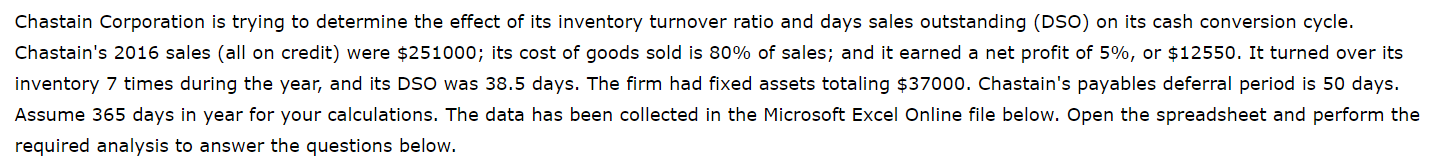

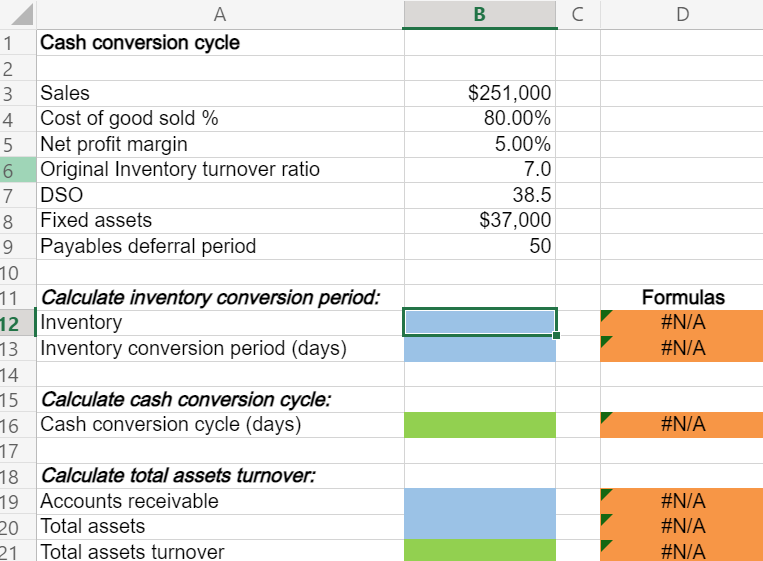

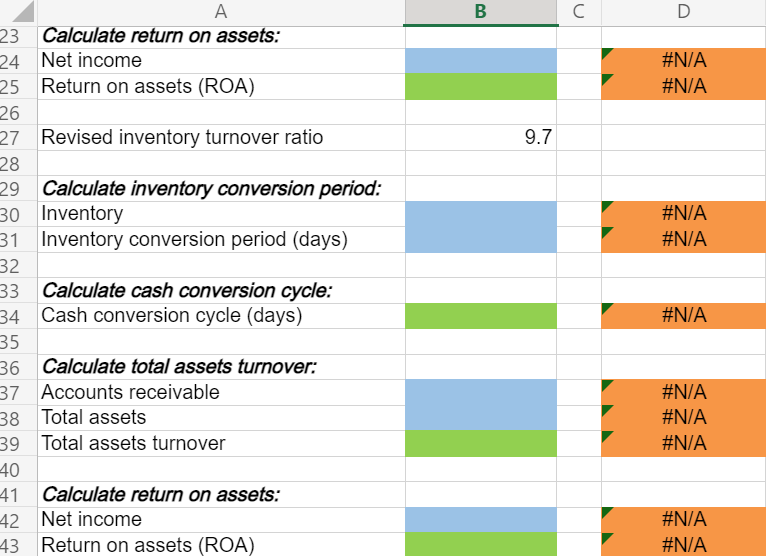

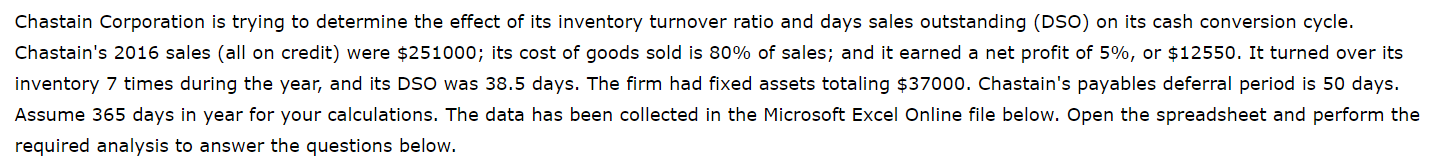

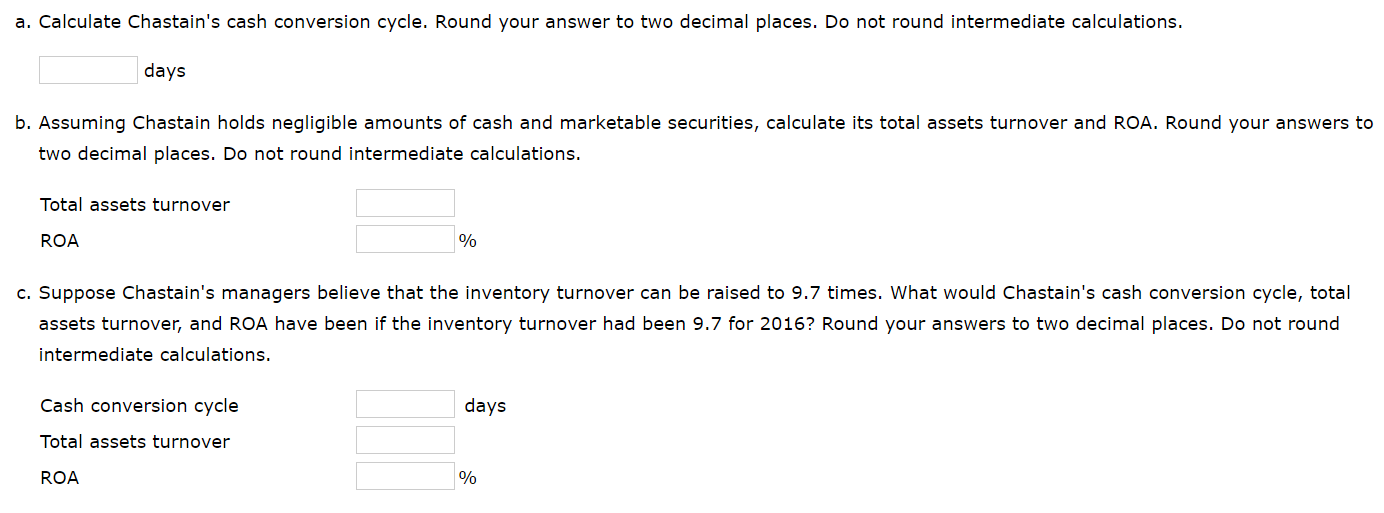

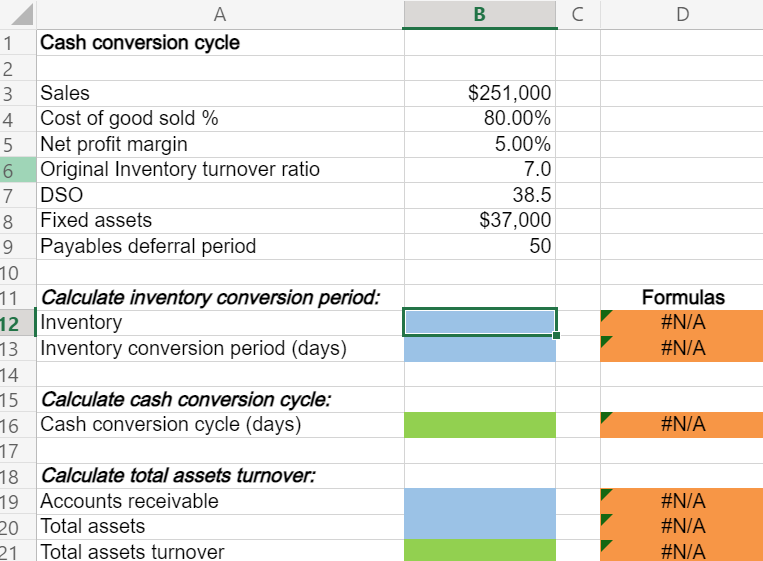

Chastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycle. Chastain's 2016 sales (all on credit) were $251000; its cost of goods sold is 80% of sales; and it earned a net profit of 5%, or $12550. It turned over its inventory 7 times during the year, and its DSO was 38.5 days. The firm had fixed assets totaling $37000. Chastain's payables deferral period is 50 days. Assume 365 days in year for your calculations. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. a. Calculate Chastain's cash conversion cycle. Round your answer to two decimal places. Do not round intermediate calculations. days b. Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Round your answers to two decimal places. Do not round intermediate calculations. Total assets turnover ROA % c. Suppose Chastain's managers believe that the inventory turnover can be raised to 9.7 times. What would Chastain's cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover had been 9.7 for 2016? Round your answers to two decimal places. Do not round intermediate calculations. Cash conversion cycle days Total assets turnover ROA % B C D $251,000 80.00% 5.00% 7.0 38.5 $37,000 50 A 1 Cash conversion cycle 2 3 Sales 4 Cost of good sold % 5 Net profit margin 6 Original Inventory turnover ratio 7 DSO 8 Fixed assets Payables deferral period 10 11 Calculate inventory conversion period: 12 Inventory 13 Inventory conversion period (days) 14 15 Calculate cash conversion cycle: 16 Cash conversion cycle (days) 17 18 Calculate total assets turnover: 19 Accounts receivable 20 Total assets 21 Total assets turnover Formulas #N/A #N/A #N/A #N/A #N/A #N/A B C D #N/A #N/A 9.7 #N/A #N/A A 23 Calculate return on assets: 24 Net income 25 Return on assets (ROA) 26 27 Revised inventory turnover ratio 28 29 Calculate inventory conversion period: 30 Inventory 31 Inventory conversion period (days) 32 Calculate cash conversion cycle: 34 Cash conversion cycle (days) 35 36 Calculate total assets turnover: 37 Accounts receivable 38 Total assets 39 Total assets turnover 40 41 Calculate return on assets: 42 Net income Return on assets (ROA) #N/A #N/A #N/A #N/A #N/A #N/A