Answered step by step

Verified Expert Solution

Question

1 Approved Answer

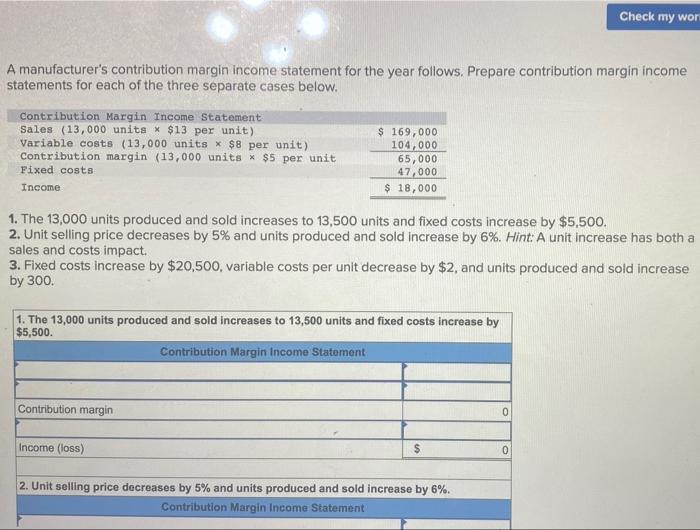

Check my wor A manufacturer's contribution margin income statement for the year follows. Prepare contribution margin income statements for each of the three separate

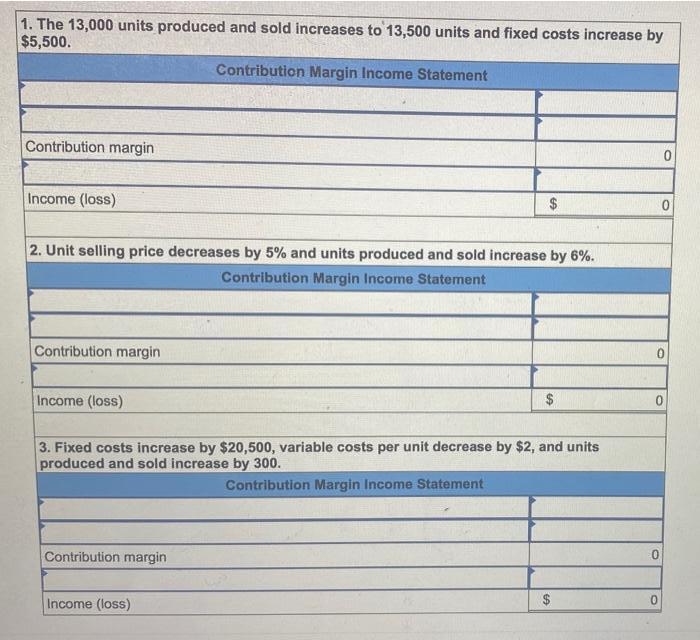

Check my wor A manufacturer's contribution margin income statement for the year follows. Prepare contribution margin income statements for each of the three separate cases below. Contribution Margin Income Statement Sales (13,000 units x $13 per unit) Variable costs (13,000 units x $8 per unit) Contribution margin (13,000 units x $5 per unit $ 169,000 104,000 65,000 47,000 $ 18,000 Fixed costs Income 1. The 13,000 units produced and sold increases to 13,500 units and fixed costs increase by $5,500. 2. Unit selling price decreases by 5% and units produced and sold increase by 6%. Hint: A unit increase has both a sales and costs impact. 3. Fixed costs increase by $20,500, variable costs per unit decrease by $2, and units produced and sold increase by 300. 1. The 13,000 units produced and sold increases to 13,500 units and fixed costs increase by $5,500. Contribution Margin Income Statement Contribution margin Income (loss) %24 2. Unit selling price decreases by 5% and units produced and sold increase by 6%. Contribution Margin Income Statement 1. The 13,000 units produced and sold increases to 13,500 units and fixed costs increase by $5,500. Contribution Margin Income Statement Contribution margin Income (loss) 2. Unit selling price decreases by 5% and units produced and sold increase by 6%. Contribution Margin Income Statement Contribution margin Income (loss) $ 3. Fixed costs increase by $20,500, variable costs per unit decrease by $2, and units produced and sold increase by 300. Contribution Margin Income Statement Contribution margin Income (loss)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Contribution Margin Income Statement Sales 175500 1350013 Variable costs 108000 135008 Cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started