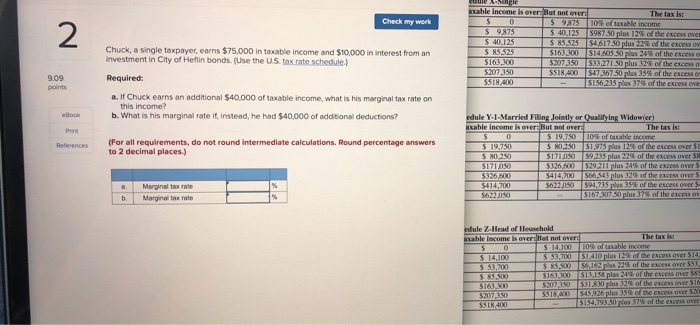

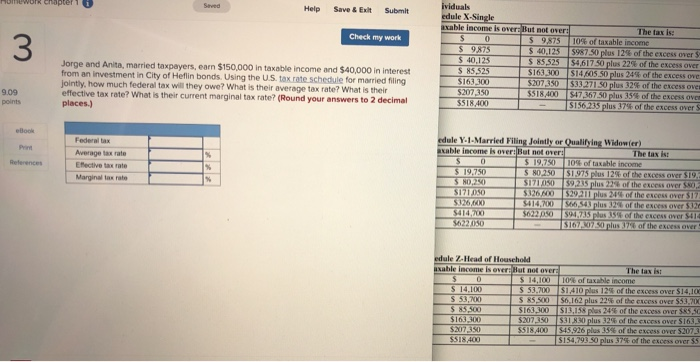

Check my work 2 Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment in City of Heflin bonds. Use the US tax rate schedule) cue axable income is over. But not ever The tax is: $ D $ 9875 107 of taxable income $ 9875 $ 40.125 $987 50 plus 12% of the excess ove S 40.125 $ US $25 $4,617 50 plus of the excess o $ 85525 $163,300 S14.605.0 plus 24% of the excess o $163,300 $207,350 $33.271 50 plus 32% of the excess o $207,350 S518.400 547,367 50 plus 15% of the excess o $518,400 SI56,235 plus 37% of the excess ove 9.09 points Required: 2. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on b. What is his marginal rate it, instead, he had $40,000 of additional deductions? eBook References (For all requirements, do not round Intermediate calculations. Round percentage answers to 2 decimal places.) edule Y-1. Married Filing Jointly or Qualifying Widower) axable income is over: But not over: The tax ist $ 0 $ 19,750 10% of taxable income $ 19.750 $ 0.250 51,975 plus 12% of the excess over $ 80.250 $171.00 59.235 plus 2266 of the excess over 58 SI71650 $376,500 529.211 plus 24% of the excess over $326,600 $414,700 566,583 plus 32 of the excess over $414,700 $622.00 $90,735 plus 335 the excess over $622.050 5167 307 50 plus 37 of the excess o Marginal tax rate Marginal tax rate b edule 2 Head of Household axable income is over: But not over: The taxi $ 0 $ 14,100 10% od taxable income $ 14,100 $ 53,700 51.410 plus of the excess over $14, $ 53.700 S RS500 56,162 pius 25 of the excess on 31 S85300 $16.00 S13.15 plus of the excess over 5 $160.00 5207150 SIXO plus 25 of the excess over 50 5207,150 $518,000 $45.926 plus 35% of the excess over $20 SS15400 5154,793 50 plus of the excess over Chapter Saved Help Save & Exit Submit Check my work 3 ividuals edule X-Single axable income is over. But not over: The tax is: S 0 $ 9875 10% of taxable income $9.875 $ 40,125 5987 50 plus 12% of the excess over $ $ 40,125 $ 85,525 54.617 50 plus 22 the excess over $ 85,525 $163,300 $14. NOS 50 plus 24% of the excess ove $163,300 $207,350 533 271 50 plus 32% of the excess ove $207,350 $518,400 $47367.50 plus 15% of the excess ove $518,400 $156,235 plus 37 of the excess over Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Hellin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Round your answers to 2 decimal places) 9.09 points Book Print References Federal tax Average tax rate Effective tax rate Marginal tax rate edule Y. 1. Married Filing Jointly or Qualifying Widower) Ruable income is over. But not over: The tax is S 0 $ 19,750 105 of taxable income $ 19.750 $ 80250 $1.975 plus 12% of the excess over $19. S 80,250 SI71.00 $9,25 plus 224 of the excess over 50, $171030 $326.NO $29.211 plus 24 of the excess over $17 $426,600 $414,700 566.54 plus 32% of the excess over 12 $414,700 $622.po $94215 plus 15% of the excess over $41 $622050 51677 plus of the excess over edule Z-Ilead of Household axable income is over Hut not over: The tax is $ 0 S 14,100 10 of taxable income $ 14.100 $ 53.700 S1410 plus 12% of the excess over $14,100 S 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,70 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,50 $16.00 $207,150 $31.0 plus 32 of the excess over $16) $207,150 $518,400 $45,926 plus 35% of the excess over $2073 $518,400 $154,793.50 plus 37% of the excess over 55