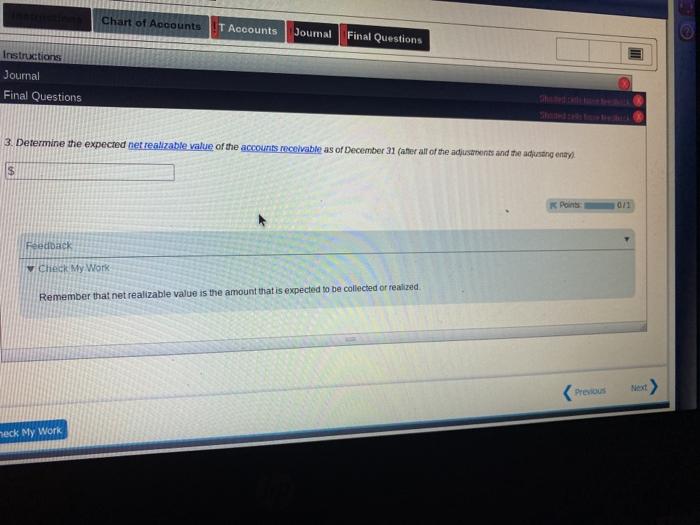

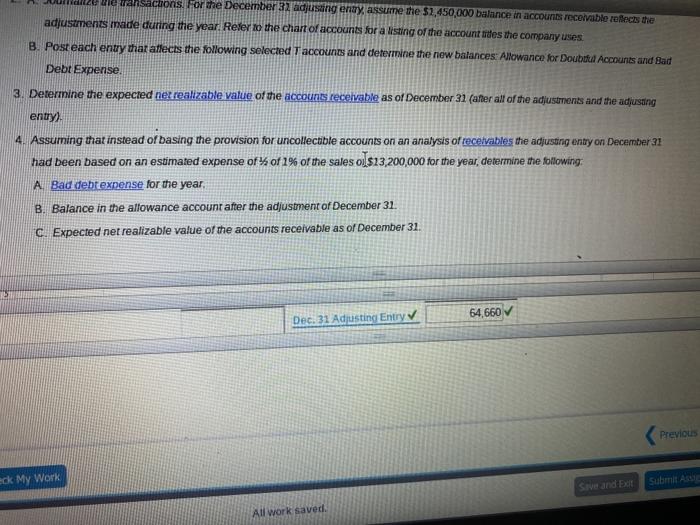

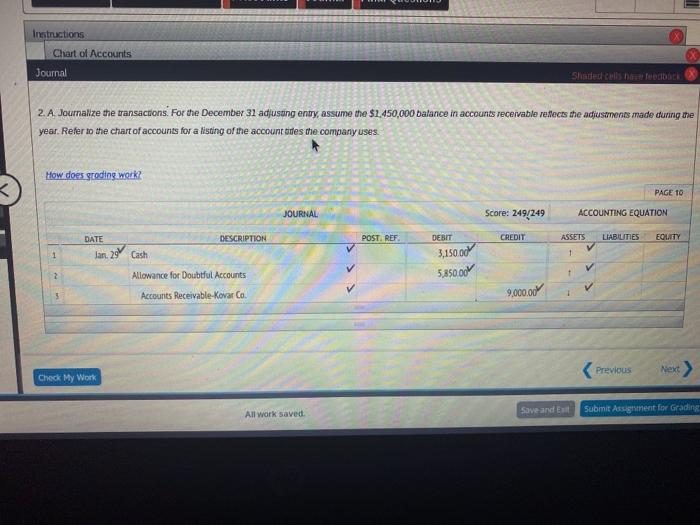

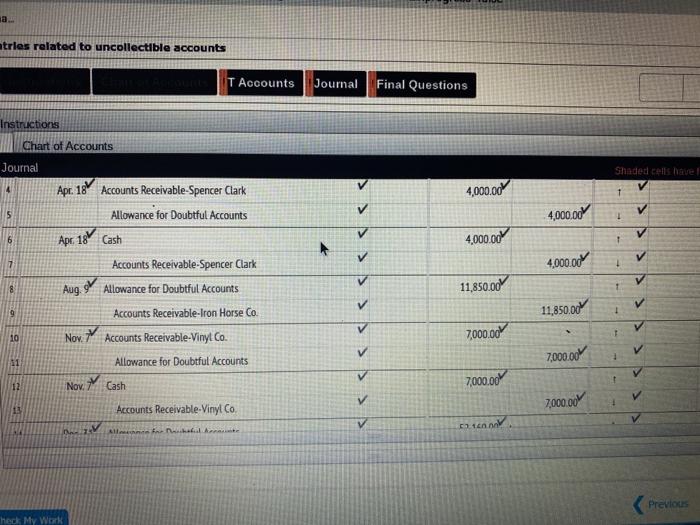

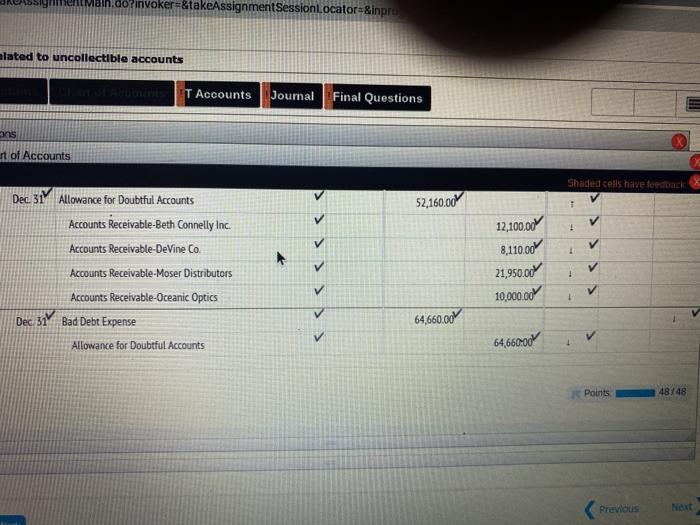

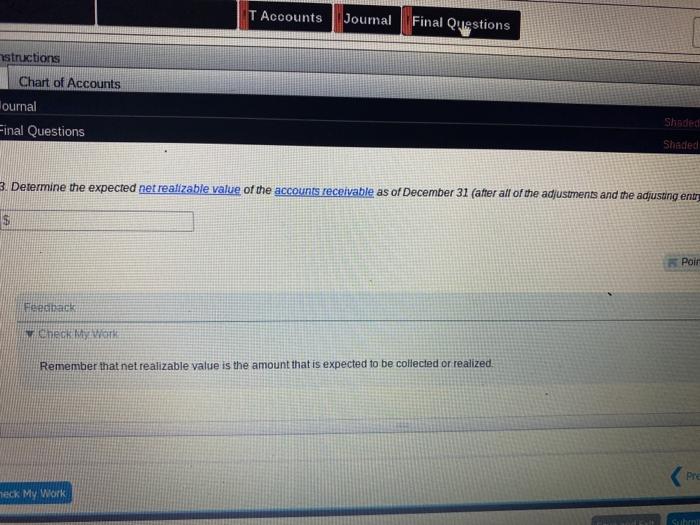

Chart of Accounts T Accounts Joumal Final Questions Instructions Journal Final Questions 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting enny. S Point 011 Feedback V Check My Work Remember that net realizable value is the amount that is expected to be collected or realized Next Previous heck My Work ZEUG ns. For the December 32 adjusang enay, assume the $1,450,000 balance in accounts receivable reflects the adjustments made during the year. Refer to the chart of accounts for a listing of the account fides the company uses B. Posteach entry that atlects the following selected Taccounts and determine the new balances: Allowance for Doubt Accounts and Bad Debt Expense 3. Determine the expected ner realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 21 had been based on an estimated expense of 4 of 1% of the sales ol$13,200,000 for the year, determine the following A Bad debt expense for the year, B. Balance in the allowance account after the adjustment of December 31. C. Expected net realizable value of the accounts receivable as of December 31. 64,660 Dec. 31 Adjusting Entry Previous eck My Work Save and bet Submit AS All work saved. Instructions Chart of Accounts Journal 2. A. Journalize the transactions. For the December 31 adjusting entry, assume the $1.450,000 balance in accounts receivable reflects the adjustments made during me year. Refer to the chart of accounts for a listing of the account ides the company uses. How does groding work? PAGE 10 JOURNAL Score: 249/249 ACCOUNTING EQUATION DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EOLITY DATE Jan. 29 Cash 1 3,150.00 5850.00 + Allowance for Doubtful Accounts Accounts Receivable-Kovar Co. 9,000.00 Previous Next Check My Work All work saved Save and Submit Assignment for Grading tries related to uncollectible accounts TAccounts Journal Final Questions Instructions Chart of Accounts Journal Shaded Cells lave Apr. 18 Accounts Receivable Spencer Clark 4,000.00 1 4,000.00 1 6 4,000.00 4,000.00 7 1 8 Allowance for Doubtful Accounts Apr 18 Cash Accounts Receivable-Spencer Clark Aug. gl Allowance for Doubtful Accounts Accounts Receivable-Iron Horse Co Now 7 Accounts Receivable-Vinyl Co. Allowance for Doubtful Accounts 11,850.00 9 11,850.001 V 7,000.00W 10 V 7,000.00 11 V 7,000.00 12 Nov. Cash V 7,000.00 3 Accounts Receivable Vinyl Co Alle fall V