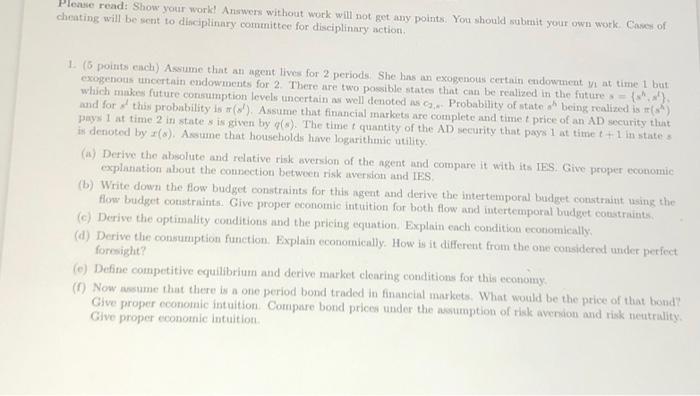

cheating will be sent to difork? Answers without work will not get any points. You should subrnit your own work. Casos of cheating will besent to difiplinary cornmittee for disciplinary action. 1. ( 5 points each) Assume that an agent lives for 2 periods. She has an exogenous certain endowment y1 at time 1 but exogenous uncertain endowments for 2. There are two possible states that can be realized in the future,={sh,xh}. pays 1 at time 2 in state s is given by q(s). The time t quantity of the AD security that pays 1 at time t+1 in state s in denoted by x(s). Assune that households have logarithuic utility. (a) Derive the absolute and relative risk aversion of the agent and compare it with its IFS. Give proper economic explatation about the connection between risk aversion and IES. (b) Write down the flow budget constraints for this agent and derive the intertemporal budget constraitit using the flow budget constraints. Give proper economic intuition for both flow and intertemporal budget constraints. (c) Derive the optimality conditions and the pricing equation. Explain ench condition economleally. (d) Derive the consumption function. Explain economically. How is it different from the one considered under perfect forcsight? (e) Define competitive equilibrium and derive market elearing conditions for this cochomy: (f) Now ansume that there is a one period bond traded in financial maskets. What would be the price of that bond? Give proper economic intuition. Compare bond prices under the assumption of risk avenion and risk neutrality. Give proper econotnic intuition. cheating will be sent to difork? Answers without work will not get any points. You should subrnit your own work. Casos of cheating will besent to difiplinary cornmittee for disciplinary action. 1. ( 5 points each) Assume that an agent lives for 2 periods. She has an exogenous certain endowment y1 at time 1 but exogenous uncertain endowments for 2. There are two possible states that can be realized in the future,={sh,xh}. pays 1 at time 2 in state s is given by q(s). The time t quantity of the AD security that pays 1 at time t+1 in state s in denoted by x(s). Assune that households have logarithuic utility. (a) Derive the absolute and relative risk aversion of the agent and compare it with its IFS. Give proper economic explatation about the connection between risk aversion and IES. (b) Write down the flow budget constraints for this agent and derive the intertemporal budget constraitit using the flow budget constraints. Give proper economic intuition for both flow and intertemporal budget constraints. (c) Derive the optimality conditions and the pricing equation. Explain ench condition economleally. (d) Derive the consumption function. Explain economically. How is it different from the one considered under perfect forcsight? (e) Define competitive equilibrium and derive market elearing conditions for this cochomy: (f) Now ansume that there is a one period bond traded in financial maskets. What would be the price of that bond? Give proper economic intuition. Compare bond prices under the assumption of risk avenion and risk neutrality. Give proper econotnic intuition