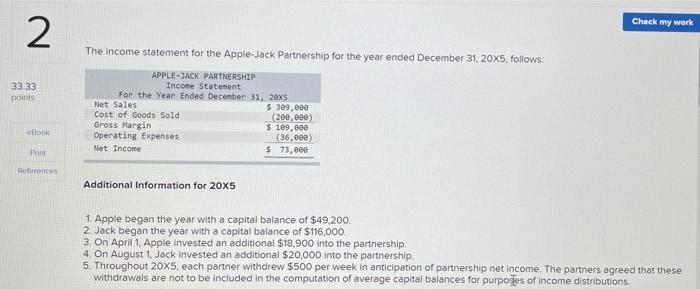

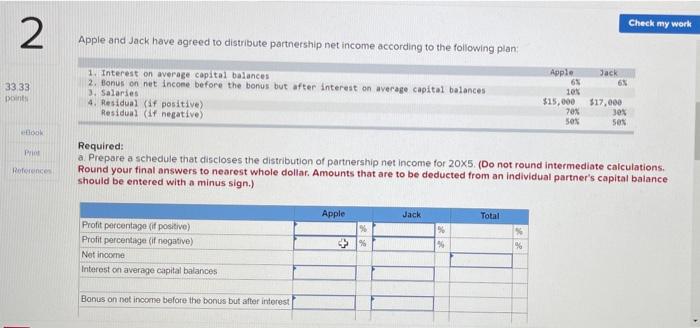

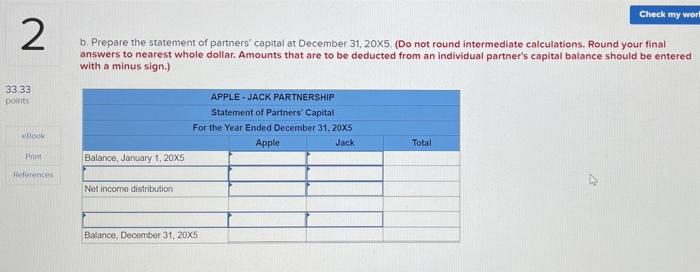

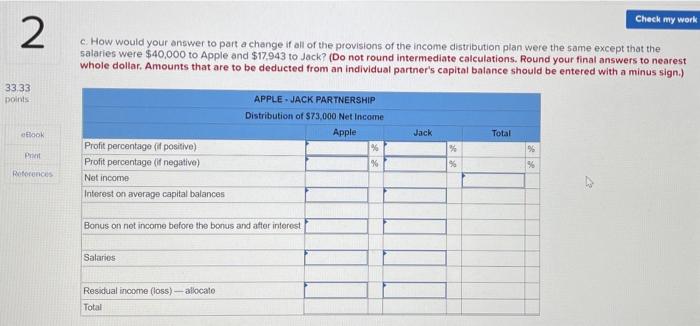

Check my work 2 33.33 points The income statement for the Apple-Jack Partnership for the year ended December 31, 20X5, follows: APPLE-JACK PARTNERSHIP Income Statement For the Year Ended December 31, 20x5 Net Sales $ 309,000 Cost of Goods Sold (200,000) Gross Margin $ 109,000 Operating Expenses (36.000) Net Income $ 73,860 Book Print References Additional Information for 20X5 1. Apple began the year with a capital balance of $49.200. 2 Jack began the year with a capital balance of $116,000 3. On April 1. Apple invested an additional $18.900 into the partnership 4. On August 1, Jack invested an additional $20,000 into the partnership 5. Throughout 20X5, each partner withdrew $500 per week in anticipation of partnership net income. The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purpoges of income distributions Check my work 2 Apple and Jack have agreed to distribute partnership net income according to the following plan 33 33 points 1. Interest on average capital balances 2. Bonus on net income before the bonus but after interest on werage capital balances 4. Residual (if positive) Residus (If negative) 3. Salaries Apple Jack 65 63 103 $15,000 $17,000 70% sos sex 30% book P Reference Required: a Prepare a schedule that discloses the distribution of partnership net income for 205. (Do not round intermediate calculations, Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.) Apple Jack Total % Profit percentage (if positive) Profit percentage (if negative) Net income Interest on average capital balances % 4 % Bonus on not income before the bonus but after interest Check my work 2 b. Prepare the statement of partners' capital at December 31, 20X5. (Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.) 33.33 points APPLE-JACK PARTNERSHIP Statement of Partners' Capital For the Year Ended December 31, 20X5 Apple Jack Book Total Print Balance, January 1, 20X5 Reference Net income distribution Balance, December 31, 20X5 Check my work 2 c. How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $40,000 to Apple and $17.943 to Jack? (Do not round intermediate calculations. Round your final answers to nearest whole dollar. Amounts that are to be deducted from an individual partner's capital balance should be entered with a minus sign.) 33.33 Doints APPLE JACK PARTNERSHIP Distribution of $73,000 Net Income Apple Book Jack Total Pet % % % $ Profit percentage of positive) Profit percentage (if negative) Net income Interest on average capital balances % References Bonus on net income before the bonus and after interest Salarios Residual income (loss) -allocato Total