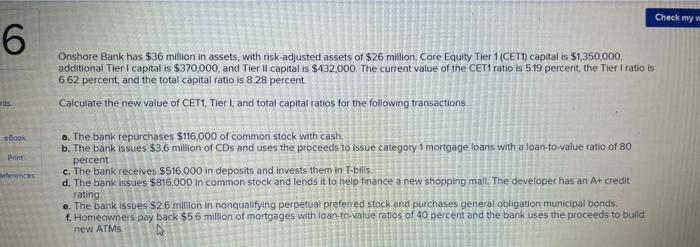

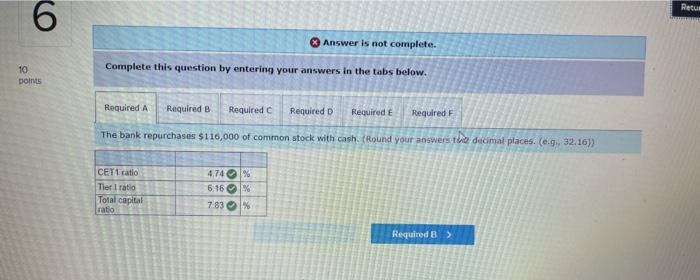

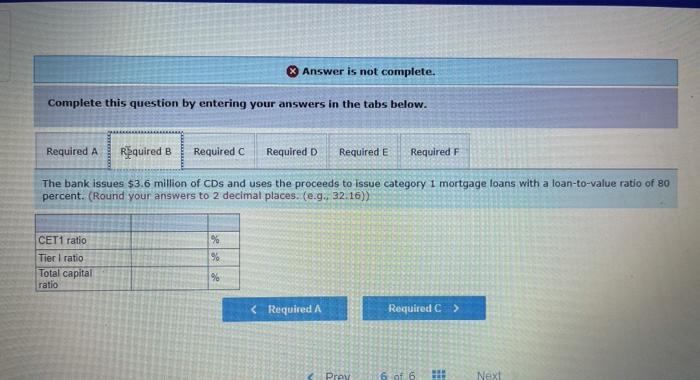

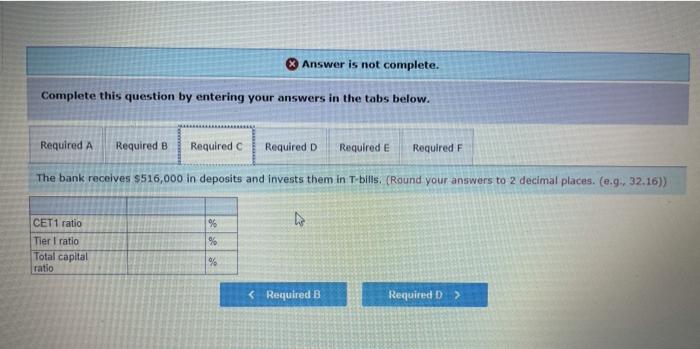

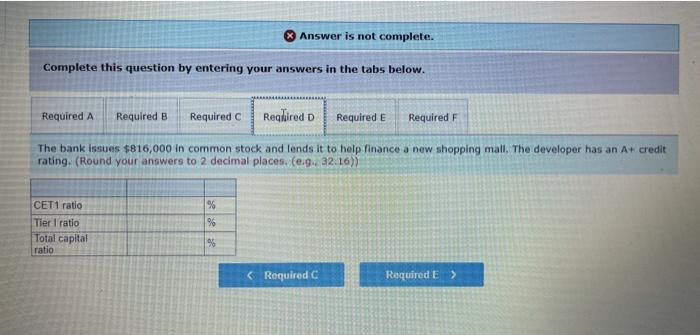

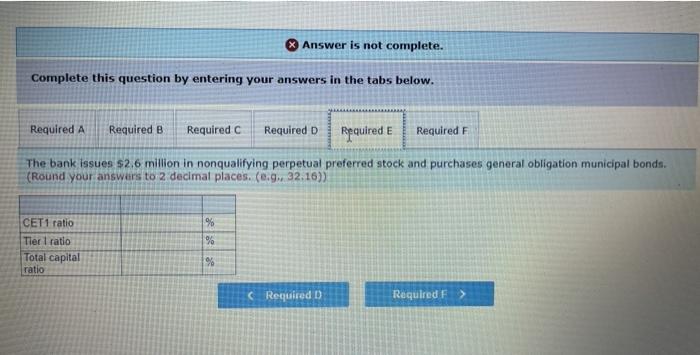

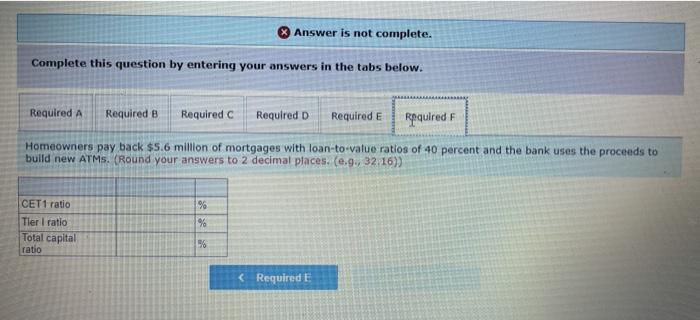

Check my w 6 Onshore Bank has $36 million in assets, with risk-adjusted assets of $26 million Core Equity Tier 1 (CET1) capital is $1,350,000, additional Tier I capital is $370,000, and Tier Il capital is $432,000. The current value of the CET1 ratio is 5.19 percent, the Tier I ratio is 6.62 percent, and the total capital ratio is 8 28 percent Calculate the new value of CET1 Tier I, and total capital ratios for the following transactions Book Print rences a. The bank repurchases $116,000 of common stock with cash b. The bank issues $3.6 million of CDs and uses the proceeds to issue category 1 mortgage loans with a loan-to-value ratio of 80 percent c. The bank receives $516,000 in deposits and invests them in Tbilis d. The bank issues $816,000 in common stock and lends it to help finance a new shopping mall. The developer has an A+ credit rating e. The bank issues $26 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds f. Homeowners pay back $56 milion of mortgages with loan-to-value ratio of 40 percent and the bank uses the proceeds to build new ATMs Retur 6 Answer is not complete. 10 points Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required The bank repurchases $116,000 of common stock with cash (Round your answers the decimal places. (0.9., 32.16) CET1 ratio Tier I ratio Total capital ratio 4.74% 6.16% 7.83% Required 8) Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F The bank issues $3.6 million of CDs and uses the proceeds to issue category 1 mortgage loans with a loan-to-value ratio of 80 percent. (Round your answers to 2 decimal places. (e.g. 32.16)) % 9 CET1 ratio Tier I ratio Total capital ratio % Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Reghired D Required E Required F The bank issues $816,000 in common stock and lends it to help finance a new shopping mall. The developer has an A+ credit rating. (Round your answers to 2 decimal places. (eg 32.16)) % CET1 ratio Tier I ratio Total capital ratio 1% Required Required E> & Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required The bank issues s2.6 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds. (Round your answers to 2 decimal places. (eg, 32.16) % % CET 1 ratio Tier I ratio Total capital ratio % (Required D Required F > Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F Homeowners pay back $5.6 million of mortgages with loan-to-value ratio of 40 percent and the bank uses the proceeds to build new ATMs. (Round your answers to 2 decimal places. (e.9., 32.16)) % CET1 ratio Tier I ratio Total capital ratio % 16