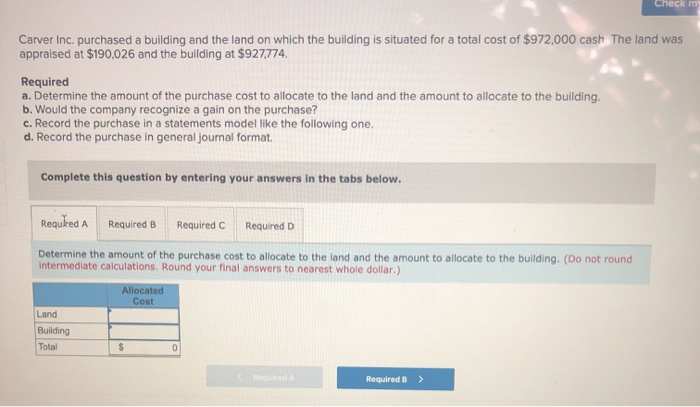

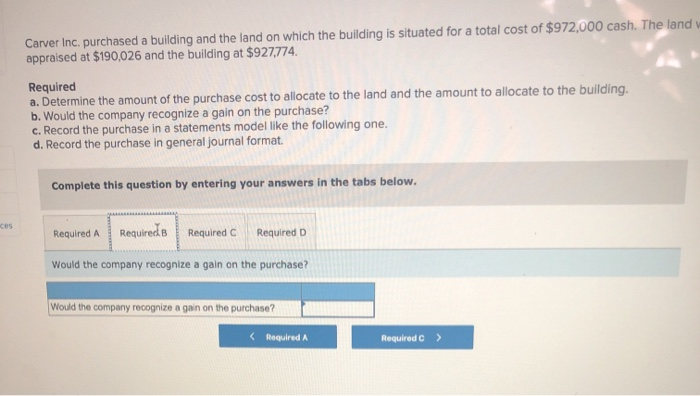

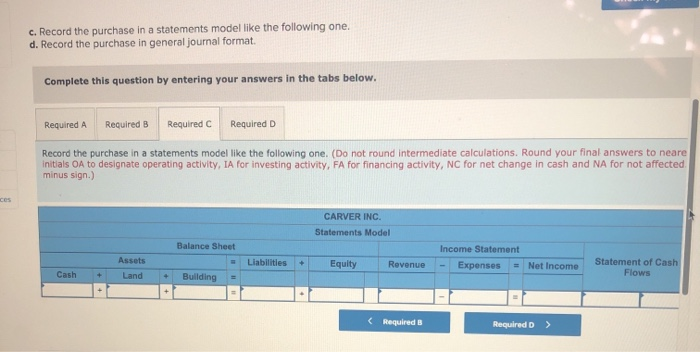

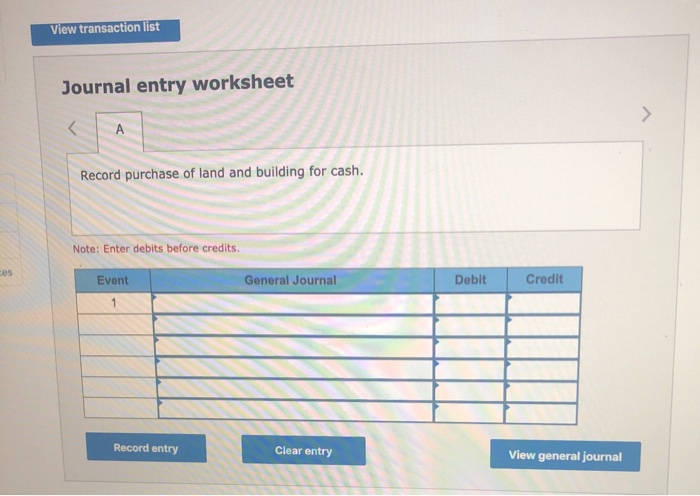

Check my Carver Inc. purchased a building and the land on which the building is situated for a total cost of $972,000 cash The land was appraised at $190,026 and the building at $927,774. Required a. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. b. Would the company recognize a gain on the purchase? c. Record the purchase in a statements model like the following one. d. Record the purchase in general journal format Complete this question by entering your answers in the tabs below. Required B Required c Required D Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building Total Required B > Carver Inc. purchased a building and the land on which the building is situated for a total cost of $972,000 cash. The land appraised at $190,026 and the building at $927,774 Required a. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. b. Would the company recognize a gain on the purchase? c. Record the purchase in a statements model like the following one. d. Record the purchase in general journal format. Complete this question by entering your answers in the tabs below. 25 Required A Required. Required C Required D Would the company recognize a gain on the purchase? Would the company recognize a gain on the purchase? Required A Required c > c. Record the purchase in a statements model like the following one. d. Record the purchase in general journal format. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Record the purchase in a statements model like the following one. (Do not round intermediate calculations. Round your final answers to neare initials OA to designate operating activity, IA for investing activity, FA for financing activity, NC for net change in cash and NA for not affected minus sign.) CARVER INC. Statements Model Balance Sheet Assets Land Income Statement - Expenses = Net Income Liabilities - Equity Revenue Cash - Statement of Cash Flows - Building View transaction list Journal entry worksheet Record purchase of land and building for cash. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal