Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check my work 3 Dower Corporation prepares its financial statements according to IFRS. On March 31, 2018, the company purchased equipment for $240,000. The equipment

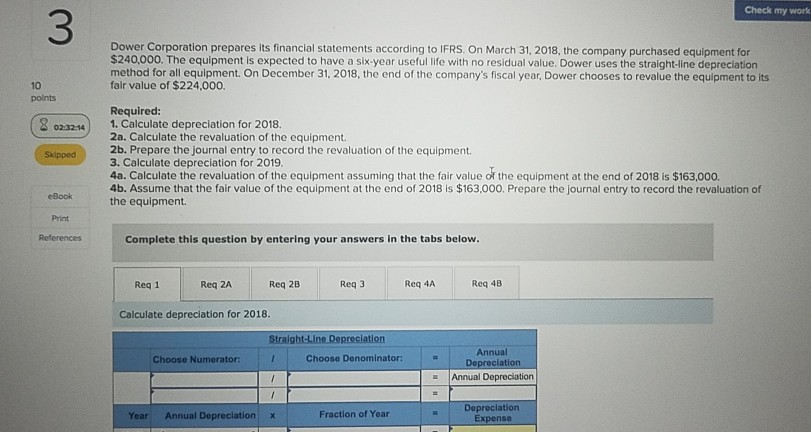

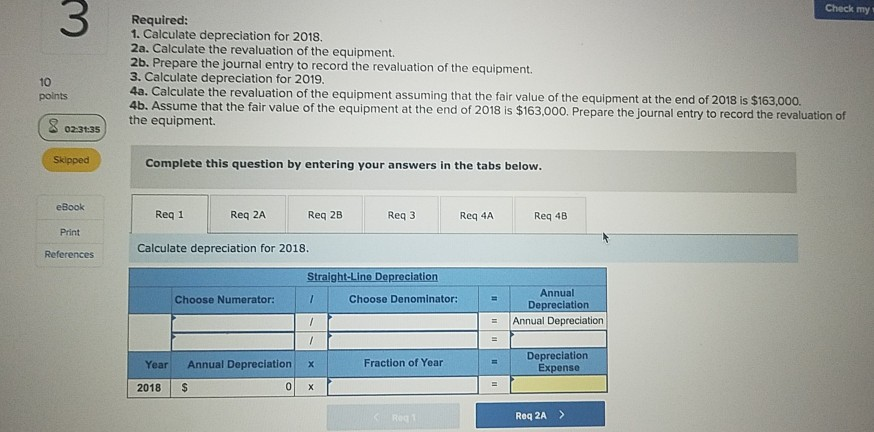

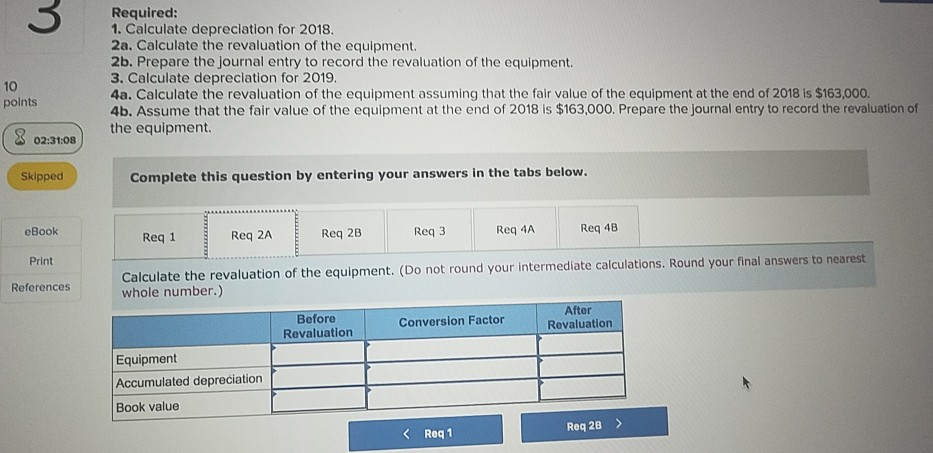

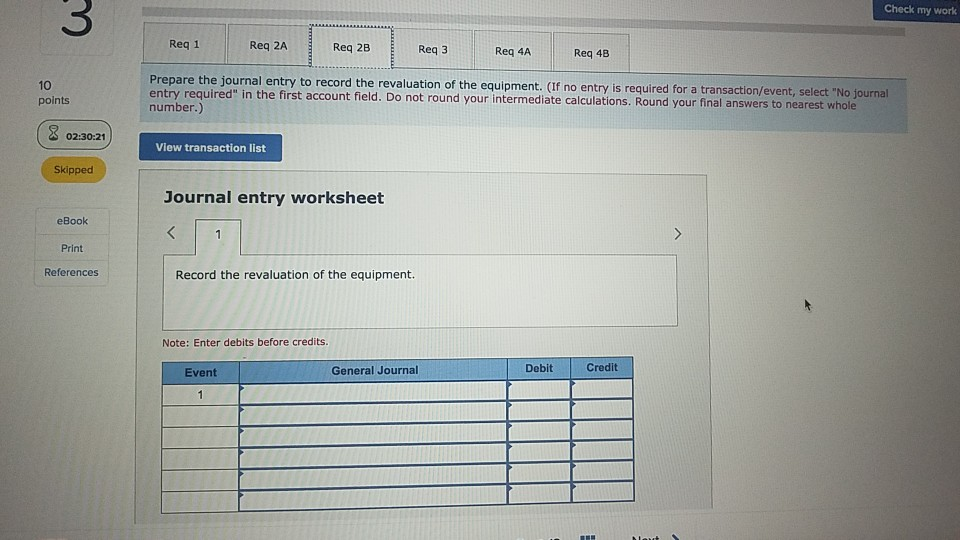

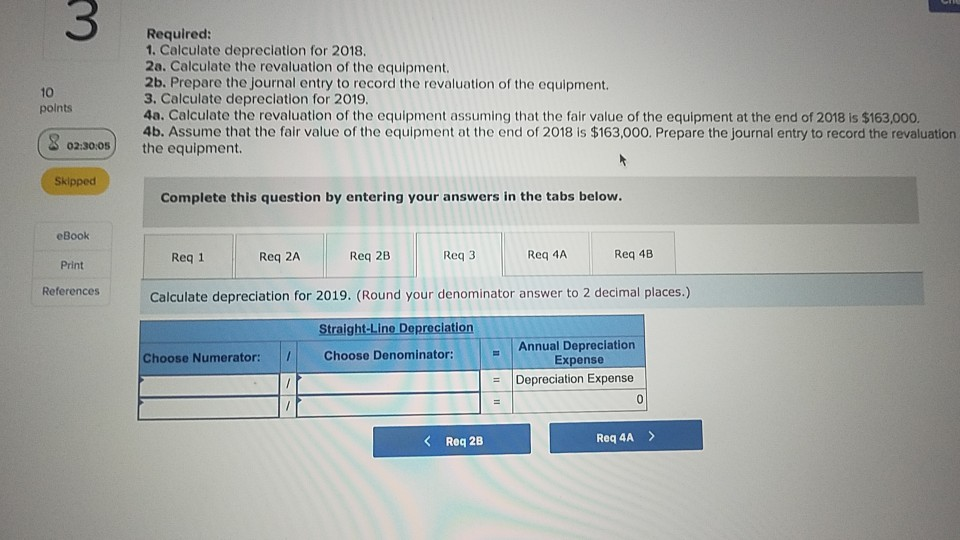

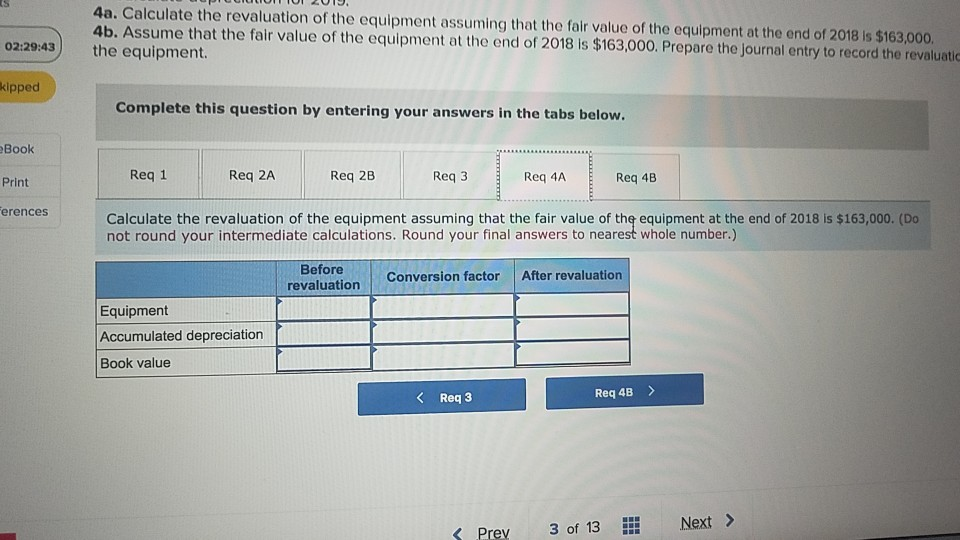

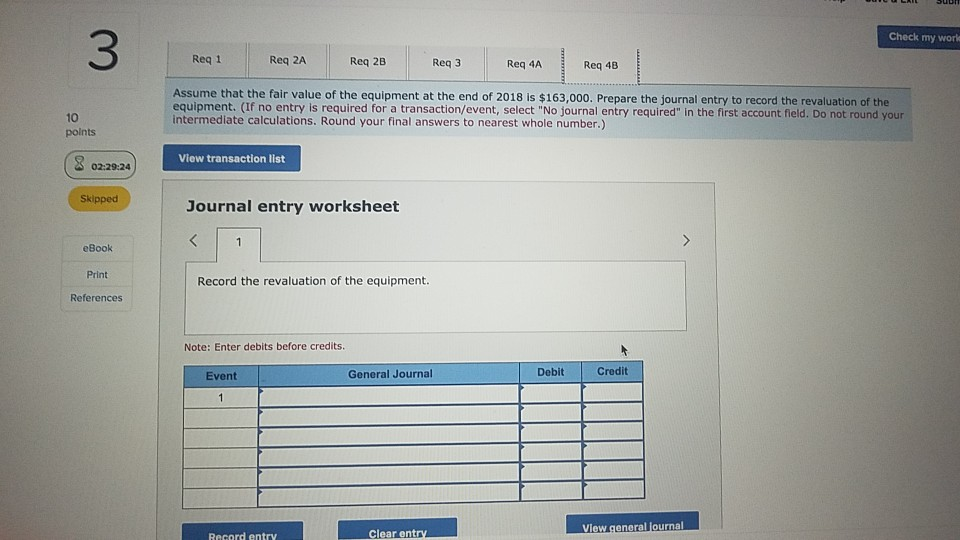

Check my work 3 Dower Corporation prepares its financial statements according to IFRS. On March 31, 2018, the company purchased equipment for $240,000. The equipment is expected to have a six-year useful life with no residual value. Dower uses the straight-line depreciation method for all equipment. On December 31, 2018, the end of the company's fiscal year, Dower chooses to revalue the equipment to its fair value of $224,000 10 points Required 023214 1. Calculate depreciation for 2018. 2a. Calculate the revaluation of the equipment. 2b. Prepare the journal entry to record the revaluation of the equipment 3. Calculate depreciation for 2019 4a. Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000. 4b. Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluation of the equipment eBook Print References Complete this question by entering your answers in the tabs below Req 1 Req 2A Req 2B Req 3 Req 4A Req 4B Calculate depreciation for 2018. Straight-Line Depreciation Annual Choose Numerator Choose Denominator: Annual Depreciation Depreciation Expense Year Annual Depreclationx Fraction of Year 3 Check my Required: 1. Calculate depreciation for 2018. 2a. Calculate the revaluation of the equipment. 2b. Prepare the journal entry to record the revaluation of the equipment. 3. Calculate depreciation for 2019 4a. Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000. 10 polnts 4b. Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluation of the equipment. 02-31:35 Skipped Complete this question by entering your answers in the tabs below. eBook Print References Req 1 Req 2A Req 2B Req 3 Req 4A Req 4B Calculate depreciation for 2018. Straight-Line Depreciation Annual Annual Depreciation Depreciation Choose Numerator: Choose Denominator:Depreciation Year Annual Depreciation x Fraction of Year 2018 Req 2A > Required: 1. Calculate depreciation for 2018 2a. Calculate the revaluation of the equipment 2b. Prepare the journal entry to record the revaluation of the equipment. 3. Calculate depreciation for 2019. 4a. Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000. 4b. Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluation of the equipment. 10 points Skipped Complete this question by entering your answers in the tabs below. eBook Print References Req 1 Req 2A Req 2B Req 3 Req 4A Req 48 aluation of the equipment. (Do not round your intermediate calculations. Round your final answers to nearest whole number.) Before Revaluation After Revaluation Conversion Factor Equipment Accumulated depreciation Book value K Req 1 Req 28> 3 Check my work Req 1 Req 2A Req 2B Req 3 Req 4A Req 4B e revaluation of the equipment. (If no entry is required for a transaction/event, select "No journal 10 points entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole number.) 02:30:21 View transaction list Skipped Journal entry worksheet eBook Print References Record the revaluation of the equipment. Note: Enter debits before credits. Event General Journal Debit Credit 3 Required: 1. Calculate depreclation for 2018 2a. Calculate the revaluation of the equipment 2b. Prepare the journal entry to record the revaluation of the equipment 3. Calculate depreciation for 2019 4a. Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000. 4b. Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluation 10 polnts 02:3005the equipment. Skipped Complete this question by entering your answers in the tabs below eBook Print References Req 1 Req 2A Req 2B Req 3 Req 4A Req 4B Calculate depreciation for 2019. (Round your denominator answer to 2 decimal places.) Straight-Line Depreciation Annual Depreciation Choose Numerator: Choose Denominator: Expense Depreciation Expense Req 2B Req 4A > 4a. Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000 4b. Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluatio 02:29:43 the equipment. kipped Complete this question by entering your answers in the tabs below. Book Req 1 Req 2A Req 2B Req 3 Req 4A Req 4B Print erences Calculate the revaluation of the equipment assuming that the fair value of the equipment at the end of 2018 is $163,000. (Do not round your intermediate calculations. Round your final answers to nearest whole number.) Before revaluation Conversion factor After revaluation Equipment Accumulated depreciation Book value K Req 3 Req 4B> Next> Prev 3 of 13 3 Check my work Req 1 Req 2A Req 2B Req 3 Req 4A Req 48 Assume that the fair value of the equipment at the end of 2018 is $163,000. Prepare the journal entry to record the revaluation of the 10 points equipment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Do not round your intermediate calculations. Round your final answers to nearest whole number.) View transaction list 02:29:24 Skipped Journal entry worksheet eBook Print References Record the revaluation of the equipment. Note: Enter debits before credits General Journal Debit Credit Event View general fournal Clear en

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started