Answered step by step

Verified Expert Solution

Question

1 Approved Answer

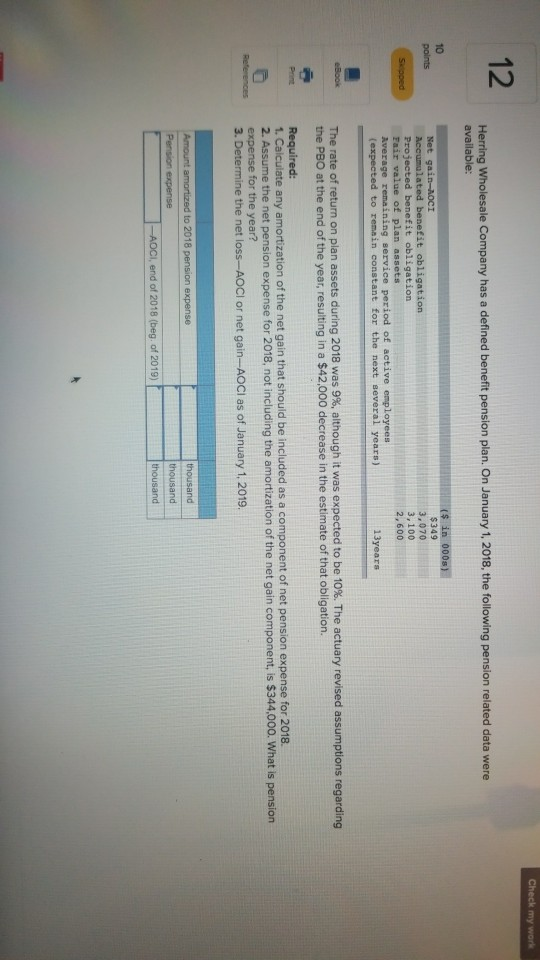

Check my work 12 Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: 10

Check my work 12 Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension related data were available: 10 points ($ in 000s) $349 3.070 3,100 2,600 Net gain-AOCI Accumulated benefit obligation Projected benefit obligation Fair value of plan assets Skipped Average remaining service period of active employee (expected to remain constant for the next several years) 13years eBook The rate of return on plan assets during 2018 was 9% , although it was expected to be 10 %. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $42,000 decrease in the estimate of that obligation. Required: 1. Caiculate any amortization of the net gain that should be included as a component of net pension expense for 2018 2. Assume the net pension expense for 2018, not including the amortization of the net gain component, is $344,000. What is pension expense for the year? 3. Determine the net loss-AOCI or net gain-AOCI as of January 1, 2019. Print References Amount amortized to 2018 pension expense thousand Pension expense thousand -AOCI, end of 2018 (beg. of 2019) thousand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started