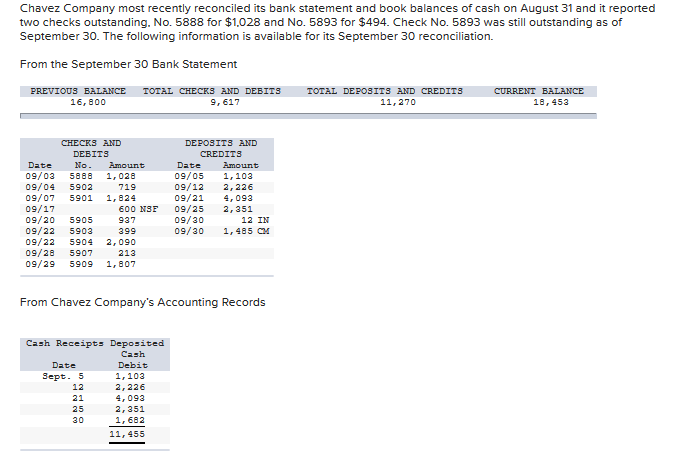

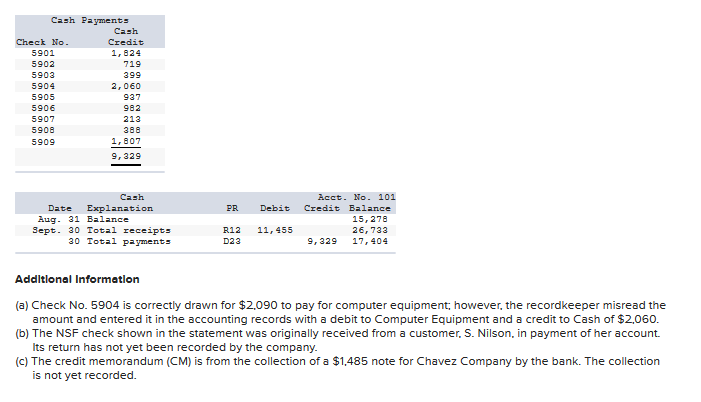

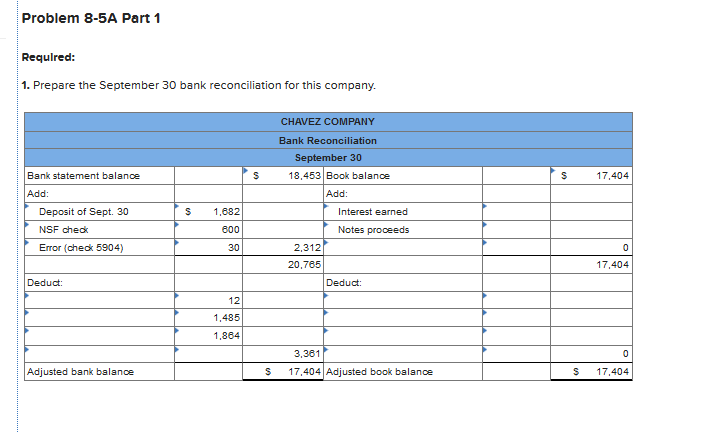

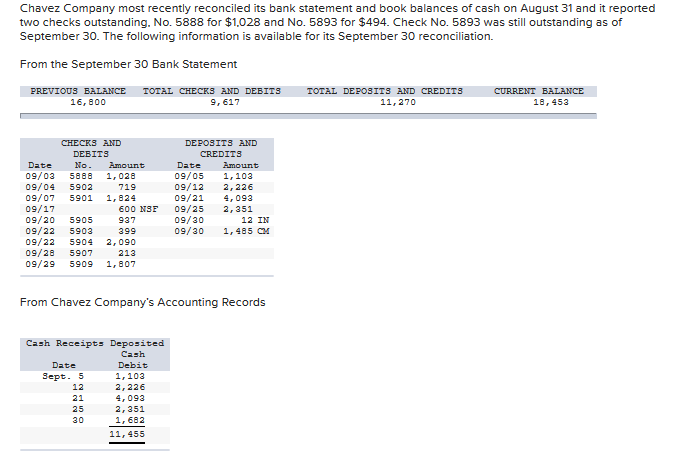

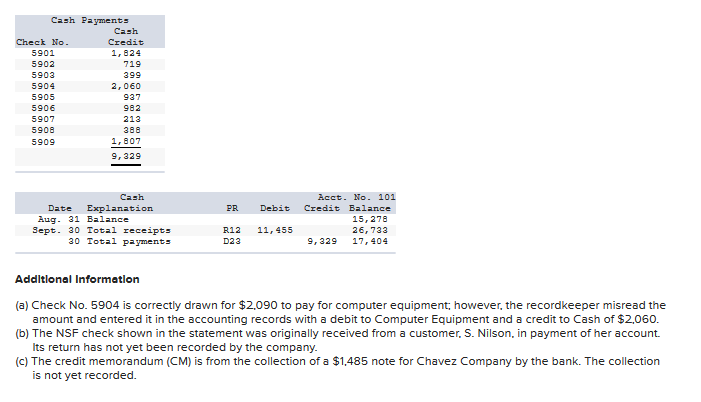

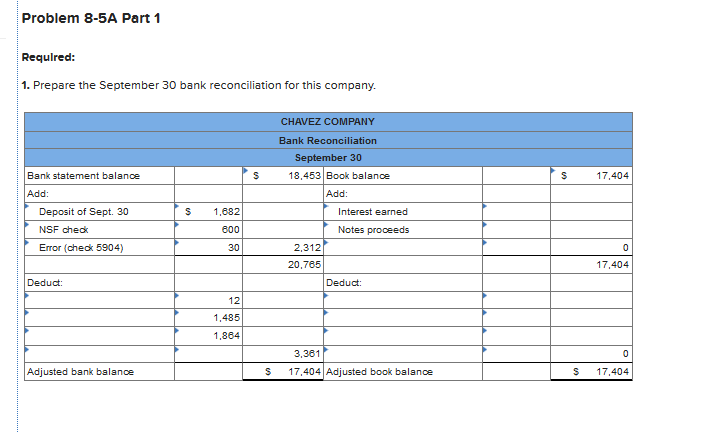

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding. No. 5888 for $1.028 and No. 5893 for $494. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. From the September 30 Bank Statement PREVIOUS BALANCE 16,800 TOTAL CHECKS AND DEBITS 9,617 TOTAL DEPOSITS AND CREDITS 11,270 CURRENT BALANCE 18, 453 CHECKS AND DEBITS Date No. Amount 09/02 5808 1,028 09/04 5902719 09/07 5901 1.824 09/17 600 NSF 09/20 5905 937 09/22 5902 399 09/22 5904 2,090 09/28 5907213 09/29 5909 1,807 DEPOSITS AND CREDITS Date Amount 09/05 1,103 09/12 2,226 09/21 4,092 09/25 2,351 09/30 12 IN 09/30 1,485 CM From Chavez Company's Accounting Records Cash Receipts Deposited Cash Date Debit Sept. 5 1,103 2, 226 4,092 2,351 1,682 11,455 12 Cash Payments Cash Check No. Credit 5901 1,824 5902 719 5902 399 5904 2.060 5905 5906 982 5907 213 5908 388 5909 1,807 9,329 937 PR Cash Date Explanation Aug. 31 Balance Sept. 30 Total receipts 30 Total payments Acct. No. 101 Debit Credit Balance 15,278 11,455 26,733 R12 R12 11.9 9.329 17,404 Additional Information (a) Check No. 5904 is correctly drawn for $2.090 to pay for computer equipment, however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2.060. (b) The NSF check shown in the statement was originally received from a customer. S. Nilson, in payment of her account. Its return has not yet been recorded by the company. (c) The credit memorandum (CM) is from the collection of a $1,485 note for Chavez Company by the bank. The collection is not yet recorded. Problem 8-5A Part 1 Required: 1. Prepare the September 30 bank reconciliation for this company. CHAVEZ COMPANY Bank Reconciliation September 30 18,453 Book balance Bank statement balance s $ 17,404 Add: Add: s Deposit of Sept. 30 NSF check Error (check 5904) 1.682 600 30 Interest earned Notes proceeds 2,3121 20.765 Deduct: Deduct: 1,485 1.864 Adjusted bank balance ank balance 3,381 17,404 Adjusted book balance $ $ 17,404