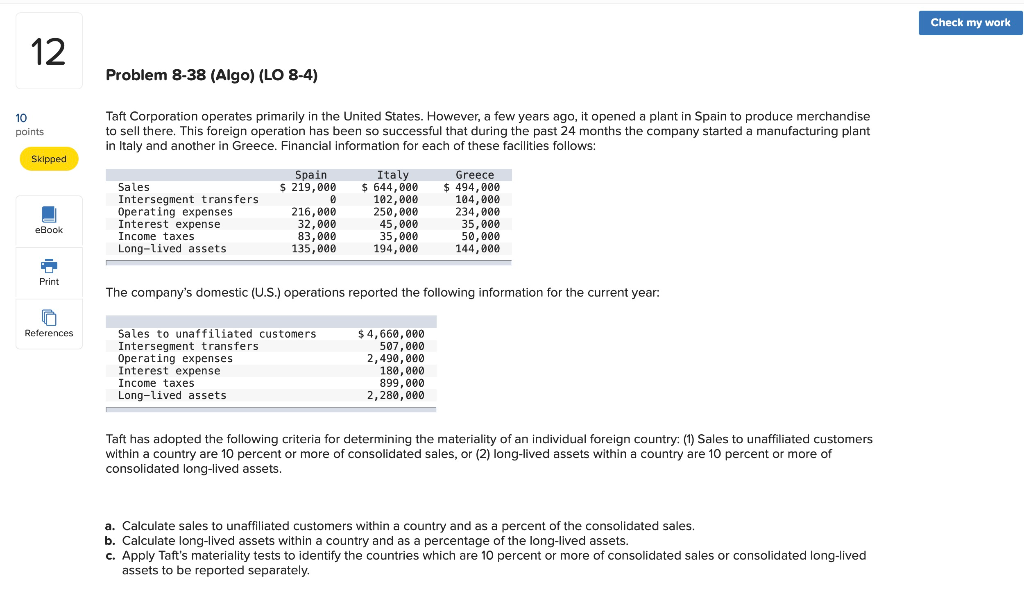

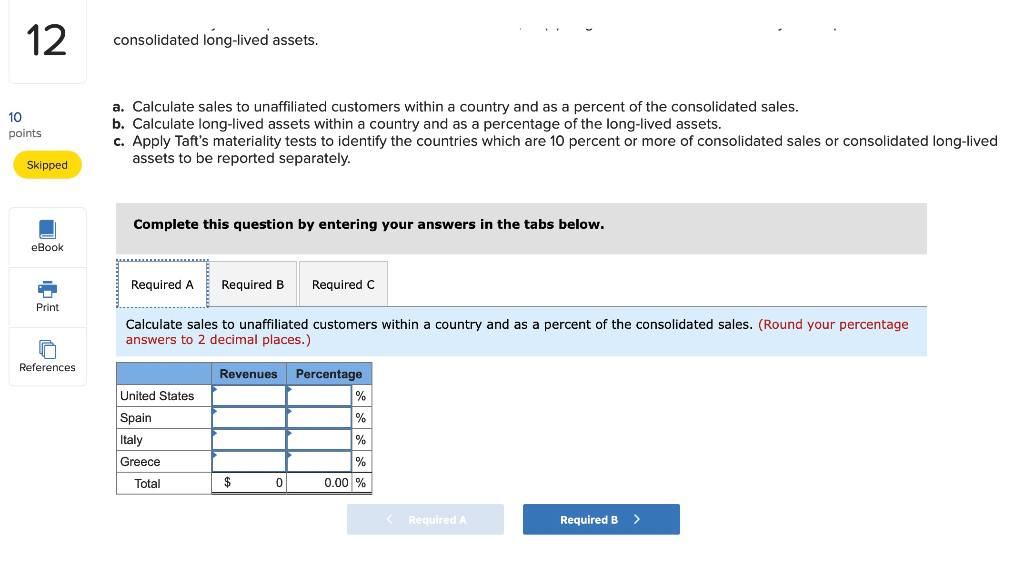

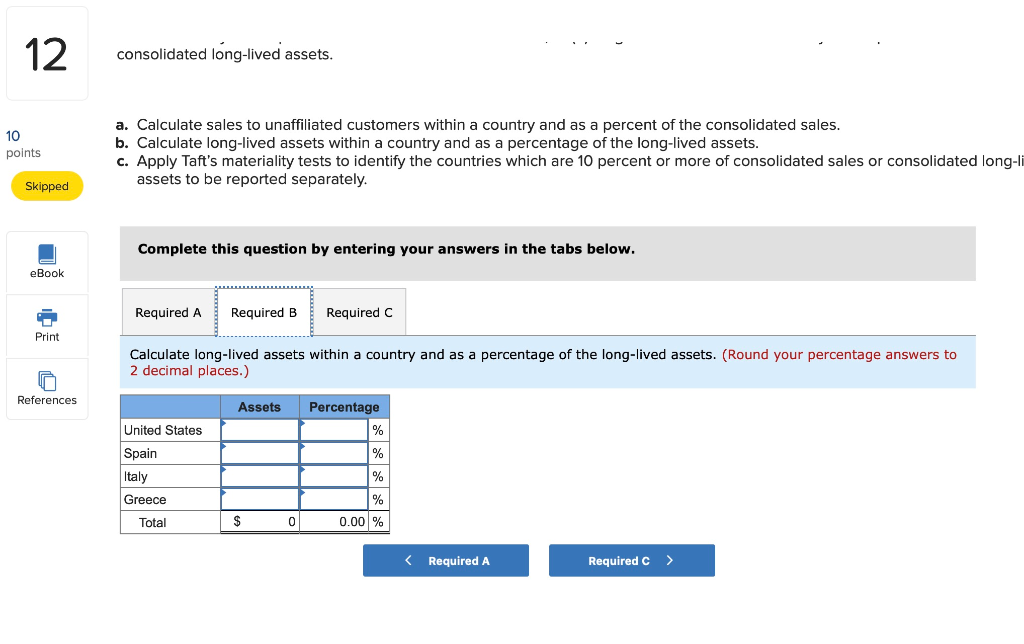

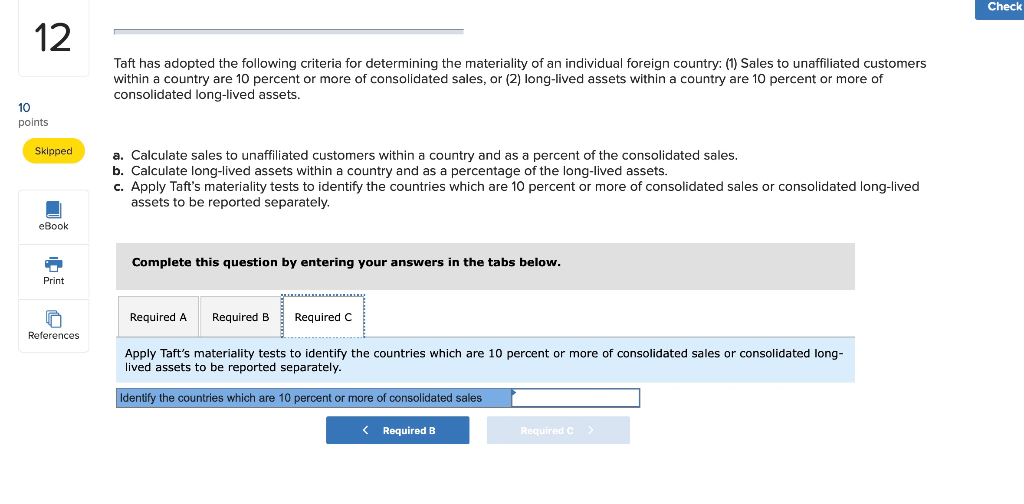

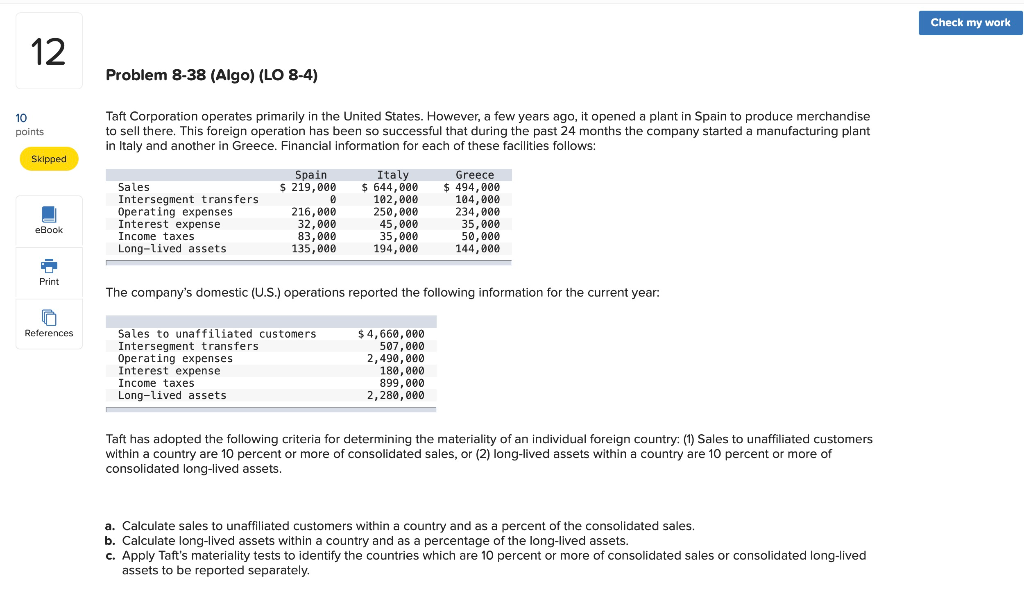

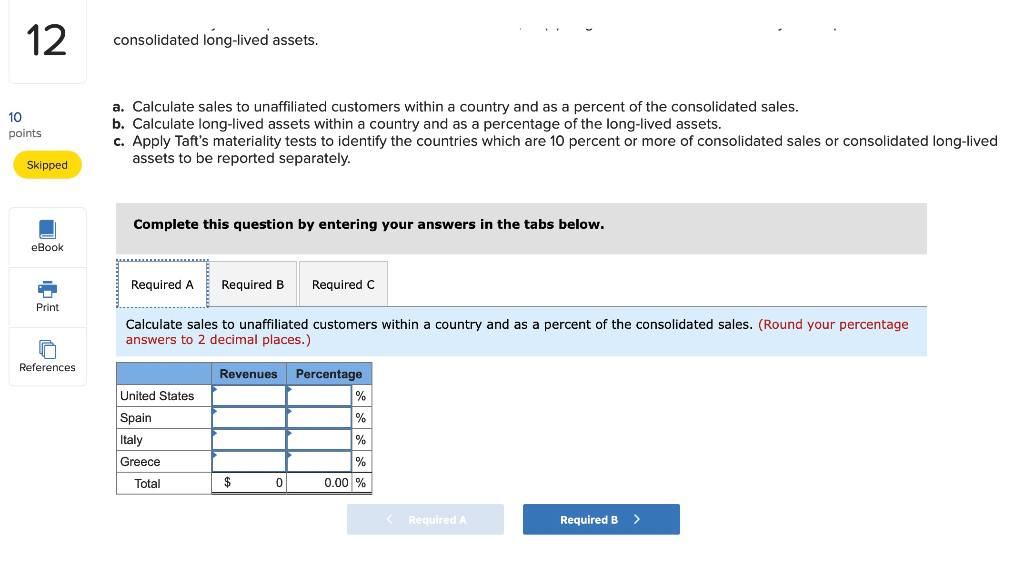

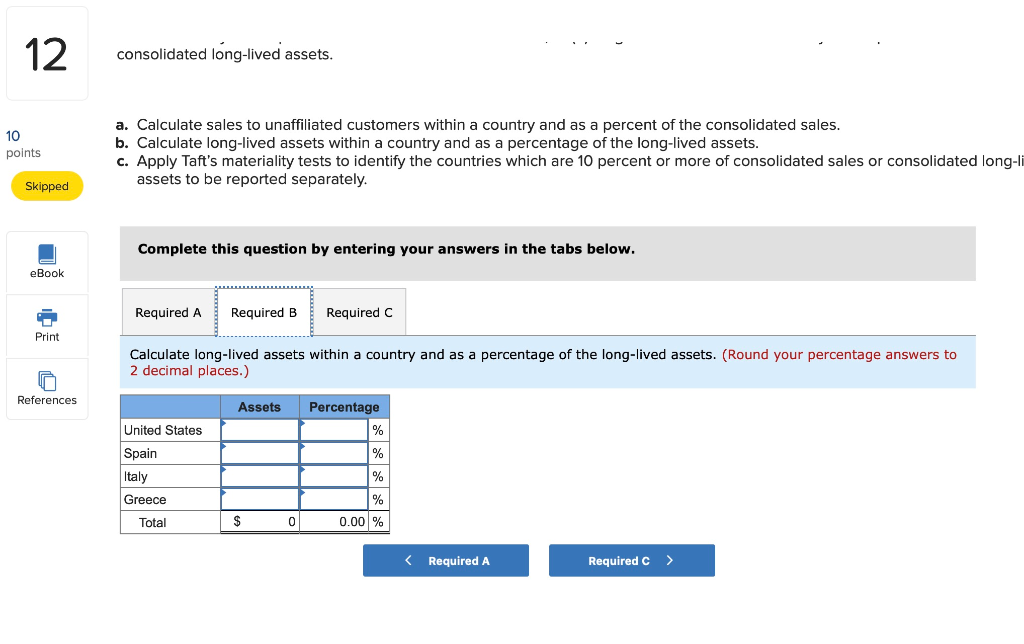

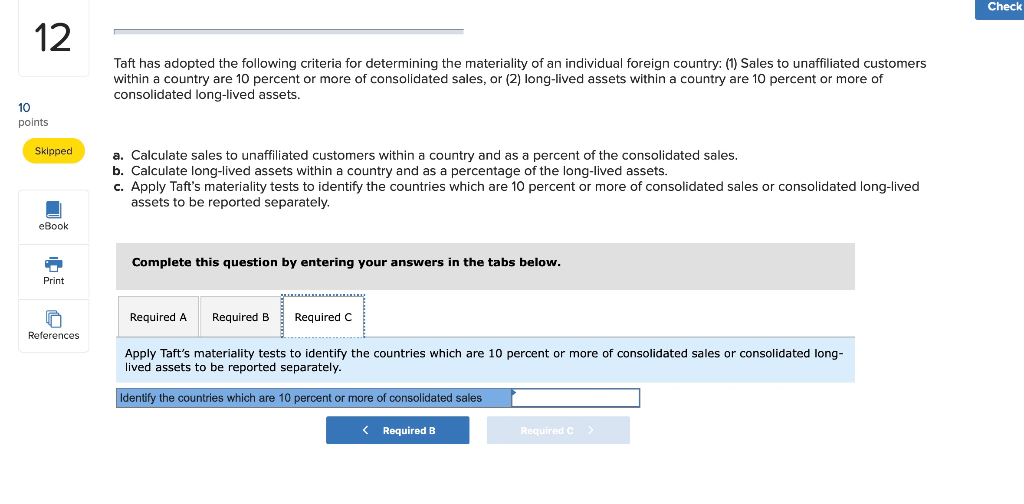

Check my work 12 Problem 8-38 (Algo) (LO 8-4) 10 points Taft Corporation operates primarily in the United States. However, a few years ago, it opened a plant in Spain to produce merchandise to sell there. This foreign operation has been so successful that during the past 24 months the company started a manufacturing plant in Italy and another in Greece. Financial information for each of these facilities follows: Skipped Spain $ 219,000 Sales Intersegment transfers Operating expenses Interest expense Income taxes Long-lived assets Italy $ 644,000 102,000 250,000 45,000 35,000 194,900 216,000 32,000 83,000 135,000 Greece $ 494,000 104,900 234,000 35,000 50,000 144,000 eBook Print The company's domestic (U.S.) operations reported the following information for the current year: References Sales to unaffiliated customers Intersegment transfers Operating expenses Interest expense Income taxes Long-lived assets $ 4,660,000 507,000 2,490,000 180,000 899,000 2,280,000 Taft has adopted the following criteria for determining the materiality of an individual foreign country: (1) Sales to unaffiliated customers within a country are 10 percent or more of consolidated sales, or (2) long-lived assets within a country are 10 percent or more of consolidated long-lived assets. a. Calculate sales to unaffiliated customers within a country and as a percent of the consolidated sales. b. Calculate long-lived assets within a country and as a percentage of the long-lived assets. c. Apply Taft's materiality tests to identify the countries which are 10 percent or more of consolidated sales or consolidated long-lived assets to be reported separately. 12 consolidated long-lived assets. 10 points a. Calculate sales to unaffiliated customers within a country and as a percent of the consolidated sales. b. Calculate long-lived assets within a country and as a percentage of the long-lived assets. c. Apply Taft's materiality tests to identify the countries which are 10 percent or more of consolidated sales or consolidated long-lived assets to be reported separately. Skipped Complete this question by entering your answers in the tabs below. eBook Required A Required B Required C Print Calculate sales to unaffiliated customers within a country and as a percent of the consolidated sales. (Round your percentage answers to 2 decimal places.) References Revenues Percentage United States % % % Spain Italy Greece Total % $ 0 0.00 % 12 consolidated long-lived assets. 10 points a. Calculate sales to unaffiliated customers within a country and as a percent of the consolidated sales. b. Calculate long-lived assets within a country and as a percentage of the long-lived assets. c. Apply Taft's materiality tests to identify the countries which are 10 percent or more of consolidated sales or consolidated long-li assets to be reported separately. Skipped Complete this question by entering your answers in the tabs below. eBook Required A Required B Required C Print Calculate long-lived assets within a country and as a percentage of the long-lived assets. (Round your percentage answers to 2 decimal places.) Robert References Assets Percentage % % United States Spain Italy Greece % % Total $ 0 0.00 %