Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check my we The following information applies to the questions displayed below) Carrie Dlake, Reed A Green and Doug A. Divot share a passion for

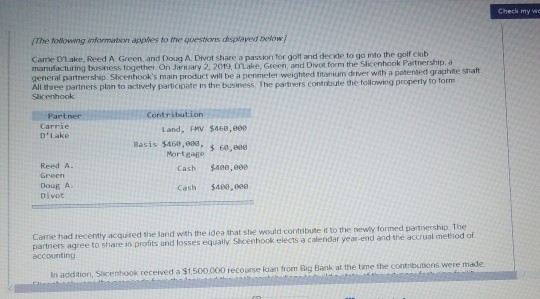

Check my we The following information applies to the questions displayed below) Carrie Dlake, Reed A Green and Doug A. Divot share a passion for golf and decide to go into the golf club manufacturing business together. On January 2, 2019, Dlake, Green, and Divot form the Slicenhook Partnership, a general partnership Slicenhook's main product will be a perimeter weighted titanium driver with a patented graphite shaft All three partners plan to actively participate in the business. The parties contribute the following properly to form Slikenhook. Partner Contribution Carrie Land, FMV $450,000 D'Lake Basis $460,000, $ 60,00 Mortgage Reed A Cash $.400,00 Green Doug A Cash $480, Divot Carrie had recently acquired the land with the idea that she would contribute it to the newly formed partnership. The partners agree to share in profits and losses equally Sheenhook elects a calendar year end and the accrual method of accounting In addition, Shenhook received a $1.500.000 recourse loan from Big Bank at the time the contributions were made Check my we The following information applies to the questions displayed below) Carrie Dlake, Reed A Green and Doug A. Divot share a passion for golf and decide to go into the golf club manufacturing business together. On January 2, 2019, Dlake, Green, and Divot form the Slicenhook Partnership, a general partnership Slicenhook's main product will be a perimeter weighted titanium driver with a patented graphite shaft All three partners plan to actively participate in the business. The parties contribute the following properly to form Slikenhook. Partner Contribution Carrie Land, FMV $450,000 D'Lake Basis $460,000, $ 60,00 Mortgage Reed A Cash $.400,00 Green Doug A Cash $480, Divot Carrie had recently acquired the land with the idea that she would contribute it to the newly formed partnership. The partners agree to share in profits and losses equally Sheenhook elects a calendar year end and the accrual method of accounting In addition, Shenhook received a $1.500.000 recourse loan from Big Bank at the time the contributions were made

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started