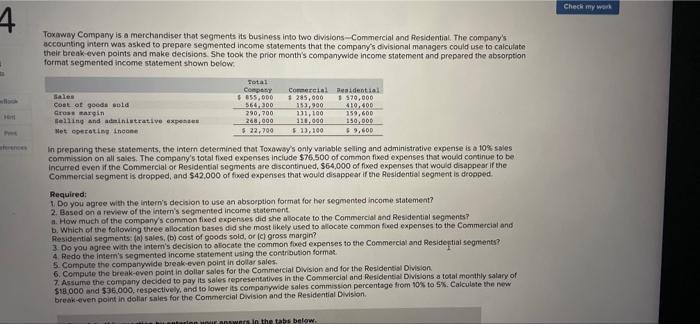

Check my work 4 Toxiway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below Total Company Sales Commercial Besidential $ 155,000 1 285,000 1 570,000 Coat of goods sold 566300 133,900 10,400 Gros margin 290,700 131,100 159,600 Belling and administrative expenses 268,000 110,000 150,000 Net Operating income $22.700 1,100 59,600 In preparing these statements, the intern determined that Toxoway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $76.500 of common fixed expenses that would continue to be incurred even if the Commercial or Residential segments are discontinued, $64,000 of fixed expenses that would disappear if the Commercial segment is dropped, and $42.000 of foved expenses that would disappear if the Residential segment is dropped Required: 1. Do you agree with the intern's decision to use an absorption format for her segmented income statement? 2. Based on a review of the intern's segmented income statement a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments? b. Which of the following three allocation bases did she most likely used to allocate common fed expenses to the Commercial and Residential segments: (a) sales, (b) cost of goods sold, or ich gross margin? 3 Do you agree with the inter's decision to locate the common fwed expenses to the Commercial and Residential segments? 4 Redo the inter's segmented income statement using the contribution format 5. Compute the companywide break even point in dollar sales 6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division 7. Assume the company decided to pay its sales representatives in the Commercial and Residential Misions a total monthly salary of $18.000 and $36.000, respectively, and to lower its companywide sales commission percentage from 10% to Sk. Calculate the new break-even point in dollar sales for the Commercial Division and the Residential Division in nur answers in the tabs below Help Save & Ext Submit --- Check my work Required: 1. Do you agree with the intern's decision to use an absorption format for her segmented income statement? 2. Based on a review of the Intern's segmented income statement. a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments? b. Which of the following three allocation bases did she most likely used to allocate common fixed expenses to the Commercial and Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin? 3. Do you agree with the intern's decision to allocate the common fixed expenses to the Commercial and Residential segments? 4. Redo the intern's segmented income statement using the contribution format. 5. Compute the companywide break-even point in dollar sales. 6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division 7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of $18,000 and $36,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the new break-even point in dollar sales for the Commercial Division and the Residential Division Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 28 Req3 Reg 4 Reg 5 Req6 Reg 7 Do you agree with the intem's decision to use an absorption format for her segmented income statement? Yes No