Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Che Wai Yeung is a self-employed insurance Salesperson. She started her business on January 1, 2023, and ended her first taxation on December 31,

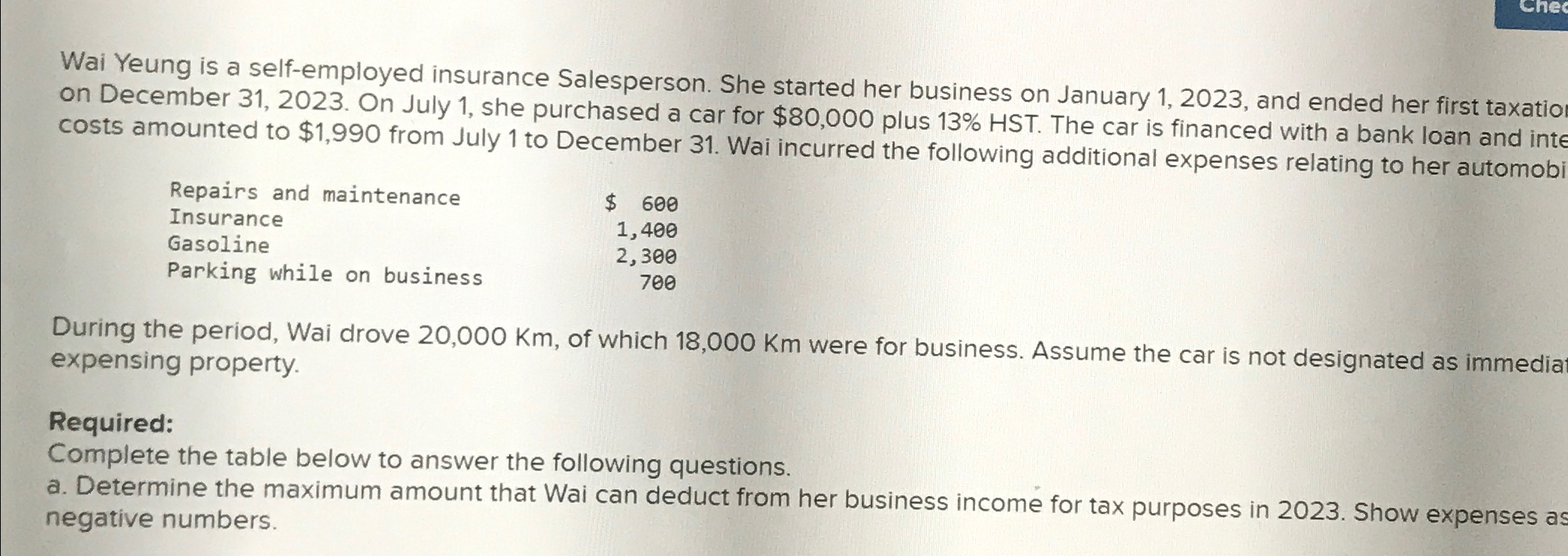

Che Wai Yeung is a self-employed insurance Salesperson. She started her business on January 1, 2023, and ended her first taxation on December 31, 2023. On July 1, she purchased a car for $80,000 plus 13% HST. The car is financed with a bank loan and inte costs amounted to $1,990 from July 1 to December 31. Wai incurred the following additional expenses relating to her automobi Repairs and maintenance Insurance Gasoline Parking while on business $ 600 1,400 2,300 700 During the period, Wai drove 20,000 Km, of which 18,000 Km were for business. Assume the car is not designated as immediat expensing property. Required: Complete the table below to answer the following questions. a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2023. Show expenses as negative numbers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Completing the Kelp Company SplitOff Point Analysis a1 Incremental Benefit Cost of Further Processin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started