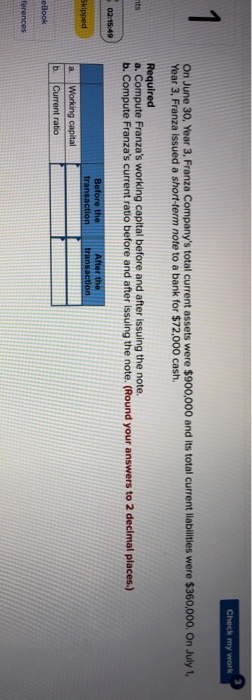

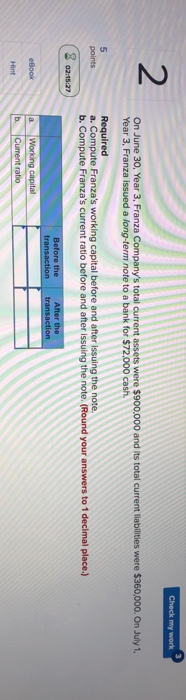

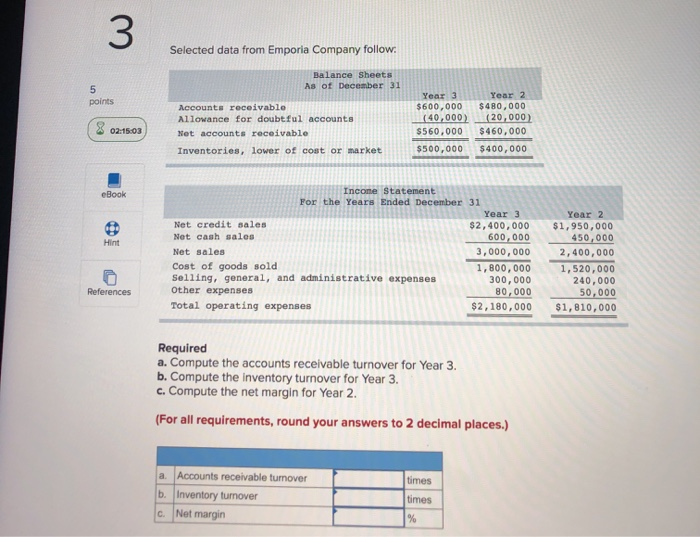

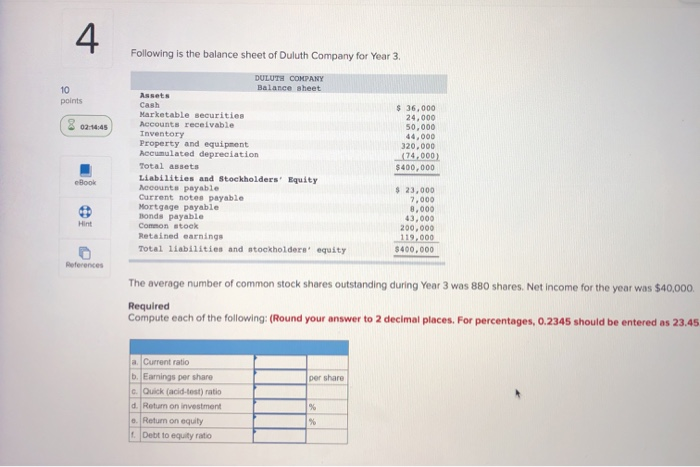

Check my work 1 On June 30, Year 3, Franza Company's total current assets were $900,000 and its total current liabilities were $360,000. On July 1, Year 3, Franza issued a short-term note to a bank for $72,000 cash. Required a. Compute Franza's working capital before and after issuing the note. b. Compute Franza's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) nts 02.15.49 Before the transaction After the transaction Skipped a. Working capital Current ratio b. eBook ferences Check my work 2 On June 30, Year 3. Franza Company's total current assets were $900,000 and its total current liabilities were $360,000. On July 1. Year 3, Franza issued a long-term note to a bank for $72,000 cash. Required a. Compute Franza's working capital before and after issuing the note. b. Compute Franza's current ratio before and after issuing the note. (Round your answers to 1 decimal place.) 5 points 02:15:27 Before the transaction After the transaction eBook a Working capital Current ratio Hint b. 3 Selected data from Emporia Company follow. Balance Sheets As of December 31 5 points Year 3 $600,000 (40,000) $560,000 $500,000 Accounts receivable Allowance for doubtful accounts Net accounts receivable Inventories, lower of cost or market Year 2 $ 480,000 (20,000) $460,000 $400,000 02:15:03 eBook Hint Income Statement For the Years Ended December 31 Year 3 Net credit sales $2,400,000 Net cash sales 600,000 Net sales 3,000,000 Cost of goods sold 1,800,000 Selling, general, and administrative expenses 300,000 Other expenses 80,000 Total operating expenses $2,180,000 meble Year 2 $1,950,000 450,000 2,400,000 1,520,000 240,000 50,000 $1,810,000 References Required a. Compute the accounts receivable turnover for Year 3. b. Compute the inventory turnover for Year 3. c. Compute the net margin for Year 2. (For all requirements, round your answers to 2 decimal places.) times a. Accounts receivable turnover b. Inventory turnover C. Net margin times % 4. Following is the balance sheet of Duluth Company for Year 3. 10 points 02:14:45 DULUTH COMPANY Balance sheet Assets Cash Marketable securities Accounts receivable Inventory Property and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Mccounts payable Current notes payable Mortgage payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 36,000 24,000 50,000 44,000 320,000 (74,000) $400,000 Book $ 23,000 7.000 8.000 43,000 200,000 119,000 $400,000 References The average number of common stock shares outstanding during Year 3 was 880 shares. Net Income for the year was $40,000 Required Compute each of the following: (Round your answer to 2 decimal places. For percentages, 0.2345 should be entered as 23.45 per share a. Current ratio b. Earnings per share c. Quick (acid-test) ratio d. Return on investment Return on equity Debt to equity ratio