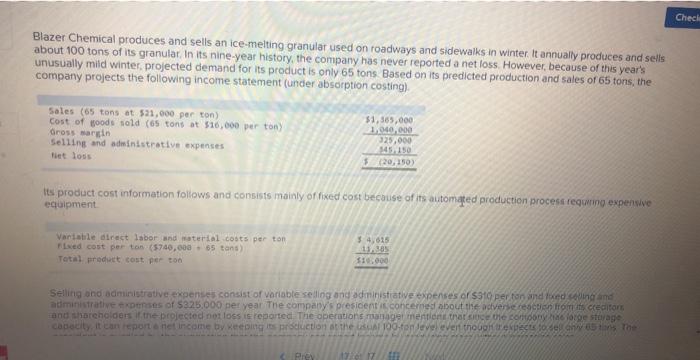

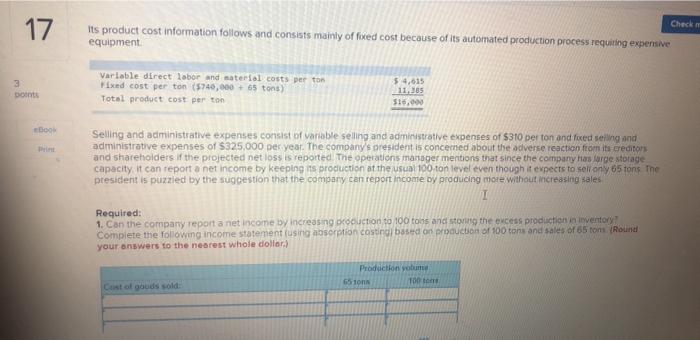

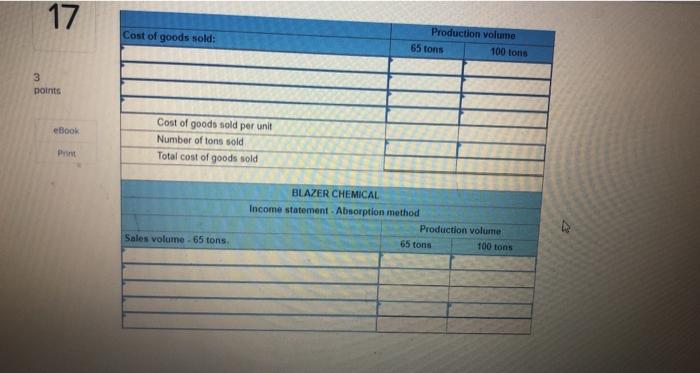

Check Blazer Chemical produces and sells an ice-melting granular used on roadways and sidewalks in winter. It annually produces and sells about 100 tons of its granular. In its nine-year history, the company has never reported a net loss. However, because of this year's unusually mild winter projected demand for its product is only 65 tons Based on its predicted production and sales of 65 tons, the company projects the following income statement (under absorption costing) Sales (65 tons at 521,000 per ton) Cost of woods sold (65 tons at $10,000 per tony Gross sarcin Selling and administrative expenses tiet loss $1,565,000 1,040,000 325,000 545 150 $(20,250) its product cost information follows and consists mainly of fixed cost because of its automated production process requiring expensive equipment 3.4,625 Variable direct labor and material costs per ton Fixed cost per ton (5740,000 -65 tans) Total product cost per to $10.000 Selling and administrative expenses consist of variable selling and administrative expenses of 5310 perton and fixed wing and administrative tense of $325,000 per year. The company's president is concerned about the adverse reaction is creditors and shareholders if the projected not loss is reported the operations manager mention that is le como forge storage capacity, it can spontane income by keong its production at the 100 tonlever even thouontre este to sell was the Pre 177 17 Check Its product cost information follows and consists mainly of fixed cost because of its automated production process requirting expensive equipment 3 points Variable direct labor and material costs per ton Fixed cost per ton (5745,000+ 65 tons) Total product cost per ton 5.4,615 11.305 516,00 Door Selling and administrative expenses consist of variable selling and administrative expenses of $310 per ton and foxed selling and administrative expenses of $325,000 per year. The company's president is concerned about the adverse reaction from its creditors and Shareholders if the projected netloss is reported the operations manager mentions that since the company has farge storage capacity, it can report a net income by keeping its production at the usual 100 ton level even though it expects to sell any 65 tons The president is puzzled by the suggestion that the company can report Income by producing more without increasing sales 1 Required: 1. Can the company report a net income by increasing koouction to 100 tons and song the excess production in inventory Complete the following income statement using absorption costi di based on production of 100 tons and sales of 65 tom (Round your answers to the nearest whole dollor.) Production you 65 tons TO Cost of goods sold: 17 Cost of goods sold: Production volume 65 tons 100 tons 3 points eBook Cost of goods sold per unit Number of tons sold Total cost of goods sold Print BLAZER CHEMICAL Income statement. Absorption method Production volume 65 tons 100 tons Sales volume - 65 tons