Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chateau Napa purchased a small vineyard and is now producing magnum bottles (1.5 liters) of Redwood Cabernet Sauvignon. This wine is much sought after, and

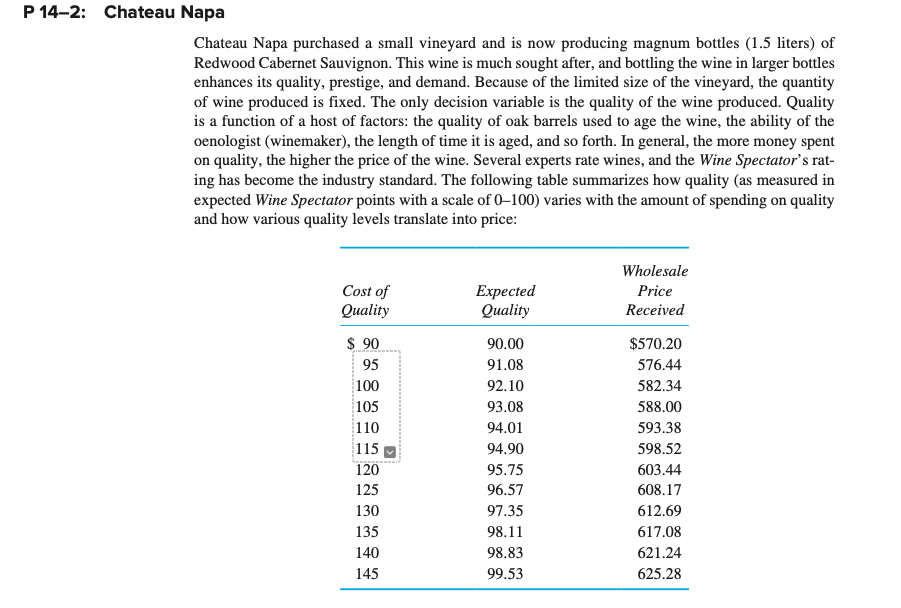

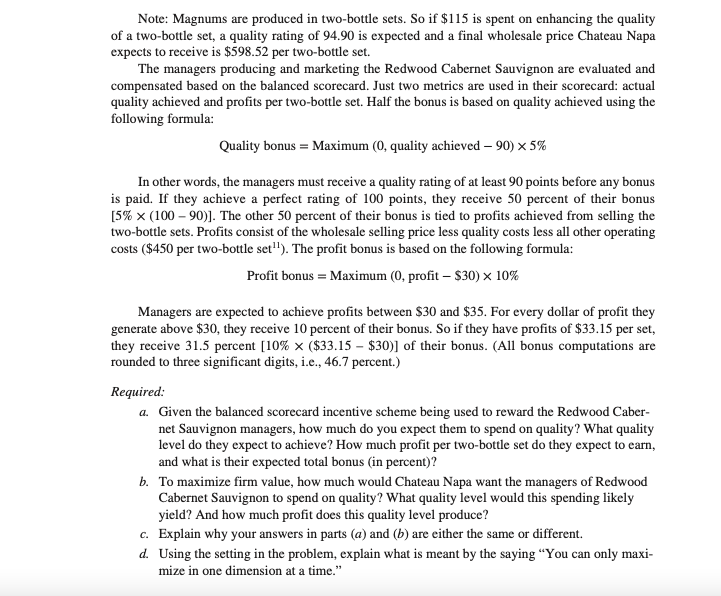

Chateau Napa purchased a small vineyard and is now producing magnum bottles (1.5 liters) of Redwood Cabernet Sauvignon. This wine is much sought after, and bottling the wine in larger bottles enhances its quality, prestige, and demand. Because of the limited size of the vineyard, the quantity of wine produced is fixed. The only decision variable is the quality of the wine produced. Quality is a function of a host of factors: the quality of oak barrels used to age the wine, the ability of the oenologist (winemaker), the length of time it is aged, and so forth. In general, the more money spent on quality, the higher the price of the wine. Several experts rate wines, and the Wine Spectator's rating has become the industry standard. The following table summarizes how quality (as measured in expected Wine Spectator points with a scale of 0100 ) varies with the amount of spending on quality and how various quality levels translate into price: Note: Magnums are produced in two-bottle sets. So if $115 is spent on enhancing the quality of a two-bottle set, a quality rating of 94.90 is expected and a final wholesale price Chateau Napa expects to receive is $598.52 per two-bottle set. The managers producing and marketing the Redwood Cabernet Sauvignon are evaluated and compensated based on the balanced scorecard. Just two metrics are used in their scorecard: actual quality achieved and profits per two-bottle set. Half the bonus is based on quality achieved using the following formula: Qualitybonus=Maximum(0,qualityachieved90)5% In other words, the managers must receive a quality rating of at least 90 points before any bonus is paid. If they achieve a perfect rating of 100 points, they receive 50 percent of their bonus [5%(10090)]. The other 50 percent of their bonus is tied to profits achieved from selling the two-bottle sets. Profits consist of the wholesale selling price less quality costs less all other operating costs ( $450 per two-bottle set 11 ). The profit bonus is based on the following formula: Profitbonus=Maximum(0,profit$30)10% Managers are expected to achieve profits between $30 and $35. For every dollar of profit they generate above $30, they receive 10 percent of their bonus. So if they have profits of $33.15 per set, they receive 31.5 percent [10%($33.15$30)] of their bonus. (All bonus computations are rounded to three significant digits, i.e., 46.7 percent.) Required: a. Given the balanced scorecard incentive scheme being used to reward the Redwood Cabernet Sauvignon managers, how much do you expect them to spend on quality? What quality level do they expect to achieve? How much profit per two-bottle set do they expect to earn, and what is their expected total bonus (in percent)? b. To maximize firm value, how much would Chateau Napa want the managers of Redwood Cabernet Sauvignon to spend on quality? What quality level would this spending likely yield? And how much profit does this quality level produce? c. Explain why your answers in parts (a) and (b) are either the same or different. d. Using the setting in the problem, explain what is meant by the saying "You can only maximize in one dimension at a time

Chateau Napa purchased a small vineyard and is now producing magnum bottles (1.5 liters) of Redwood Cabernet Sauvignon. This wine is much sought after, and bottling the wine in larger bottles enhances its quality, prestige, and demand. Because of the limited size of the vineyard, the quantity of wine produced is fixed. The only decision variable is the quality of the wine produced. Quality is a function of a host of factors: the quality of oak barrels used to age the wine, the ability of the oenologist (winemaker), the length of time it is aged, and so forth. In general, the more money spent on quality, the higher the price of the wine. Several experts rate wines, and the Wine Spectator's rating has become the industry standard. The following table summarizes how quality (as measured in expected Wine Spectator points with a scale of 0100 ) varies with the amount of spending on quality and how various quality levels translate into price: Note: Magnums are produced in two-bottle sets. So if $115 is spent on enhancing the quality of a two-bottle set, a quality rating of 94.90 is expected and a final wholesale price Chateau Napa expects to receive is $598.52 per two-bottle set. The managers producing and marketing the Redwood Cabernet Sauvignon are evaluated and compensated based on the balanced scorecard. Just two metrics are used in their scorecard: actual quality achieved and profits per two-bottle set. Half the bonus is based on quality achieved using the following formula: Qualitybonus=Maximum(0,qualityachieved90)5% In other words, the managers must receive a quality rating of at least 90 points before any bonus is paid. If they achieve a perfect rating of 100 points, they receive 50 percent of their bonus [5%(10090)]. The other 50 percent of their bonus is tied to profits achieved from selling the two-bottle sets. Profits consist of the wholesale selling price less quality costs less all other operating costs ( $450 per two-bottle set 11 ). The profit bonus is based on the following formula: Profitbonus=Maximum(0,profit$30)10% Managers are expected to achieve profits between $30 and $35. For every dollar of profit they generate above $30, they receive 10 percent of their bonus. So if they have profits of $33.15 per set, they receive 31.5 percent [10%($33.15$30)] of their bonus. (All bonus computations are rounded to three significant digits, i.e., 46.7 percent.) Required: a. Given the balanced scorecard incentive scheme being used to reward the Redwood Cabernet Sauvignon managers, how much do you expect them to spend on quality? What quality level do they expect to achieve? How much profit per two-bottle set do they expect to earn, and what is their expected total bonus (in percent)? b. To maximize firm value, how much would Chateau Napa want the managers of Redwood Cabernet Sauvignon to spend on quality? What quality level would this spending likely yield? And how much profit does this quality level produce? c. Explain why your answers in parts (a) and (b) are either the same or different. d. Using the setting in the problem, explain what is meant by the saying "You can only maximize in one dimension at a time Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started