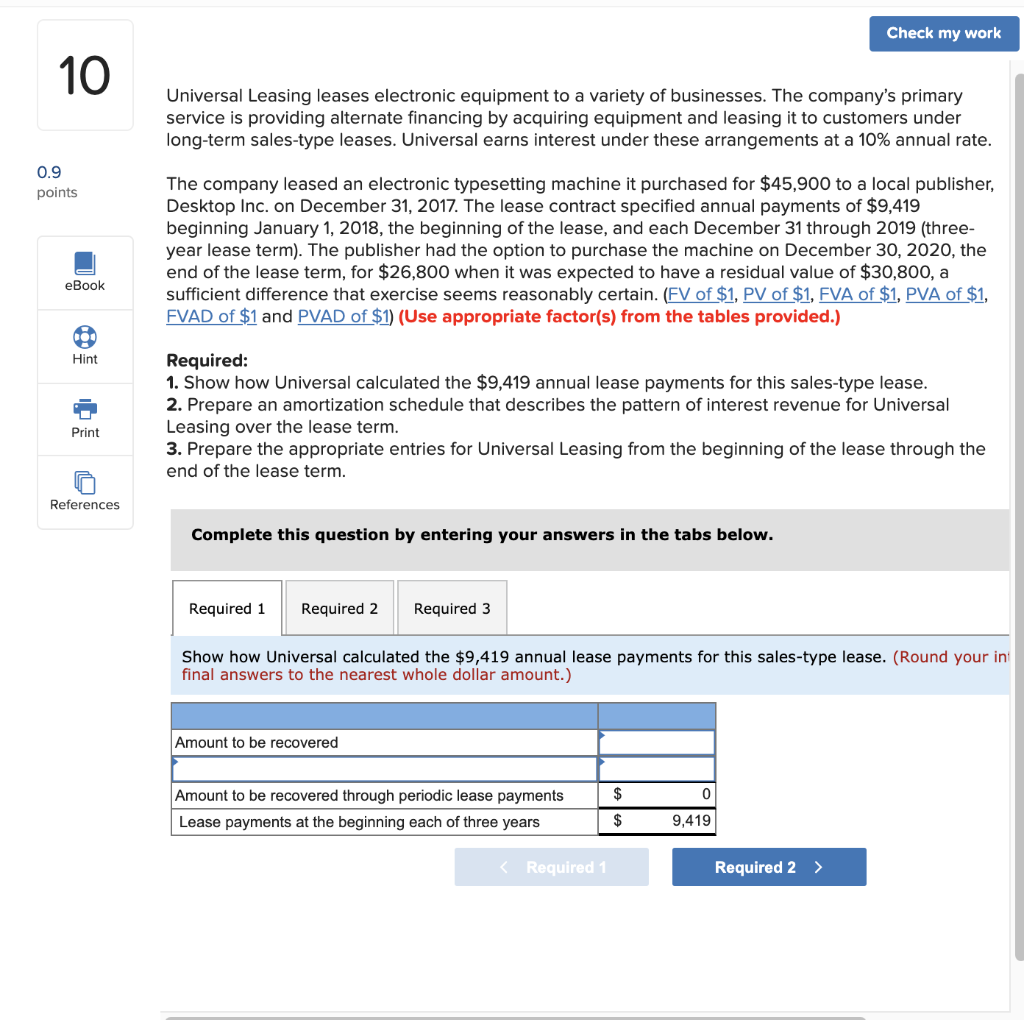

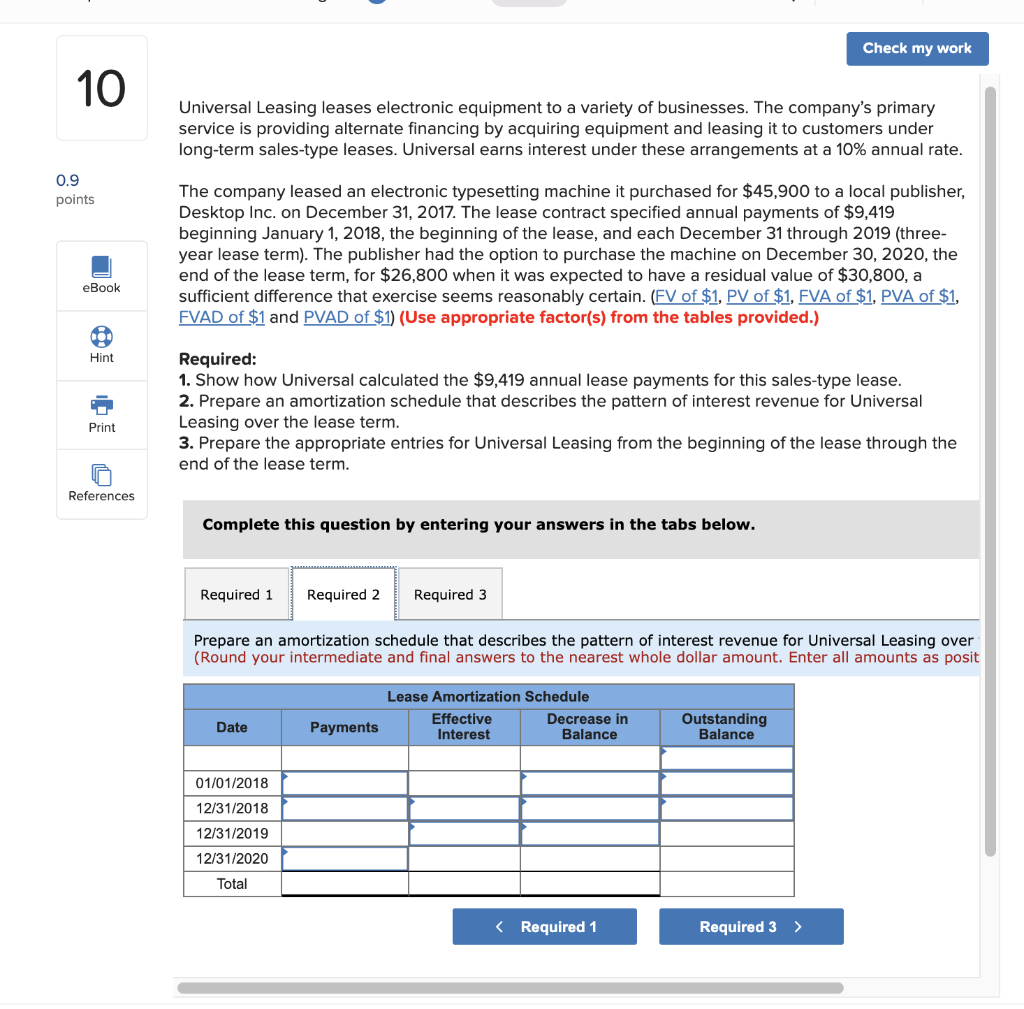

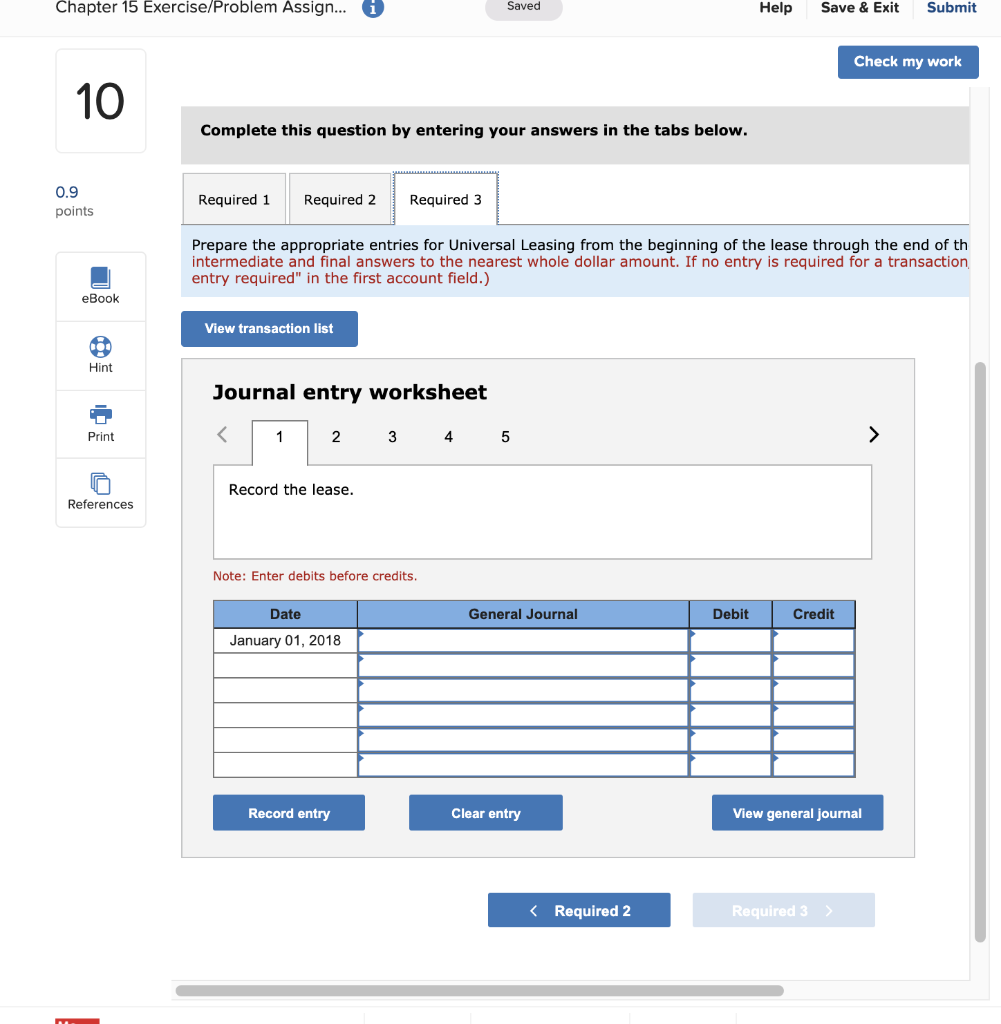

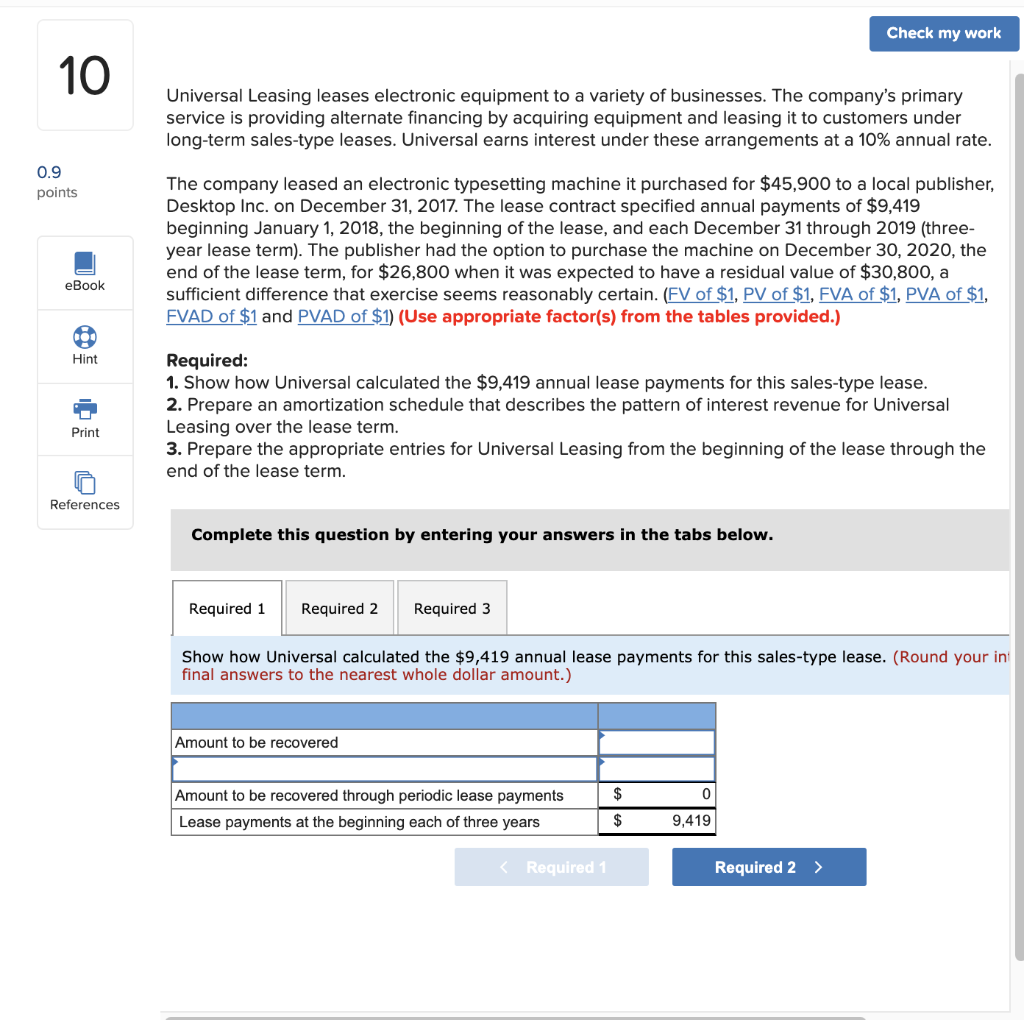

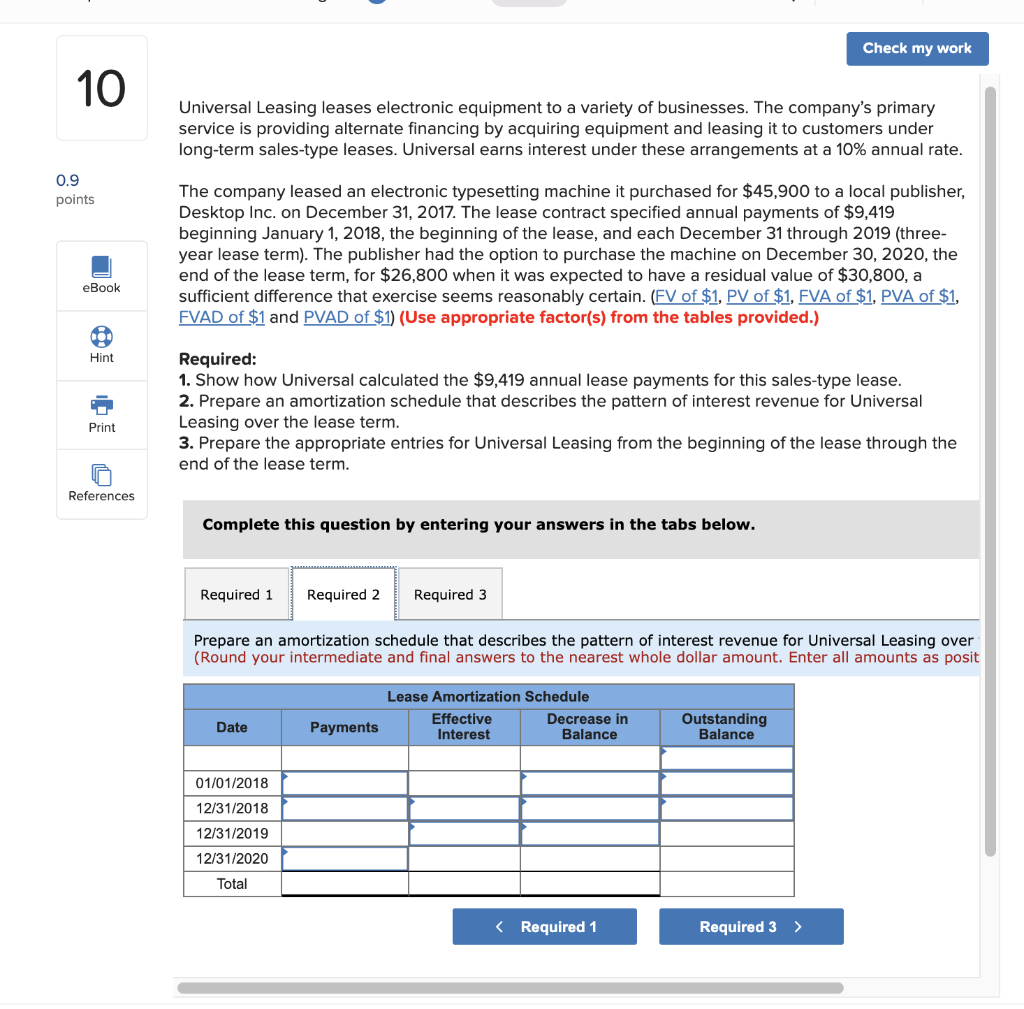

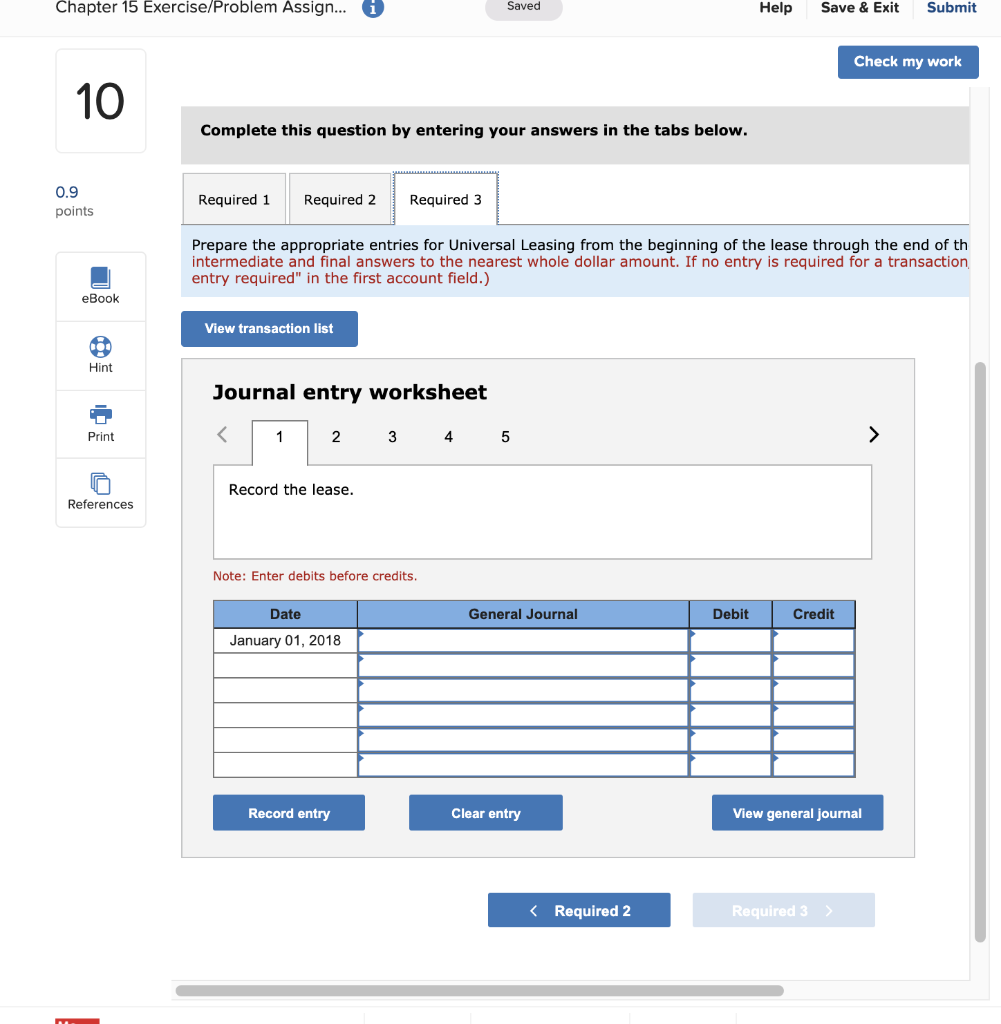

Check my work 10 Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. Universal earns interest under these arrangements at a 10% annual rate. 0.9 points The company leased an electronic typesetting machine it purchased for $45,900 to a local publisher, Desktop Inc. on December 31, 2017. The lease contract specified annual payments of $9,419 beginning January 1, 2018, the beginning of the lease, and each December 31 through 2019 (three- year lease term). The publisher had the option to purchase the machine on December 30, 2020, the end of the lease term, for $26,800 when it was expected to have a residual value of $30,800, a sufficient difference that exercise seems reasonably certain. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) eBook Hint Required: 1. Show how Universal calculated the $9,419 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Show how Universal calculated the $9,419 annual lease payments for this sales-type lease. (Round your in final answers to the nearest whole dollar amount.) Amount to be recovered $ 0 Amount to be recovered through periodic lease payments Lease payments at the beginning each of three years $ 9,419 Check my work 10 Universal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. Universal earns interest under these arrangements at a 10% annual rate. 0.9 points The company leased an electronic typesetting machine it purchased for $45,900 to a local publisher, Desktop Inc. on December 31, 2017. The lease contract specified annual payments of $9,419 beginning January 1, 2018, the beginning of the lease, and each December 31 through 2019 (three- year lease term). The publisher had the option to purchase the machine on December 30, 2020, the end of the lease term, for $26,800 when it was expected to have a residual value of $30,800, a sufficient difference that exercise seems reasonably certain. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) eBook Hint Required: 1. Show how Universal calculated the $9,419 annual lease payments for this sales-type lease. 2. Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over the lease term. 3. Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of the lease term. Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an amortization schedule that describes the pattern of interest revenue for Universal Leasing over (Round your intermediate and final answers to the nearest whole dollar amount. Enter all amounts as posit Lease Amortization Schedule Effective Decrease in Interest Balance Date Payments Outstanding Balance 01/01/2018 12/31/2018 12/31/2019 12/31/2020 Total Chapter 15 Exercise/Problem Assign... Saved Help Save & Exit Submit Check my work 10 Complete this question by entering your answers in the tabs below. 0.9 points Required 1 Required 2 Required 3 Prepare the appropriate entries for Universal Leasing from the beginning of the lease through the end of th intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction entry required" in the first account field.) eBook View transaction list Hint Journal entry worksheet Print Record the lease. References Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018 Record entry Clear entry View general journal