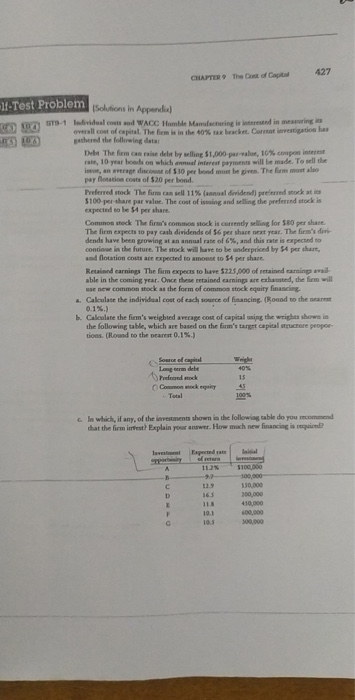

CHATO The Cost of a 427 Solutions in Appendix) 10-Test Problem 13-1 Individuals and WACC Humble Manahing is interested in meaning overall cost of capital. The firm is in the 40% tax bracket Care estigation has thered the following data Debt The fem canais dels by win $1.000 parmale, 10% coupons interest rate, 10 year s on which interest payment will be made. To sell the is , an age discount of $30 per bond must be given. The firm most pay to cost of $20 per bond. Preferred stock The firm can well 11% a sal dividend) preferred stock at $100 pershare par value. The cost of issuing and selling the preferred stock is expected to be 54 per share. Common stock The firm's common stock is currently selling for 50 per share The firm expects to pay cash dividends of $6 per share next year. The firm's divi dends have been growing at an annual rate of 6%, and this rate is expected to continue in the future. The stock will have to be underpriced by $4 per share, and flotation are expected to moto 14 per share Retained earnings The firm expects to have $225.000 of retained caring able in the coming year. Once the retained earnings are that, the firm will SE NEw common stock as the form of common stock equity finascing Calculate the individual cost of each source of financing (Round to the name b. Calculate the firm's weighid average cost of capital in the weights shown in the following table, which are based on the firm's target capital care peopor tions, (Round to the nearest 0.1%) Como rock quicy Is which, if any of the investments shown in the following table do you recommend that the firm rest Explain your answer. How much new financing is qui ? 410 000 400,000 300,000 CHATO The Cost of a 427 Solutions in Appendix) 10-Test Problem 13-1 Individuals and WACC Humble Manahing is interested in meaning overall cost of capital. The firm is in the 40% tax bracket Care estigation has thered the following data Debt The fem canais dels by win $1.000 parmale, 10% coupons interest rate, 10 year s on which interest payment will be made. To sell the is , an age discount of $30 per bond must be given. The firm most pay to cost of $20 per bond. Preferred stock The firm can well 11% a sal dividend) preferred stock at $100 pershare par value. The cost of issuing and selling the preferred stock is expected to be 54 per share. Common stock The firm's common stock is currently selling for 50 per share The firm expects to pay cash dividends of $6 per share next year. The firm's divi dends have been growing at an annual rate of 6%, and this rate is expected to continue in the future. The stock will have to be underpriced by $4 per share, and flotation are expected to moto 14 per share Retained earnings The firm expects to have $225.000 of retained caring able in the coming year. Once the retained earnings are that, the firm will SE NEw common stock as the form of common stock equity finascing Calculate the individual cost of each source of financing (Round to the name b. Calculate the firm's weighid average cost of capital in the weights shown in the following table, which are based on the firm's target capital care peopor tions, (Round to the nearest 0.1%) Como rock quicy Is which, if any of the investments shown in the following table do you recommend that the firm rest Explain your answer. How much new financing is qui ? 410 000 400,000 300,000