Answered step by step

Verified Expert Solution

Question

1 Approved Answer

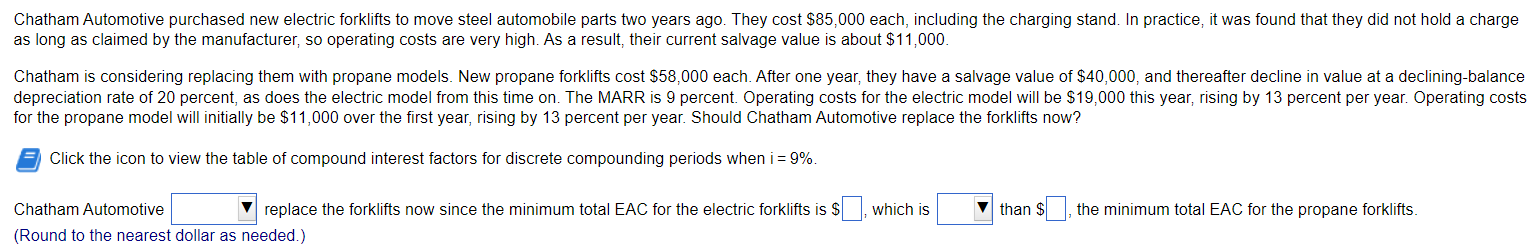

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $ 8 5 0 0 0 each , including

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $each including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so operating costs are very high. As a result, their current salvage value is about $

Chatham is considering replacing them with propane models. New propane forklifts cost $ each. After one year, they have a salvage value of $ and thereafter decline in value at a decliningbalance depreciation rate of percent as does the electric model from this time on The MARR is percent. Operating costs for the electric model will be $ this year, rising by percent per year. Operating costs for the propane model will initially be $ over the first year, rising by percent per year. Should Chatham Automotive replace the forklifts now?

FILL IN THE BLANKS: Chatham automotive "should" or "should not" replace the forklifts now since the minimum total EAC for the electric forklifts is $ which is "higher" or "lower" than $"the minimum total EAC for the propane forklifts.

USE table of compound interest factors for discrete compounding periods when i

Round to the nearest dollar as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started