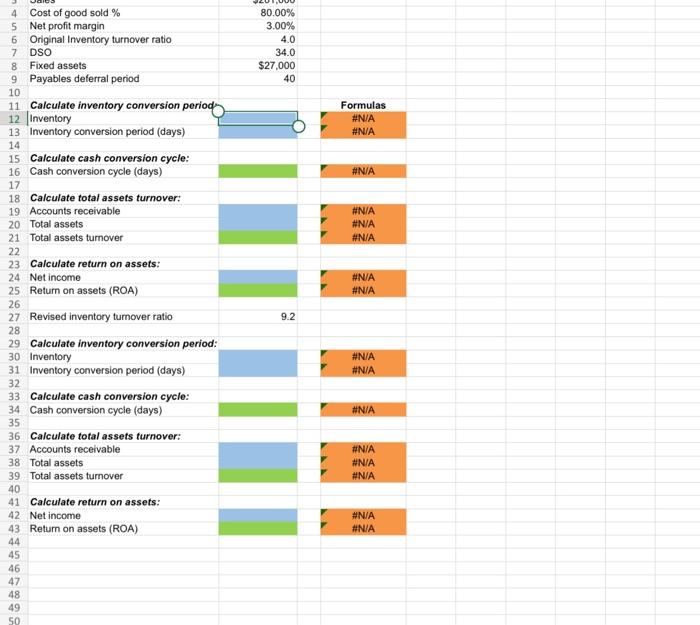

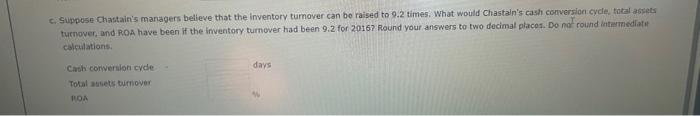

Chastain Corporation is toying to determine the effect of its irventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycte. Chastain's 2016 coles (att on credit) were $201000; its cost of goods sold is 80% of sales; and it eamed a net-profit of 3%, or $6030. It tumed over its invenfory 4 times during the year, and its DSO was 34 days. The firm had foxed assets totaling $27000. Chastain's payables deforral period is 40 days. Assume 365 dayi in rear for vour calculations. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to anjwer the questions bulow. Open spreadshect a. Calculate Chastain's cash conversion cycle. Round your answer to two decimal places. Do not round intermediata calculations dins b. Assuming Chastain holds negligble amounts of cash and markefable secirities, calculate its total assets turnover and RoA, Round your answers to tivo deciral places. Do not round intermediate calculations. Total assets tainover moA thintationt: c. Suppose Chastain's managers believe that the inventory turnover can be raised to 9.2 times. What would chastain's cash conversion cyele total arisets burnover, and ROA have been If the inventory turnover had been 9.2 for 2016 ? Round your answers to two decimal places. Do no round intermediate calcutations. Cash corverstion cyde days Totai agsets turnoyer mos \begin{tabular}{|l|r|} \hline Cost of good sold % & 80.00% \\ \hline Net profit margin & 3.00% \\ \hline Original Inventory turnover ratio & 4.0 \\ \hline DSO & 34.0 \\ \hline Fixed assets & $27,000 \\ \hline Payables deferral period & 40 \end{tabular} Calculate inventory conversion period Inventory Inventory conversion period (days) Calculate cash conversion cycle: Cash conversion cycle (days) Calculate total assets turnover: Accounts receivable Total assets Total assets tumover Calculate return on assets: Net income Return on assets (ROA) Revised inventory tumover ratio Calculate inventory conversion period: Inventory Inventory conversion period (days) Calculate cash conversion cycle: Cash conversion cycle (days) Calculate total assets turnover: Accounts receivable Total assets Total assets turnover Calculate return on assets: Net income Return on assets (ROA) Chastain Corporation is trying to determine the effect of its inventory tumover ratio and days saies outstanding (OSO) on its cash conversian cycle, Chastalin's 2016 sales (all on credit) were $201000; its cost of goods sold is 80% of soles; and it eamed a net profit of 396 , or 56030 . It turned over its invontory 4 times during the year, and its DSO was 34 days. The firm had fixed aspets totaling $27000. Chastain's payables deferral period is 40 days. Assume 365 days in yeaf for your calculations, The data has been collected in the Microsoft Excel Cnline file below. Open the spreadsheet and perform the required analyais to antwer the questions below, Open specadsheet 7. Cutcuste chastian's cash conversion cycle. Round your answer to two decimal olaces, Do not round intermediate calculations. dart b. Mssuming Chastain bolds negligible amounts of cash and markstakle securities, calculate its total assets turnover and RoA, Round your answers to two. Secimal places. Do not round iritermediate caculations. Total assats tumover noA caleutatians. c. Suppose Chastain's managers believe that the imventorv tumover can be raised to 9.2 times; What would Chastaln's cash conversian cycle, total absets calculations. Casivicorvertoricride davs Total atsets burnover lok template Open in App an Cak tenwerilon tycis \begin{tabular}{r} \hline \\ \hline 2001000 \\ 3006 \\ 3005 \\ 40 \\ 540 \\ 527000 \\ 40 \end{tabular} Salns Cent of good sod N Net proft mavon Original Inentary sumover natio Dso Fined wosets Pavatiles deferral period Cakcolate invenory cenversion perrod. Imentory Cakedate cacb comersion cyele Canh comernon cycle (dapn) Gekulate hedal assets herover: Abogunla neceivable Totrianets Tots asebs lemover Cenculafe retum en assets: Net inoorte Retum on aviete (ROM) Aevesd invecy hamover rote Calcotafe inventory calvertalon period: inviary Cakufafe cant comenalos cyele: Cinh covernion cycle (aaph) Cakcofafe foed aliets furnover: hocound necevicibe Tocal auets Totx antets bumour Cakutate retum en assets: Net income Retem in abiets (Fow)