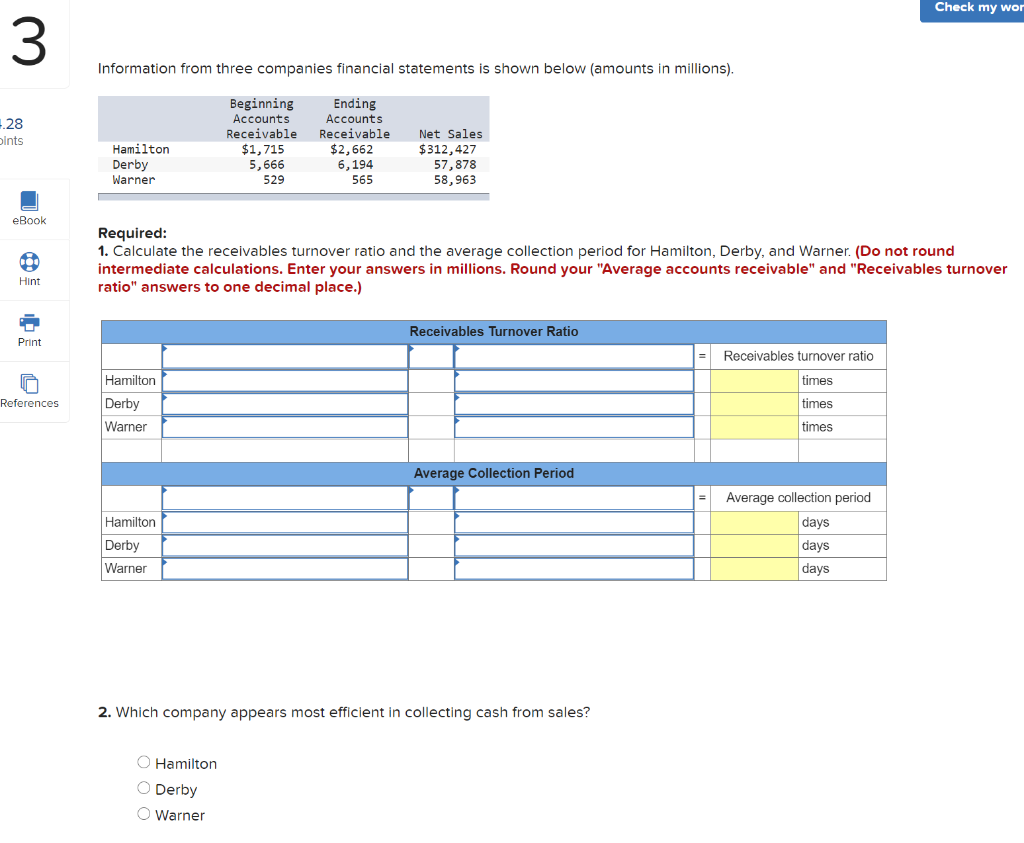

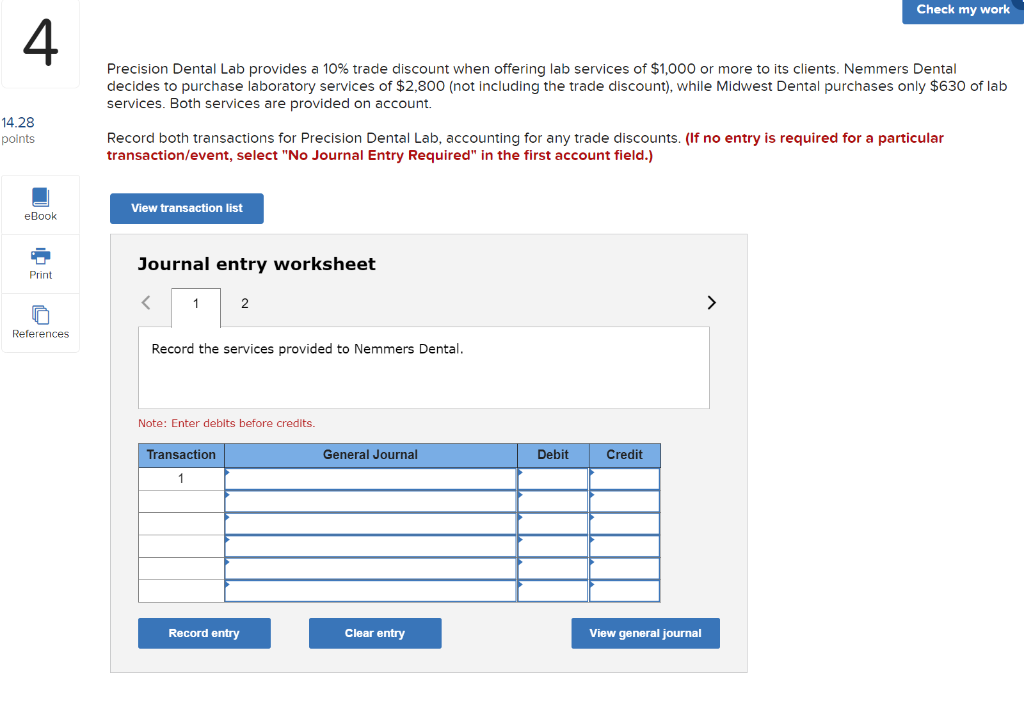

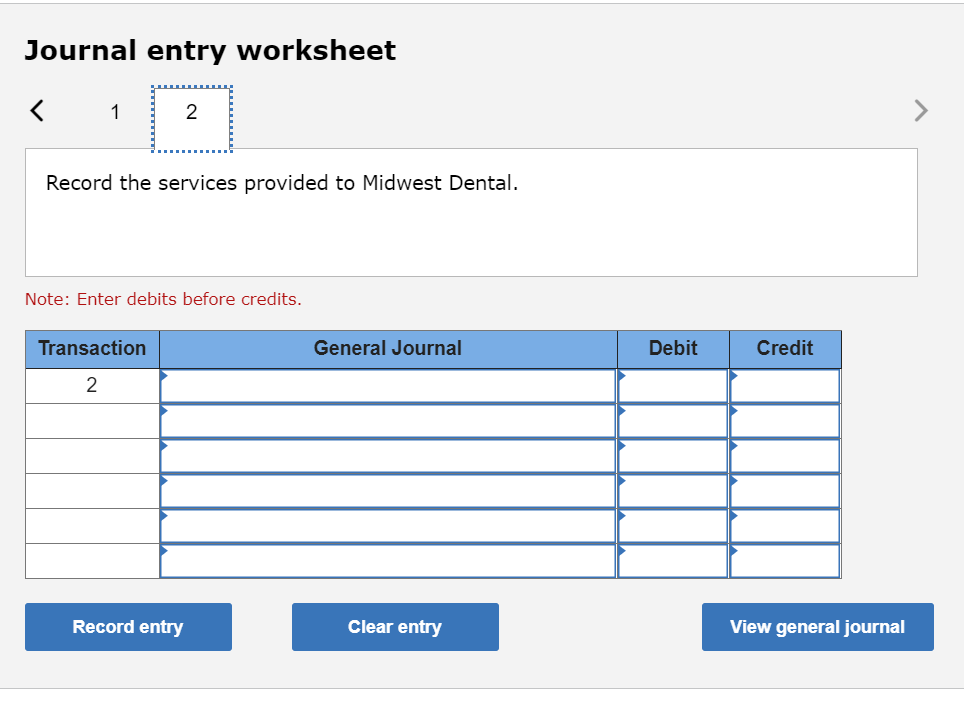

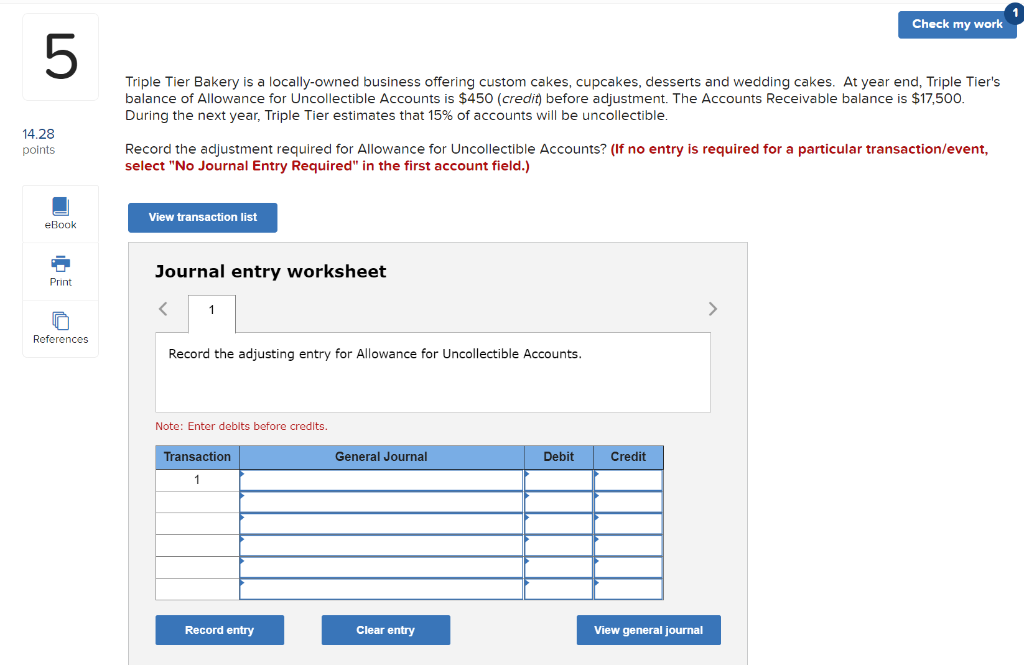

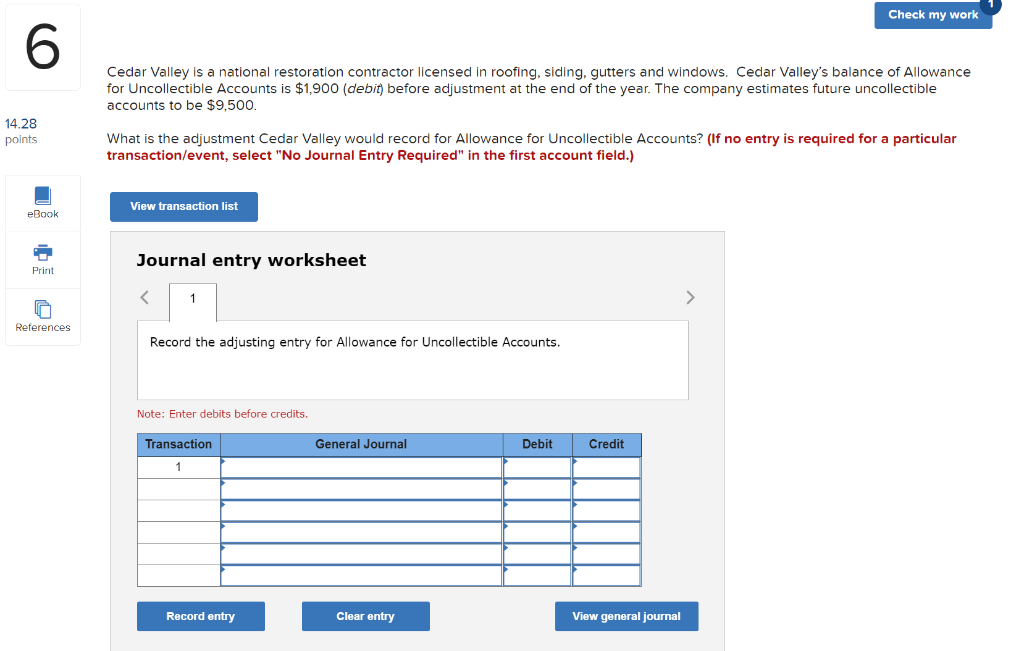

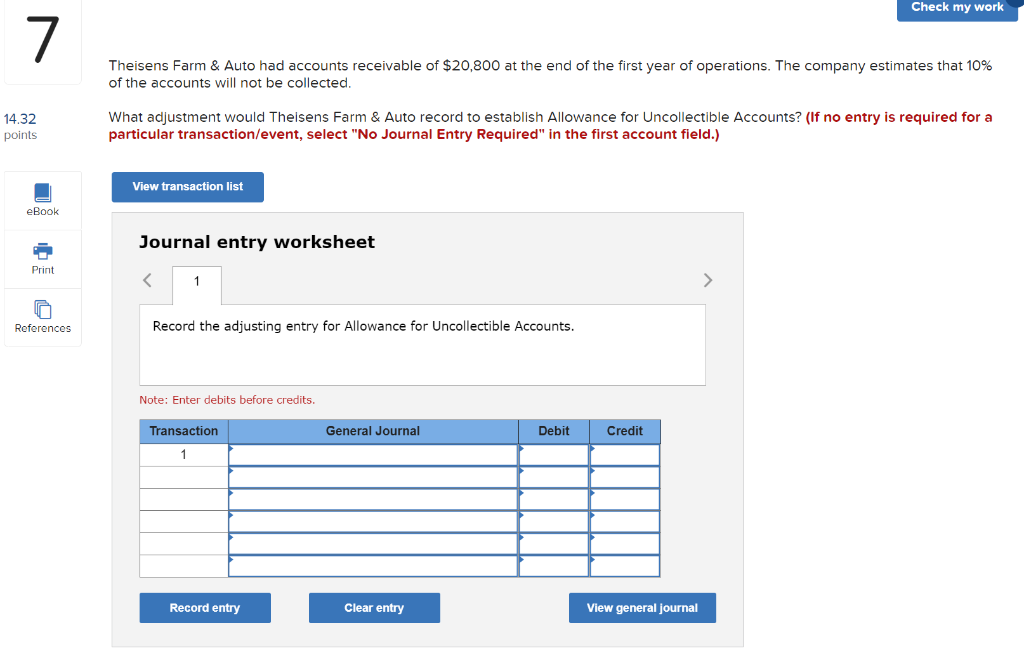

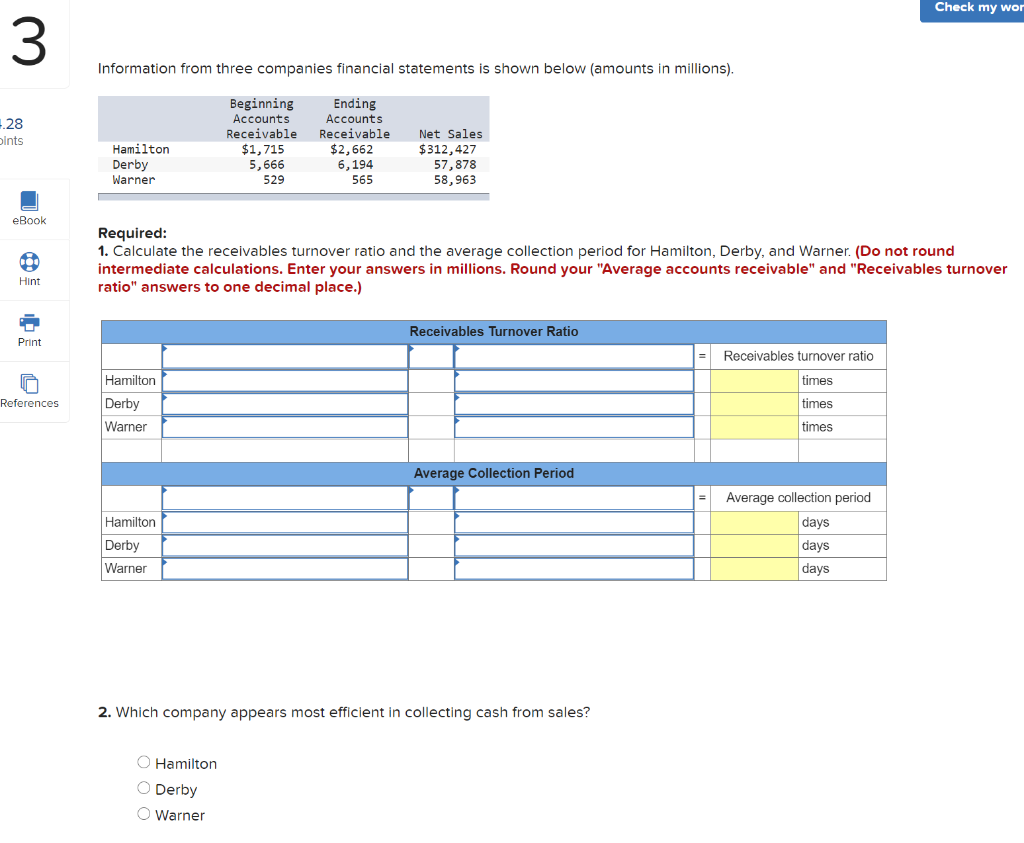

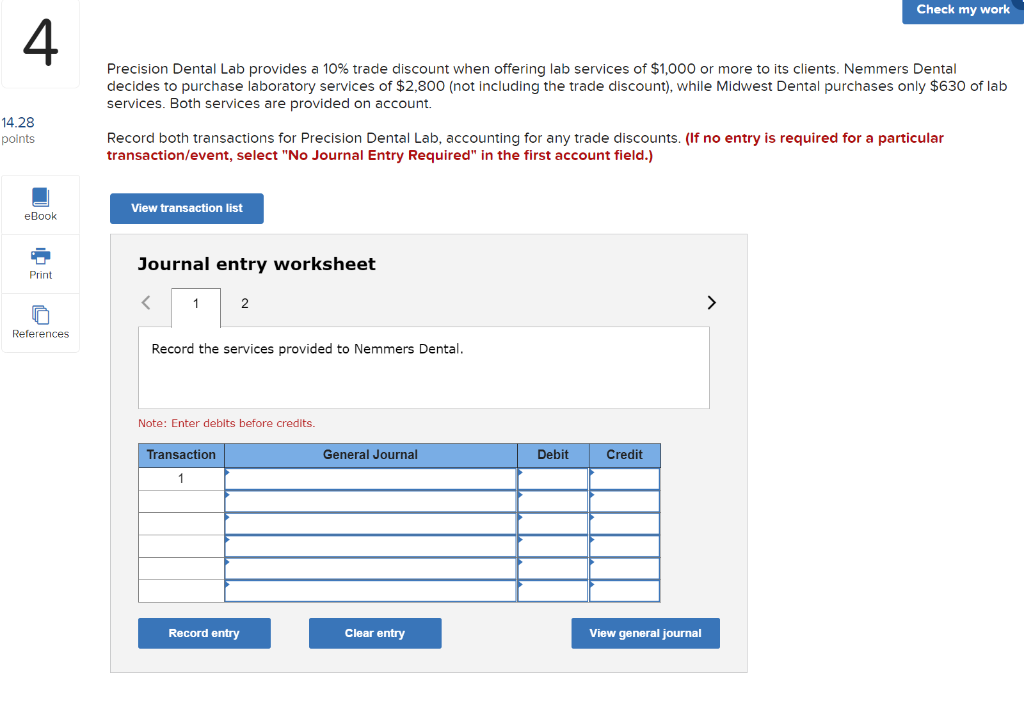

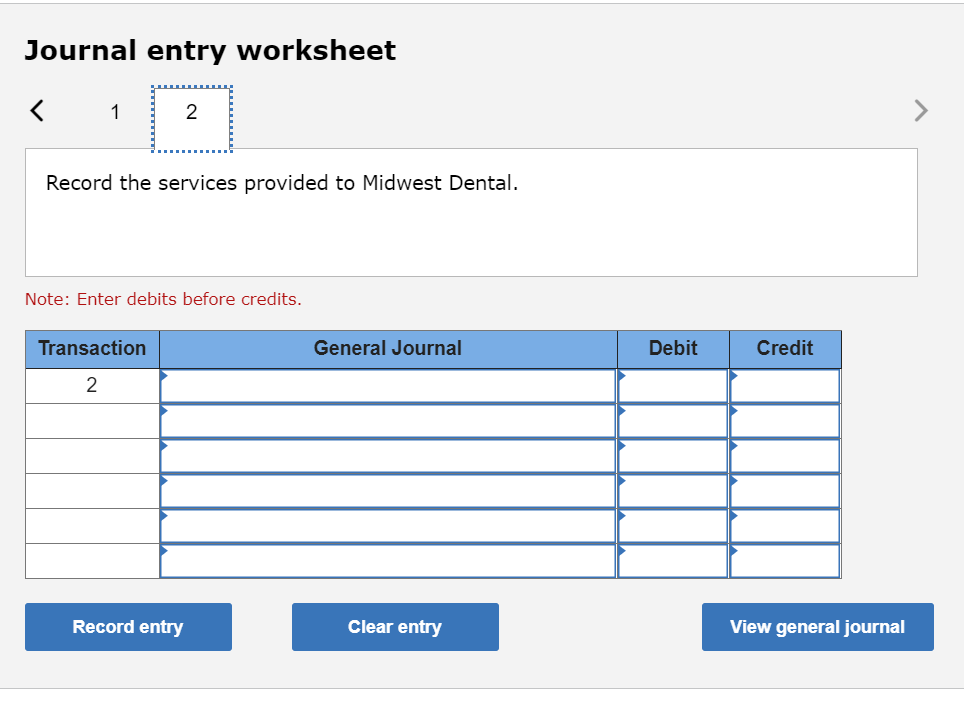

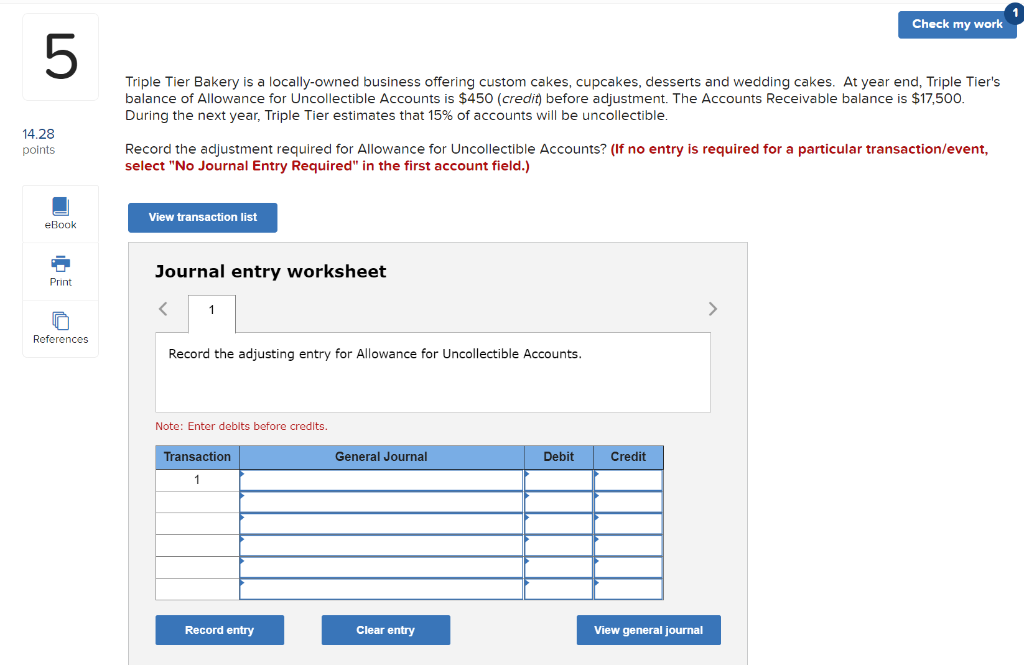

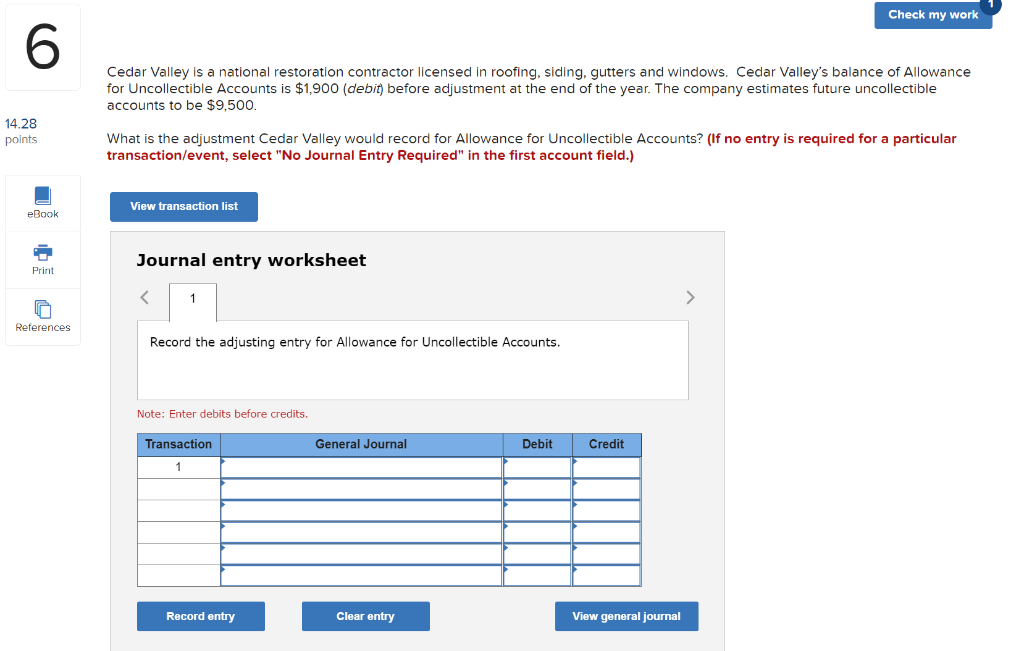

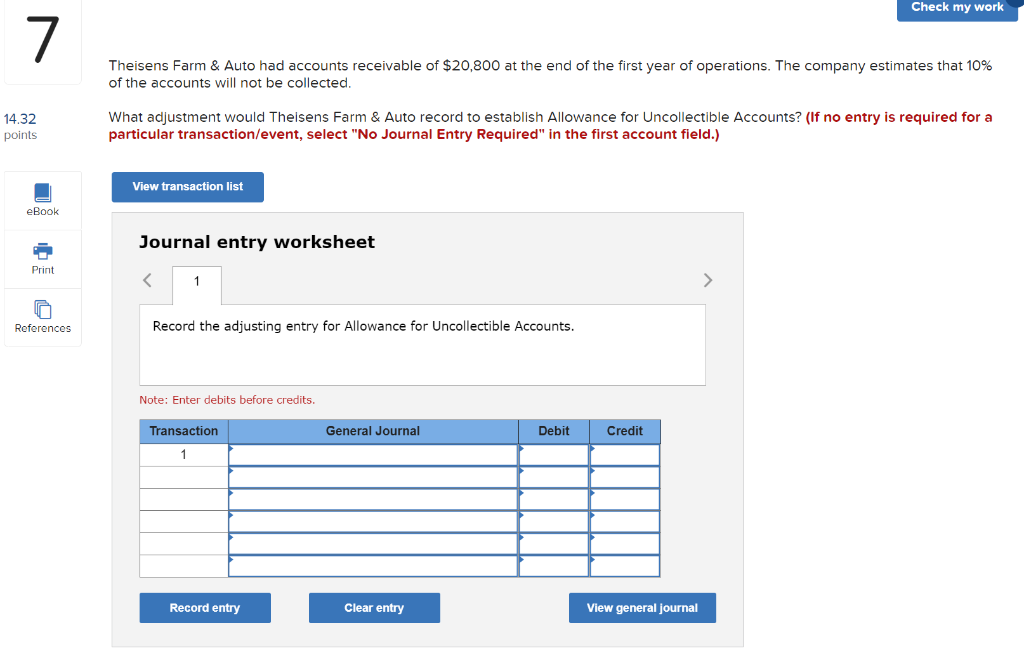

Check my wor 3 Information from three companies financial statements is shown below (amounts in millions). -.28 pints Beginning Accounts Receivable $1,715 5,666 529 Ending Accounts Receivable $2,662 6, 194 565 Hamilton Derby Warner Net Sales $312,427 57,878 58,963 eBook of Hint Required: 1. Calculate the receivables turnover ratio and the average collection period for Hamilton, Derby, and Warner. (Do not round intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.) Receivables Turnover Ratio Print Receivables turnover ratio times References Hamilton Derby Warner times times Average Collection Period Average collection period days Hamilton Derby Warner days days 2. Which company appears most efficient in collecting cash from sales? O Hamilton O Derby Warner Check my work 4 Precision Dental Lab provides a 10% trade discount when offering lab services of $1,000 or more to its clients. Nemmers Dental decides to purchase laboratory services of $2,800 (not including the trade discount), while Midwest Dental purchases only $630 of lab services. Both services are provided on account. 14.28 points Record both transactions for Precision Dental Lab, accounting for any trade discounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook Journal entry worksheet Print References Record the services provided to Nemmers Dental. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Journal entry worksheet 1 2 Record the services provided to Midwest Dental. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general journal Check my work 5 Triple Tier Bakery is a locally-owned business offering custom cakes, cupcakes, desserts and wedding cakes. At year end, Triple Tier's balance of Allowance for Uncollectible Accounts is $450 (credit) before adjustment. The Accounts Receivable balance is $17,500. During the next year, Triple Tier estimates that 15% of accounts will be uncollectible 14.28 points Record the adjustment required for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook Journal entry worksheet Print References Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Check my work 6 Cedar Valley is a national restoration contractor licensed in roofing, siding, gutters and windows. Cedar Valley's balance of Allowance for Uncollectible Accounts is $1,900 (debit) before adjustment at the end of the year. The company estimates future uncollectible accounts to be $9,500. 14.28 points What is the adjustment Cedar Valley would record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook D Journal entry worksheet Print 1 > References Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Check my work 7 Theisens Farm & Auto had accounts receivable of $20,800 at the end of the first year of operations. The company estimates that 10% of the accounts will not be collected. 14.32 points What adjustment would Theisens Farm & Auto record to establish Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook Journal entry worksheet Print References Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general Journal