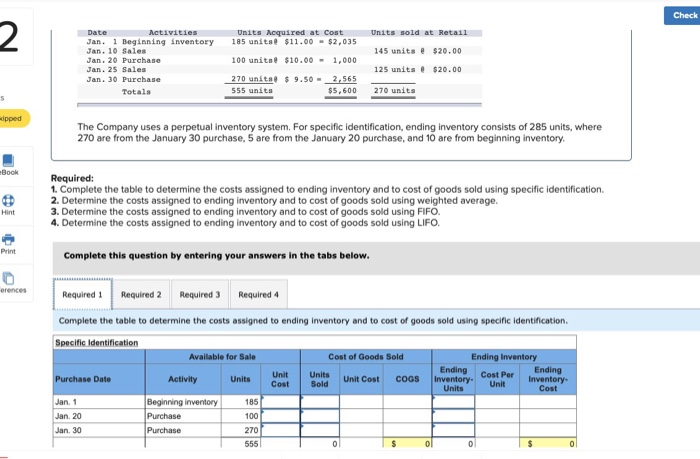

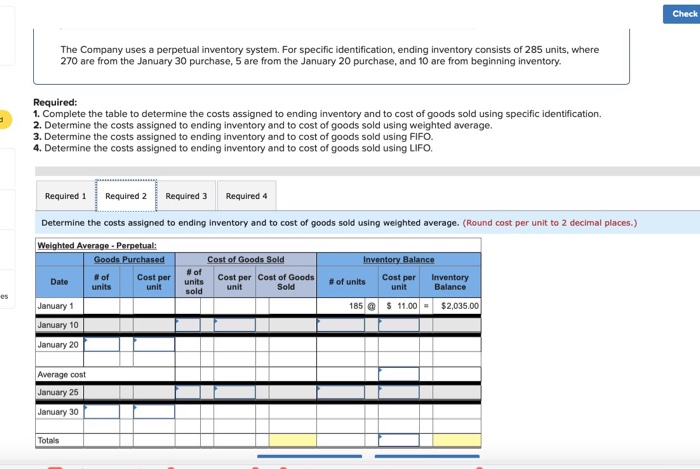

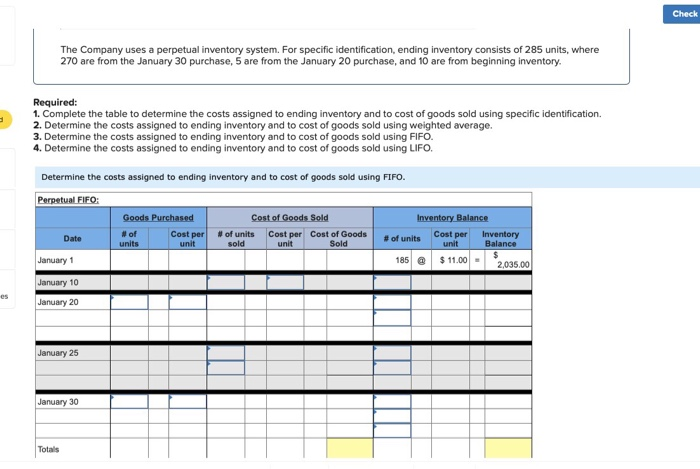

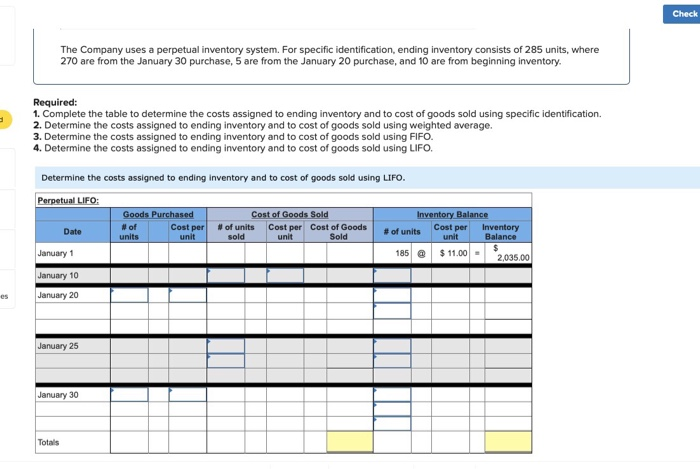

Check 2 Date Activities Units Acquired at Cost 185 unita $11.00 $2,035 Units sold at Retail 1 Beginning inventory Jan 145 units e $20.00 Jan. 10 Sales Jan. 20 Purchase Jan, 25 Sales 100 units $10.00 1,000 125 units $20.00 270 units@$ 9.50 Jan. 30 Purchase 2,565 270 units 555 units $5,600 Totals ipped The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where 270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory. Book Required: 1. Complete the table to determine the costs assigned to ending inventory and to cost of goods sold using specific identification. 2. Determine the costs assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Hint Print Complete this question by entering your answers in the tabs below. erences Required 1 Required 2 Required 3 Required 4 Complete the table to determine the costs assigned to ending inventory and to cost of goods sold using specific identification. Specific Identification Cost of Goods Sold Ending Inventory Available for Sale Ending Inventory Ending Inventory Cost Unit Units Cost Per Purchase Date Activity Units Unit Cost COGS Cost Sold Unit Units Beginning inventory Purchase Purchase Jan. 1 185 Jan. 20 100 Jan. 30 270 555 0 0 Check The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where 270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory. Required: 1. Complete the table to determine the costs assigned to ending inventory and to cost of goods sold using specific identification. 2. Determine the costs assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO Required 1 Required 2 Required 3 Required 4 Determine the costs assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average-Perpetual: Inventory Balance Goods Purchased Cost of Goods Sold #of # of units Cost per Cost of Goods unit Cost per Cost per unit Inventory Balance Date # of units units. sold Sold unit es $11.00 January 1 $2,035.00 185 January 10 January 20 Average cost January 25 January 30 Totals Check The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where 270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory. Required: 1. Complete the table to determine the costs assigned to ending inventory and to cost of goods sold using specific identification. 2. Determine the costs assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased Cost of Goods Sold Inventory Balance # of units sold # of Cost per unit Cost per unit Cost of Goods Sold Cost per unit Inventory Balance Date #of units units 185@ $11.00 January 1 2,035.00 January 10 es January 20 January 25 January 30 Totals Check The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 285 units, where 270 are from the January 30 purchase, 5 are from the January 20 purchase, and 10 are from beginning inventory. Required: 1. Complete the table to determine the costs assigned to ending inventory and to cost of goods sold using specific identification. 2. Determine the costs assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Perpetual LIFO: Goods Purchased Cost of Goods Sold Inventory Balance # of units Cost per unit # of units sold Cost per unit Cost of Goods Sold Cost per unit Inventory Balance Date #of units 185 $11.00 January 1 2,035.00 January 10 January 20 es January 25 January 30 Totals