Answered step by step

Verified Expert Solution

Question

1 Approved Answer

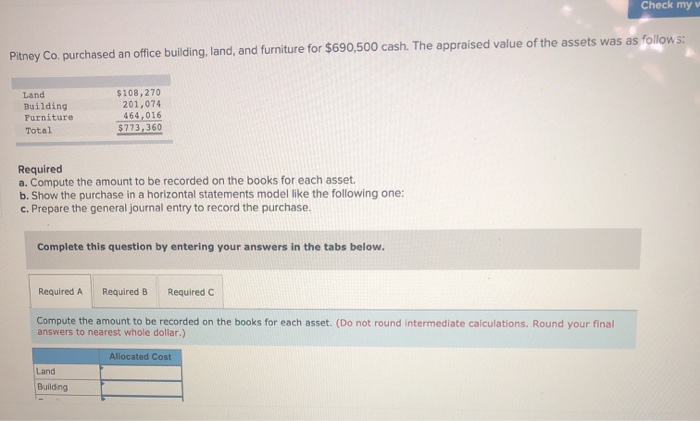

Check my v Pitney Co. purchased an office building, land, and furniture for $690,500 cash. The appraised value of the assets was as follows: Land

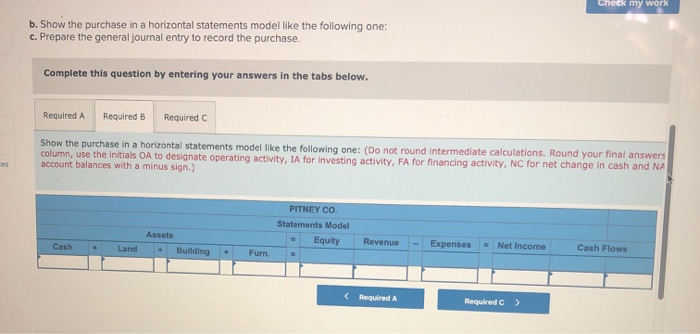

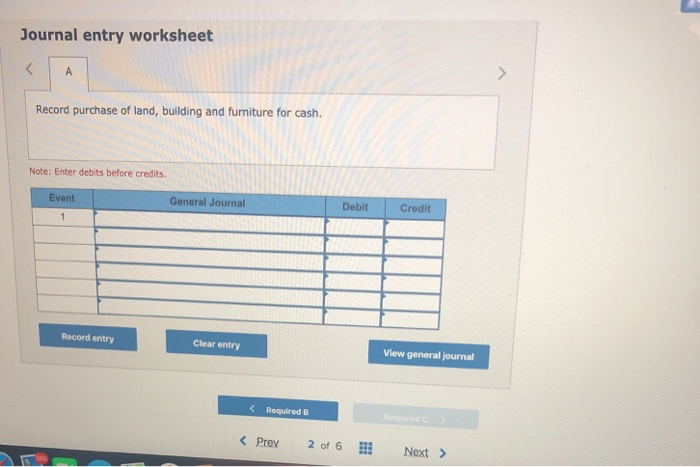

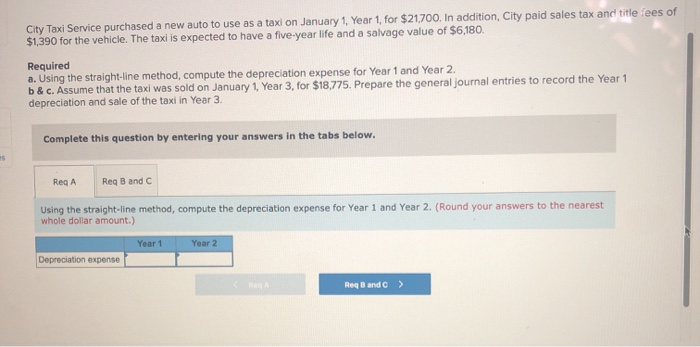

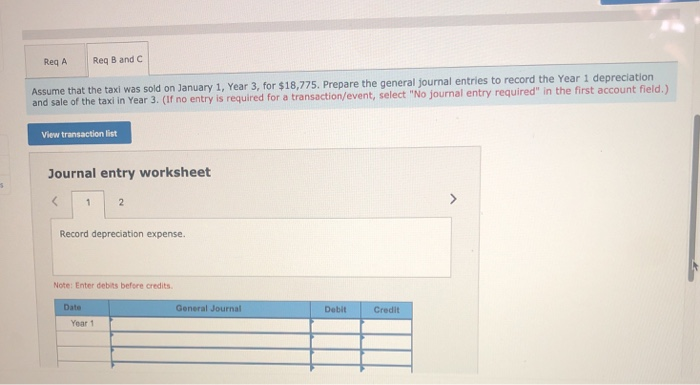

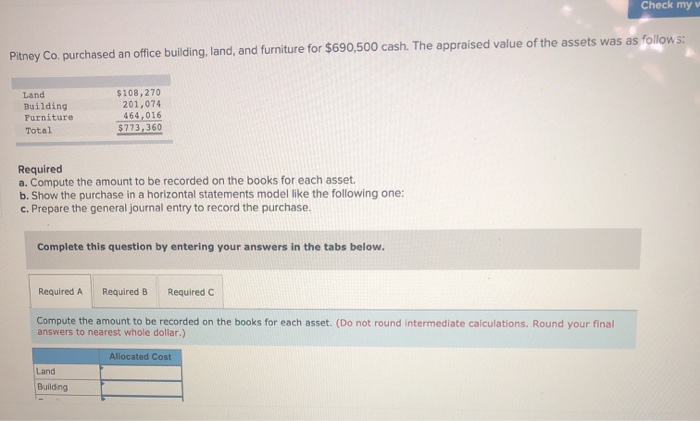

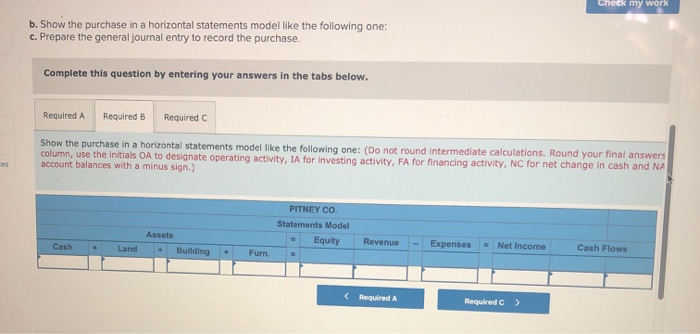

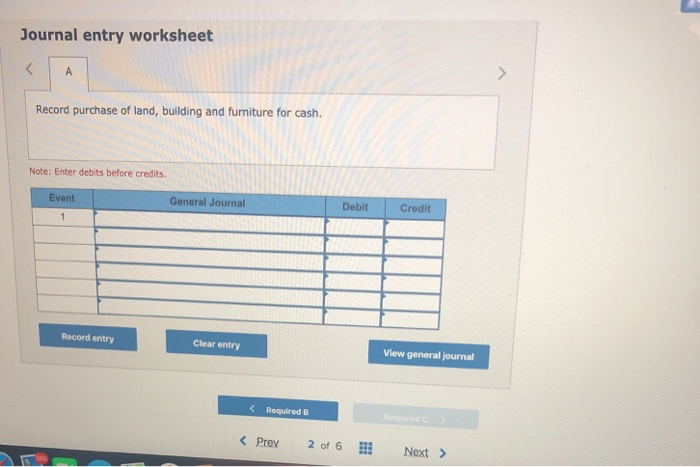

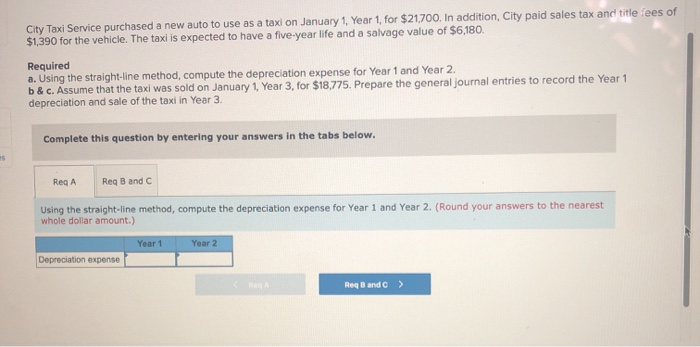

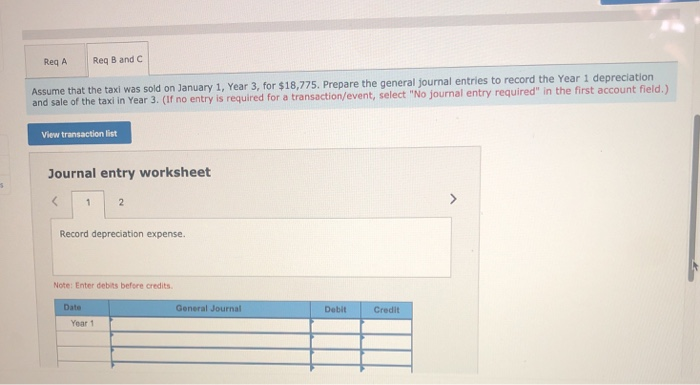

Check my v Pitney Co. purchased an office building, land, and furniture for $690,500 cash. The appraised value of the assets was as follows: Land Building Furniture Total $108,270 201.074 464,016 $ 773,360 Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model like the following one: c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building b. Show the purchase in a horizontal statements model like the following one: c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required Show the purchase in a horizontal statements model like the following one: (Do not round intermediate calculations. Round your final answers column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, NC for net change in cash and NA account balances with a minus sign.) PITNEY CO Statements Model Equity Revenue - Expenses Net Income Cash Flows Cash - Land + Building + Furn. City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $21,700. In addition, City paid sales tax and title fees of $1,390 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,180. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2 b&c. Assume that the taxi was sold on January 1 Year 3, for $18.775. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs below. Rega Reg B and C Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) Year 1 Year 2 Depreciation expense Req Band > Req A Req B and C Assume that the taxi was sold on January 1, Year 3, for $18,775. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record depreciation expense. Note: Enter debits before credits Date General Journal Debit Credit Year 1

Check my v Pitney Co. purchased an office building, land, and furniture for $690,500 cash. The appraised value of the assets was as follows: Land Building Furniture Total $108,270 201.074 464,016 $ 773,360 Required a. Compute the amount to be recorded on the books for each asset. b. Show the purchase in a horizontal statements model like the following one: c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the amount to be recorded on the books for each asset. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Allocated Cost Land Building b. Show the purchase in a horizontal statements model like the following one: c. Prepare the general journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required A Required B Required Show the purchase in a horizontal statements model like the following one: (Do not round intermediate calculations. Round your final answers column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, NC for net change in cash and NA account balances with a minus sign.) PITNEY CO Statements Model Equity Revenue - Expenses Net Income Cash Flows Cash - Land + Building + Furn. City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $21,700. In addition, City paid sales tax and title fees of $1,390 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,180. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2 b&c. Assume that the taxi was sold on January 1 Year 3, for $18.775. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs below. Rega Reg B and C Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) Year 1 Year 2 Depreciation expense Req Band > Req A Req B and C Assume that the taxi was sold on January 1, Year 3, for $18,775. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record depreciation expense. Note: Enter debits before credits Date General Journal Debit Credit Year 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started