Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check my Matt and Carrie are married, have two children, and file a joint return. Their daughter Katie is 19 years old and is a

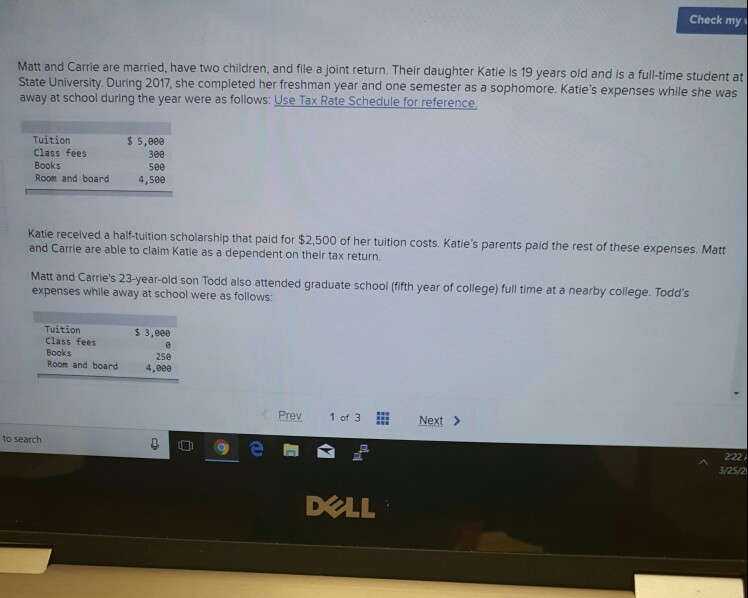

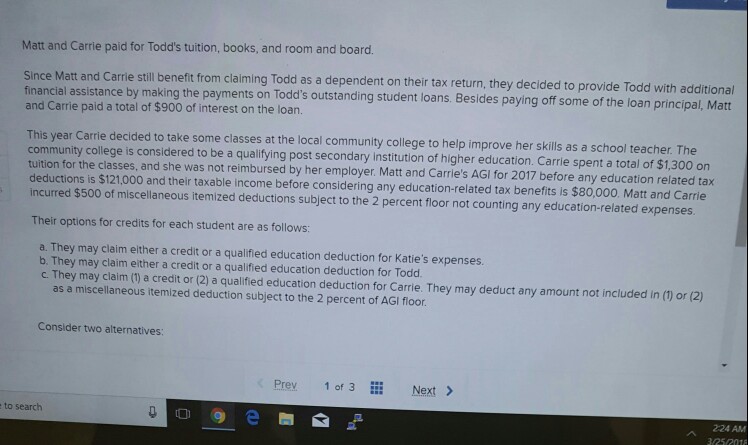

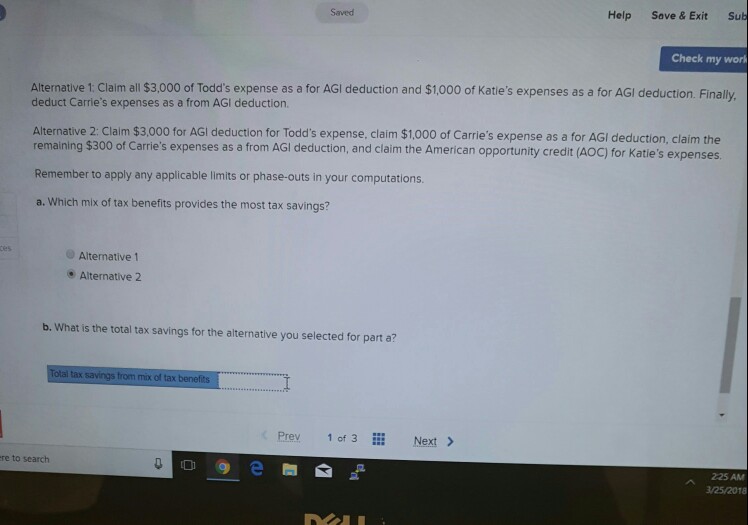

Check my Matt and Carrie are married, have two children, and file a joint return. Their daughter Katie is 19 years old and is a full-time st State University. During 2017, she completed her freshman year and one semester as a sophomore. Katie's expenses while she wa away at school during the year were as follows: Use Tax Rate Schedule for reference udent at Tuition Class fees Books Room and board $ 5,800 ??? 580 4,580 Katie received a haif-tuition scholarship that paid for $2,500 of her tuition costs. Katie's parents paid the rest of these expenses and Carrie are able to claim Katie as a dependent on their tax return. Mat and Carie's 23-year-old son Tod also attended graduate school fith year of college) ful time at a nearby college. Todd's expenses while away at school were as follows: Tuition Class fees Books Room and board $ 3,800 256 4,800 Prev 1 of 3 Next> to search 2:22 3/25/2 DLL Check my Matt and Carrie are married, have two children, and file a joint return. Their daughter Katie is 19 years old and is a full-time st State University. During 2017, she completed her freshman year and one semester as a sophomore. Katie's expenses while she wa away at school during the year were as follows: Use Tax Rate Schedule for reference udent at Tuition Class fees Books Room and board $ 5,800 ??? 580 4,580 Katie received a haif-tuition scholarship that paid for $2,500 of her tuition costs. Katie's parents paid the rest of these expenses and Carrie are able to claim Katie as a dependent on their tax return. Mat and Carie's 23-year-old son Tod also attended graduate school fith year of college) ful time at a nearby college. Todd's expenses while away at school were as follows: Tuition Class fees Books Room and board $ 3,800 256 4,800 Prev 1 of 3 Next> to search 2:22 3/25/2 DLL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started