Answered step by step

Verified Expert Solution

Question

1 Approved Answer

check my work Accounting statements represent a company's earings, but this is not the real cash that a company generates. Earnings data can be manipulated

check my work

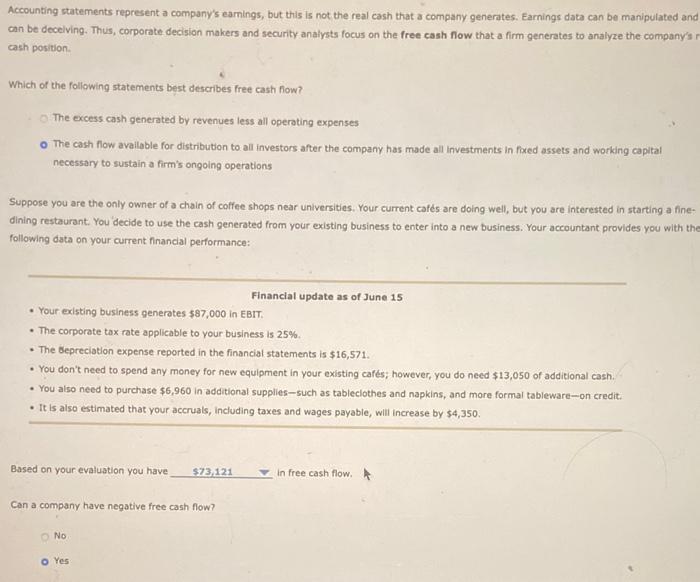

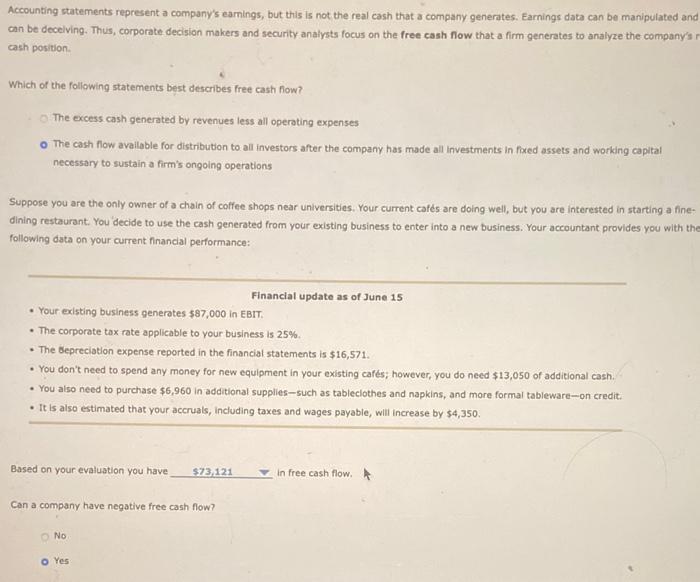

Accounting statements represent a company's earings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's cash position Which of the following statements best describes free cash flow? The excess cash generated by revenues less all operating expenses o The cash flow available for distribution to all investors after the company has made all Investments in fixed assets and working capital necessary to sustain a firm's ongoing operations Suppose you are the only owner of a chain of coffee shops near universities. Your current cafes are doing well, but you are interested in starting a fine- dining restaurant. You decide to use the cash generated from your existing business to enter into a new business. Your accountant provides you with the following data on your current financial performance: Financial update as of June 15 Your edsting business generates $87,000 in EBIT, The corporate tax rate applicable to your business is 25% . The Bepreciation expense reported in the financial statements is $16,571. You don't need to spend any money for new equipment in your existing cards; however, you do need $13,050 of additional cash, You also need to purchase $6,960 in additional supplies-such as tableclothes and napkins, and more formal tableware-on crediti It is also estimated that your accruals, including taxes and wages payable, will increase by $4,350 Based on your evaluation you have $23,121 in free cash flow. Can a company have negative free cash flow? No Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started