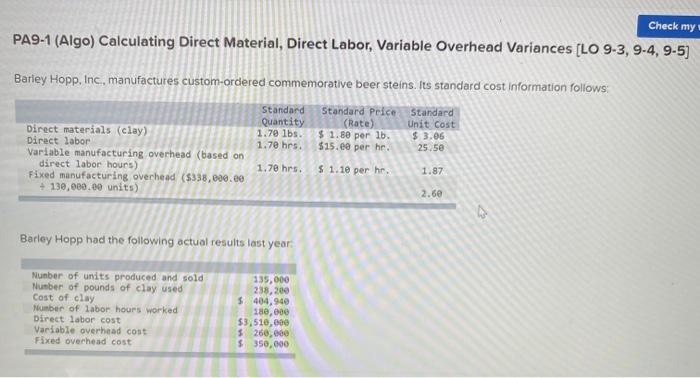

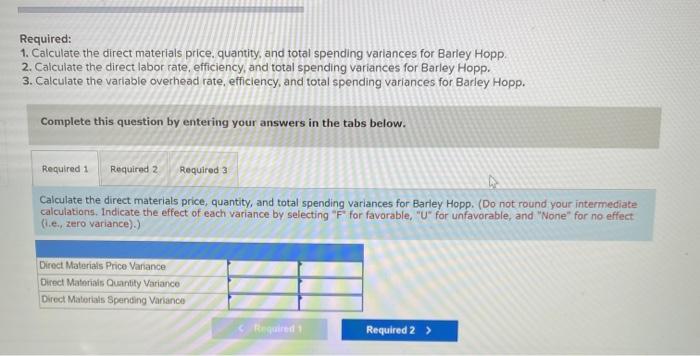

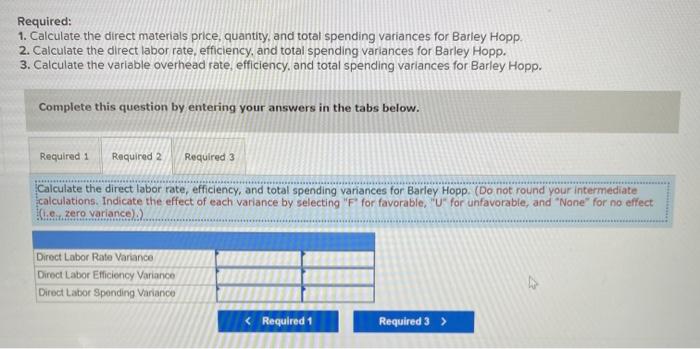

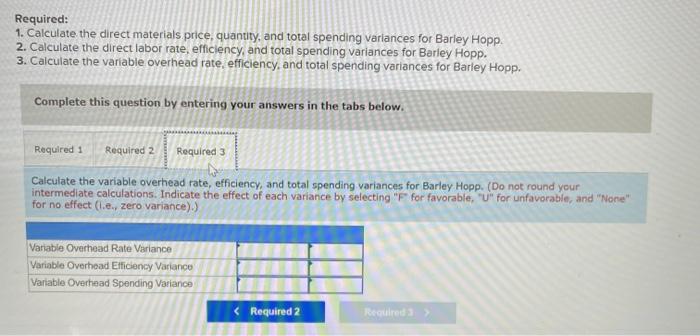

Check my PA9-1 (Algo) Calculating Direct Material, Direct Labor, Variable Overhead Variances (LO 9-3, 9-4, 9-5) Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost information follows: Standard Standard Price Standard Quantity (Rate) Unit Cost Direct materials (clay) 1.70 lbs. $ 1.80 per lb. $ 3.06 Direct labor 1.70 hrs. $15.00 per hr 25.5e Variable manufacturing overhead (based on direct labor hours) 1.70 hrs. $ 1.10 per hr 1.87 Fixed manufacturing overhead (5338,000.00 + 130,000.00 units) 2.60 Barley Hopp had the following actual results last year Number of units produced and sold Number of pounds of clay used Cost of clay Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 135,000 238,200 $ 404,940 180,000 $3,510,000 $ 260,000 $ 350,000 Required: 1. Calculate the direct materials price. quantity, and total spending variances for Barley Hopp. 2. Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp. 3. Calculate the variable overhead rate, efficiency, and total spending variances for Barley Hopp. Complete this question by entering your answers in the tabs below. Required 1. Required 2 Required 3 Calculate the direct materials price, quantity, and total spending variances for Barley Hopp. (Do not round your intermediate calculations, Indicate the effect of each variance by selecting F for favorable, "U" for unfavorable, and "Mone" for no effect (.e., zero variance).) Direct Materials Price Varance Direct Materials Quantity Variance Direct Materials Spending Variance Required Required 2 > Required: 1. Calculate the direct materials price, quantity, and total spending variances for Barley Hopp. 2. Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp. 3. Calculate the variable overhead rate, efficiency, and total spending variances for Barley Hopp. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp. (Do not round your intermediate calculations. Indicate the effect of each variance by selecting "F* for favorable, "U" for unfavorable, and "None" for no effect ...zero variance). Direct Labor Rate Varance Direct Labor Efficiency Variance Direct Lisbor Spending Variance Required: 1. Calculate the direct materials price, quantity, and total spending variances for Barley Hopp. 2. Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp. 3. Calculate the variable overhead rate, efficiency, and total spending variances for Barley Hopp. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Calculate the variable overhead rate, efficiency, and total spending variances for Barley Hopp. (Do not round your intermediate calculations. Indicate the effect of each variance by selecting "F for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Variable Overhead Rate Variance Variable Overhead Efficiency Variance Variable Overhead Spending Variance