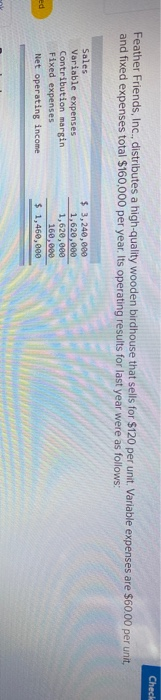

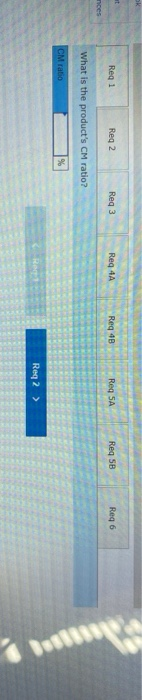

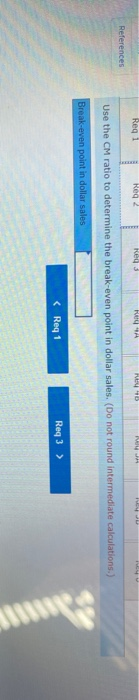

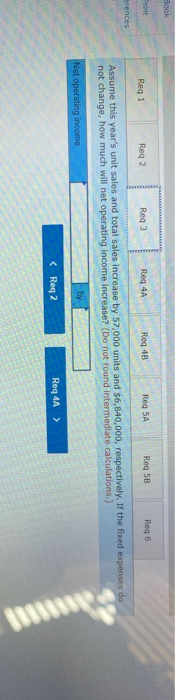

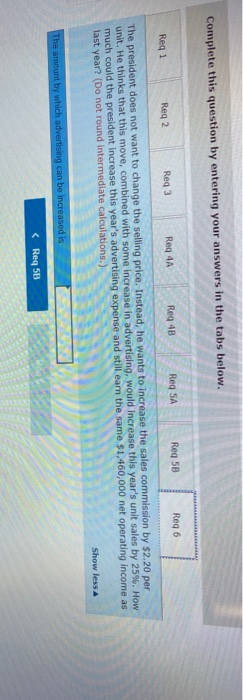

Check Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $120 per unit Variable expenses are $60.00 per unit, and fixed expenses total $160,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 3,240,000 1,620,000 1,620,000 160,000 $ 1,460,000 SK Reg 1 Reg 2 Reg 3 Reg 4 Reg 48 Reg SA Reg SB Reg 6 nces What is the product's CM ratio? CM ratio % Re Req 2 > Reg 2 Regi Red RA M HEY. References Use the CM ratio to determine the break-even point in dollar sales. (Do not round intermediate calculations.) Break-even point in dollar sales Book Print Reg 2 Reg 1 Reg 3 Reg 4 Reg 4B Reg 5A Reg 6 Reg 58 erences Assume this year's unit sales and total sales increase by 57,000 units and $6,840,000, respectively. If the fixed expenses do not change, how much will net operating income increase? (Do not round intermediate calculations.) Net operating income Reg 48 Reg SA Reg 6 Reg 3 Reg 58 Req 4A Reg 1 Reg 2 What is the degree of operating leverage based on last year's sales? (Round intermediate calculations and final answers to 2 decimal places.) Degree of operating leverage Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Req 4A Reg 4B Req 5A Reg SB Reg 6 Assume the president expects this year's unit sales to increase by 10%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year? (Round intermediate tions and final answer to 2 decimal places.) Net operating income increases by % Complete this question by entering your answers in the tabs below. Reg 5B Reg 6 Reg SA Reg 4 Reg 3 Reg 2 Reg 1 Reg 4 The sales manager is convinced that a 14% reduction in the selling price, combined with a $73,000 increase in advertising, would increase this year's unit sales by 25%. If the sales manager is right, what would be this year's net operating income his ideas are implemented? (Do not round Intermediate calculations.) Net operating income (loss) Complete this quesuun y Reg 6 Reg 5B Reg SA Reg 4B Reg 4A Reg 3 Reg 2 Reg 1 The sales manager is convinced that a 14% reduction in the selling price, combined with a $73,000 increase in advertising, would increase this year's unit sales by 25%. If the sales manager's ideas are implemented, how much erating income increase or decrease over last year? (Negative amounts should be input with a minus sign.) Increase (decrease) to net operating income Complete this question by entering your answers in the tabs below. Reg 6 Reg SA Reg 5B Reg 4 Reg 4B Reg 2 Reg 3 Reg 1 The president does not want to change the selling price. Instead, he wants to increase the sales commission by $2.20 per unit. He thinks that this move, combined with some increase in advertising, would increase this year's unit sales by 25%. How much could the president increase this year's advertising expense and still earn the same $1,460,000 net operating income as last year? (Do not round intermediate calculations.) Show less The amount by which advertising can be increased is