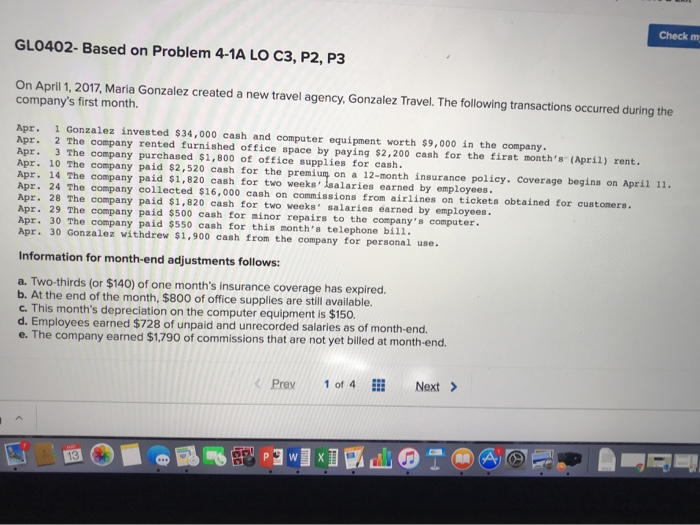

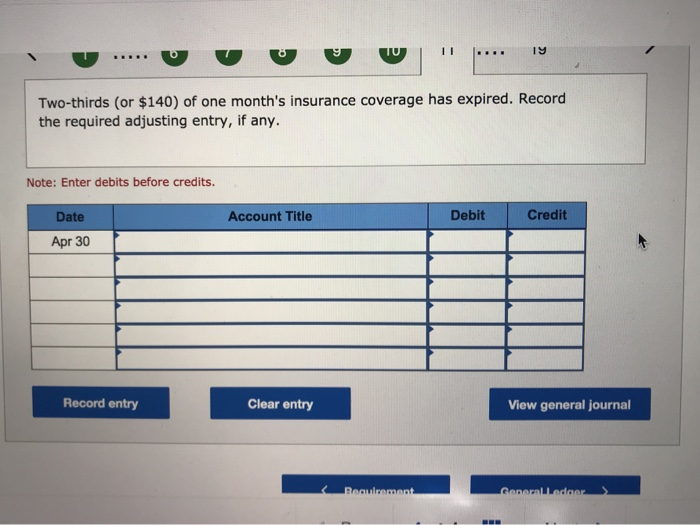

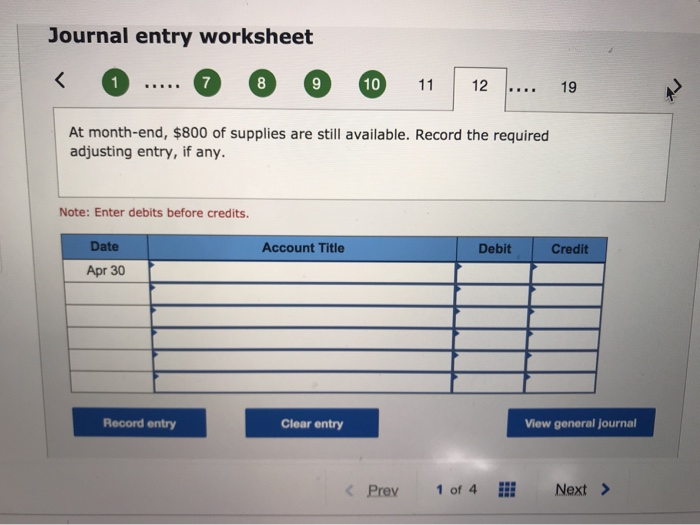

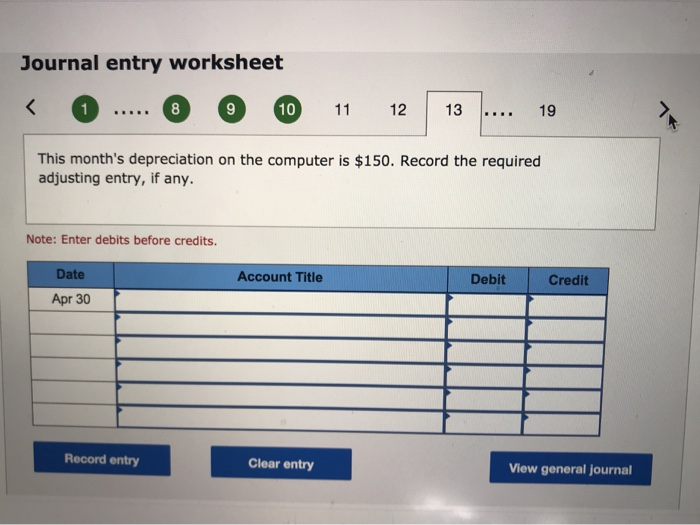

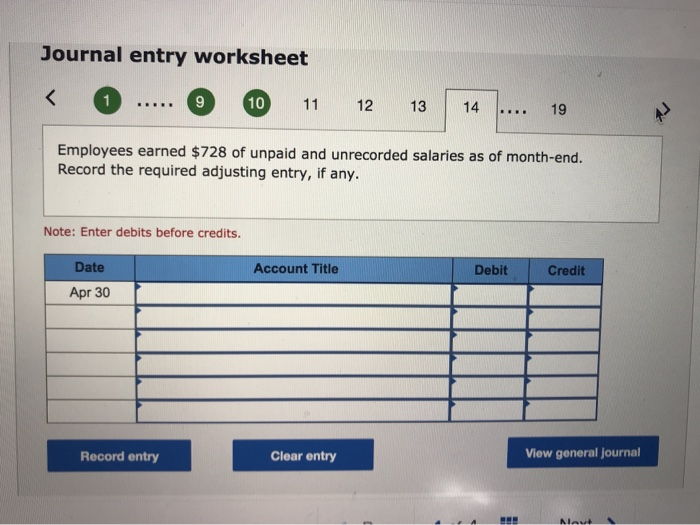

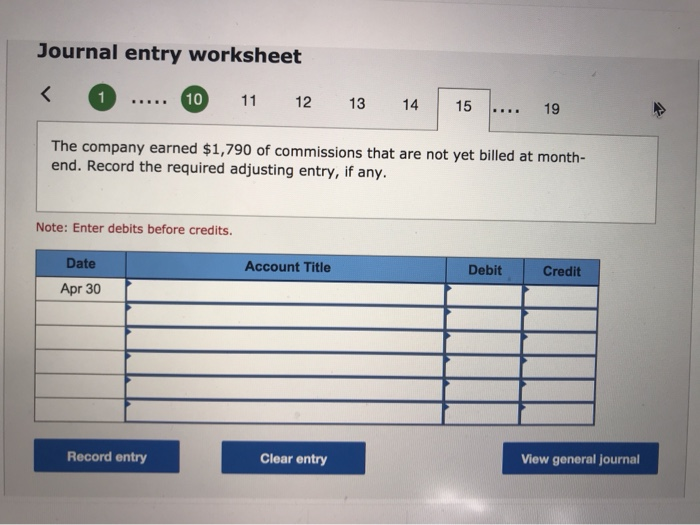

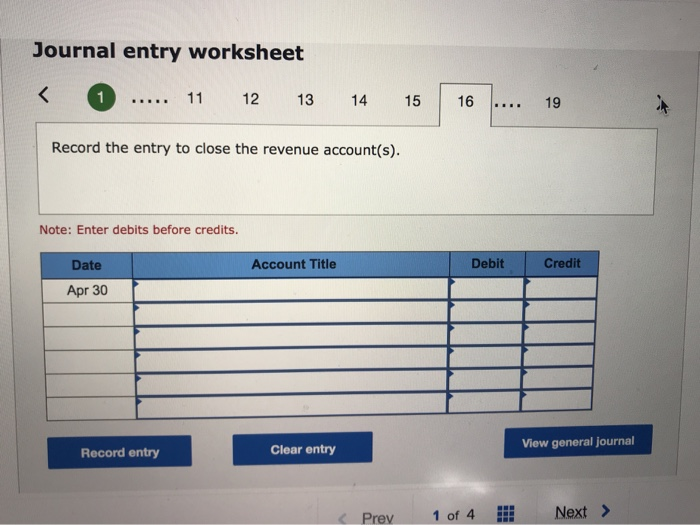

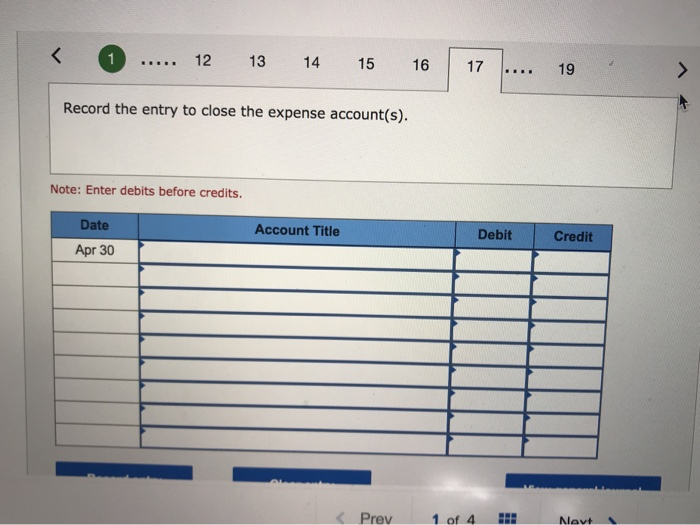

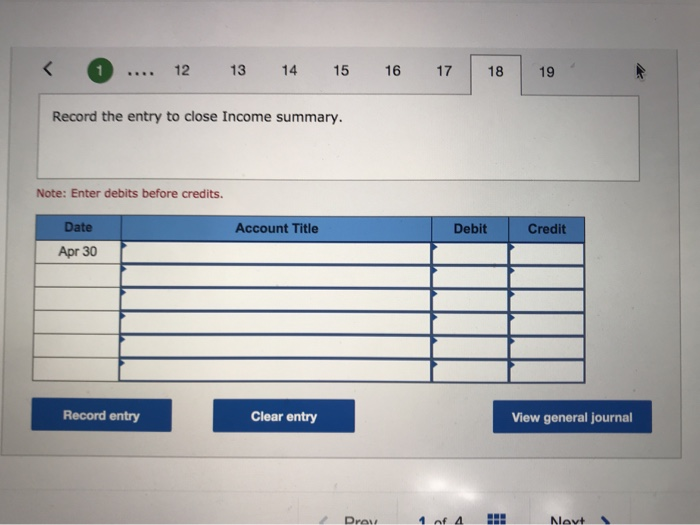

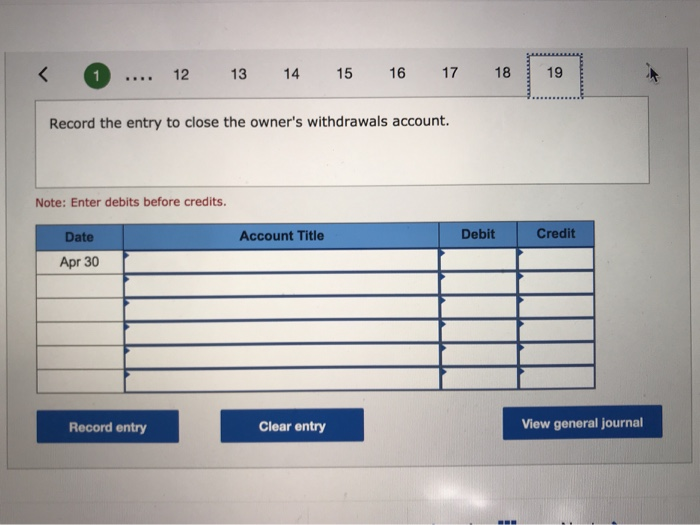

Check m GLO402- Based on Problem 4-1A LO C3, P2, P3 On April 1, 2017, Maria Gonzalez created a new travel agency, Gonzalez Travel. The following transactions occurred during the company's first month Apr. 1 Gonzalez invested $34,000 cash and computer equipment worth $9,000 in the company. Apr. 2 The company rented furnished office space by paying $2,200 cash for the first month's (April) rent. Apr. 3 The company purchased $1,800 of office supplies for cash. Apr. 10 The company paid $2,520 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $1,820 cash for two weeks' Isalaries earned by employees Apr. 24 The company collected $16,000 cash on commissions from airlines on tickets obtained for custoners. Apr. 28 The company paid $1,820 cash for two weeks' salaries earned by employees Apr. 29 The company paid $500 cash for minor repairs to the company's computer. Apr. 30 The company paid $550 cash for this month's telephone bil1. Apr. 30 Gonzalez withdrew $1,900 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $140) of one month's insurance coverage has expired. b. At the end of the month, $800 of office supplies are still available. c. This month's depreciation on the computer equipment is $150. d. Employees earned $728 of unpaid and unrecorded salaries as of month-end. e. The company earned $1.790 of commissions that are not yet billed at month-end. Next> Prev 1 ot Two-thirds (or $140) of one month's insurance coverage has expired. Record the required adjusting entry, if any. Note: Enter debits before credits. Debit Credit Date Account Title Apr 30 Record entry Clear entry View general journal Journal entry worksheet 11 12.. 19 10 7 At month-end, $800 of supplies are still available. Record the required adjusting entry, if any. Note: Enter debits before credits. Debit Credit Account Title Date Apr 30 View general journal Clear entry Record entry Prev 1 of 4 ll Next> Journal entry worksheet 19 1... 8 9 10 11 12 1319 10 11 12 13 This month's depreciation on the computer is $150. Record the required adjusting entry, if any. Note: Enter debits before credits Credit Debit Account Title Date Apr 30 Record entry View general journal Clear entry Journal entry worksheet K 0 11 12 13119 10 Employees earned $728 of unpaid and unrecorded salaries as of month-end. Record the required adjusting entry, if any Note: Enter debits before credits. Date Account Title Credit Debit Apr 30 View general journal Record entry Clear entry Journal entry worksheet 12 13 1415.. 19 10 The company earned $1,790 of commissions that are not yet billed at month- end. Record the required adjusting entry, if any. Note: Enter debits before credits. Credit Debit Account Title Date Apr 30 View general journal Clear entry Record entry Journal entry worksheet 11 12 13 14 15 16 19 Record the entry to close the revenue account(s). Note: Enter debits before credits. Debit Account Title Credit Date Apr 30 View general journal Clear entry Record entry Prev1 of 4l Next > 12 13 14 15 16 17 19 Record the entry to close the expense account(s) Note: Enter debits before credits. Date Account Title Debit Credit Apr 30 1 of 4 C Prev ....12 13 14 15 16 17 18 19 Record the entry to close Income summary. Note: Enter debits before credits. Date Debit Credit Account Title Apr 30 Record entry Clear entry View general journal Dras .. 12 13 14 15 16 17 18 19 Record the entry to close the owner's withdrawals account. Note: Enter debits before credits. Debit Credit Account Title Date Apr 30 View general journal Clear entry Record entry