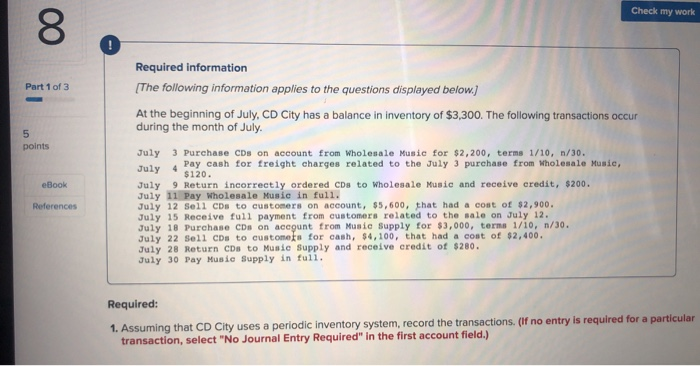

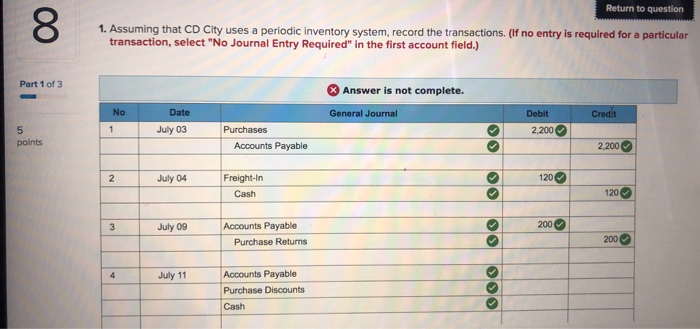

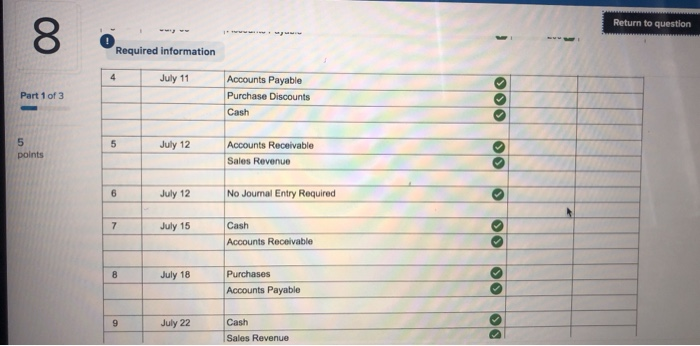

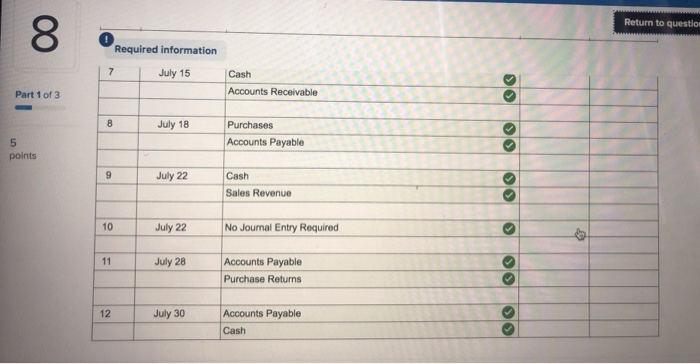

Check my work 00 Required information The following information applies to the questions displayed below.] Part 1 of 3 At the beginning of July, CD City has a balance in inventory of $3,300. The following transactions occur during the month of July. points July 3 Purchase CDs on account from Wholesale Music for $2,200, terms 1/10, n/30. Pay cash for freight charges related to the July 3 purchase from Wholesale Music, July $120. eBook 1 References July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell CDs to customers on account, $5,600, that had a cost of $2,900. July 15 Receive full payment from customers related to the sale on July 12. July 18 Purchase CDs on account from Music Supply for $3,000, terme 1/10, n/30. July 22 Sell CDs to customers for cash, $4,100, that had a cost of $2,400. July 28 Return CDs to Music Supply and receive credit of $280. July 30 Pay Music Supply in full. Required: 1. Assuming that CD City uses a periodic Inventory system, record the transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) Return to question 8 1. Assuming that CD City uses a periodic inventory system, record the transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required in the first account field.) Part 1 of 3 x Answer is not complete. No Date General Journal Credit Debit 2,200 July 03 points Purchases Accounts Payable 2,200 2 July 04 120 Freight-in Cash 120 July 09 200 Accounts Payable Purchase Returns 000 00 July 11 Accounts Payable Purchase Discounts Cash Return to question Required information July 11 Part 1 of 3 Accounts Payable Purchase Discounts Cash July 12 points Accounts Receivable Sales Revenue July 12 No Joumal Entry Required s . July 15 Cash Accounts Receivable July 18 Purchases Accounts Payable July 22 Cash Sales Revenue Return to question Required information July 15 Cash Accounts Receivable Part 1 of 3 / / July 18 Purchases Accounts Payable / 00 00 00 / points July 22 Cash Sales Revenue July 22 No Journal Entry Required July 28 Accounts Payable Purchase Returns 00 00 July 30 Accounts Payable Cash