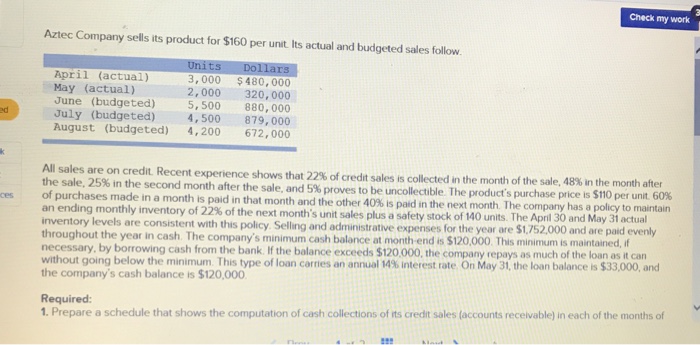

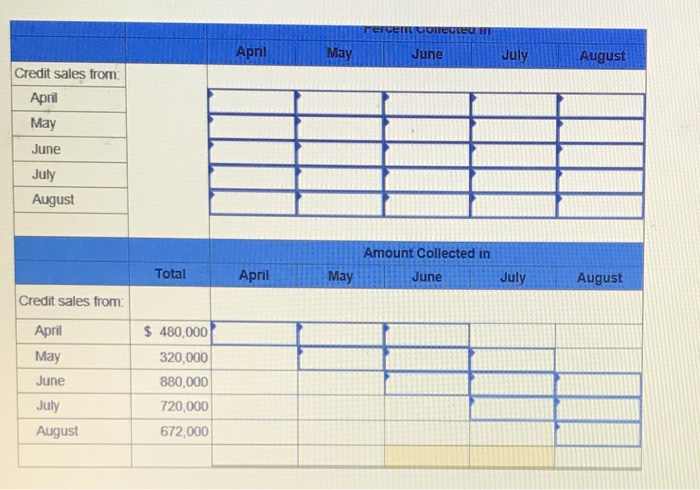

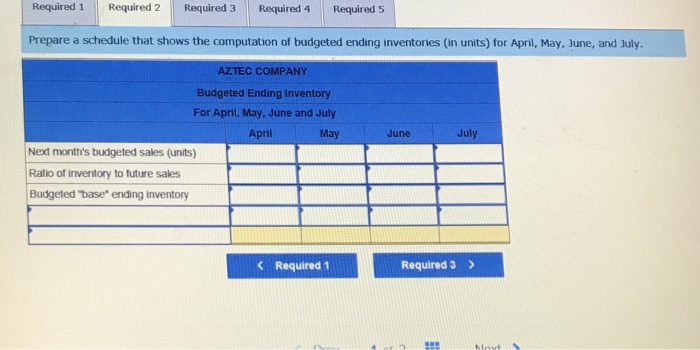

Check my work Aztec Company sells its product for $160 per unit Its actual and budgeted sales follow ts Dollars April (actual) 3,000 480,000 May (actual) 2,000 320,000 June (budgeted) 5,500 880,000 ed July (budgeted) 4,500 879, 000 August (budgeted) 4,200 672,000 All sales are on credit Recent experience shows that 22% of credit the sale, 25% in the second month after the sale, and 5% proves of purchases made an ending monthly inventory of 22% of the next month's unit sa sales is collected in the month of the sale, 48% in the month after to be uncollectible The product's purchase price is S110 per unit 60% in a month is paid in that month and the other 40% is paid in the next month The company has a policy to maintain ces les plus a safety stock of 140 units. The April 30 and May 31 tual Is are consistent with this policy Selling and administrative expenses for the year are $1,752,000 and are paid evenly throughout the year in cash. The company's minimum cash balance at month end is $120,000. This minimum is maintained, f necessary, by borrowing cash from the bank. If the balance exceeds $120.000, the without going below the minimum This type of loan carries an annual 14% interest rate On May 31, the loan balance is $33,000 and the company's cash balance is $120,000 company repays as much of the loan as it can Required: 1. Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of Check my work Aztec Company sells its product for $160 per unit Its actual and budgeted sales follow ts Dollars April (actual) 3,000 480,000 May (actual) 2,000 320,000 June (budgeted) 5,500 880,000 ed July (budgeted) 4,500 879, 000 August (budgeted) 4,200 672,000 All sales are on credit Recent experience shows that 22% of credit the sale, 25% in the second month after the sale, and 5% proves of purchases made an ending monthly inventory of 22% of the next month's unit sa sales is collected in the month of the sale, 48% in the month after to be uncollectible The product's purchase price is S110 per unit 60% in a month is paid in that month and the other 40% is paid in the next month The company has a policy to maintain ces les plus a safety stock of 140 units. The April 30 and May 31 tual Is are consistent with this policy Selling and administrative expenses for the year are $1,752,000 and are paid evenly throughout the year in cash. The company's minimum cash balance at month end is $120,000. This minimum is maintained, f necessary, by borrowing cash from the bank. If the balance exceeds $120.000, the without going below the minimum This type of loan carries an annual 14% interest rate On May 31, the loan balance is $33,000 and the company's cash balance is $120,000 company repays as much of the loan as it can Required: 1. Prepare a schedule that shows the computation of cash collections of its credit sales (accounts receivable) in each of the months of