for direct labor* (3) On September 30, joumalize the entry to record the flow of costs into the Refining Department during the period for factory overhead* b. On September 30, journalize the entry to record the transfer of production costs to the second department, Sifting.* *Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debitor credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. a(3). On September 30, joumalize the entry to record the flow of costs into the Refining Department during the period for factory overhead. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. PAGE 10 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 6. On September 30, journalize the entry to record the transfer of production costs to the second department, Sifting. Refer to the chart accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2